Highlights

- Wetherspoon reported an increase in pre-tax loss to £154.7 million in the year ended 25 July 2021, compared to £34.1 million in the previous year.

- Telereal Trillium purchased eight newly constructed Marston’s pubs from Aviva Investors for £21.23 million.

Pub owners in the UK suffered huge losses due to the Covid-19 restrictions. The pandemic imposed tremendous pressure on pub managers and staff due to a rise in pub closures and staggered reopening. With the easing of lockdown restrictions, the owners expected a return of consumers. However, businesses in the sector are struggling to fill employment vacancies along with various issues.

Although pubs in the UK were entitled to government support under the furlough initiative, they have been massively affected by the pandemic. Ongoing heavy goods vehicle driver shortage has added to pub owner woes and created acute supply chain issues.

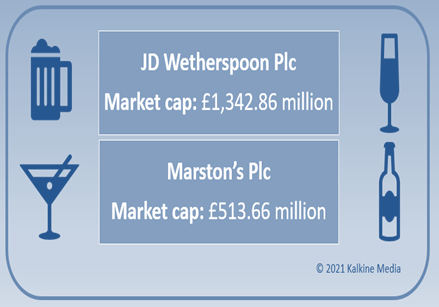

(Data source: Refinitiv)

Here is a detailed review of two pub stocks - JD Wetherspoon & Marston’s.

JD Wetherspoon Plc (LON: JDW)

JD Wetherspoon is a pub chain with operations in Ireland and the UK. In the year ended 25 July 2021, Wetherspoon reported an increase in pre-tax loss to £154.7 million, compared to £34.1 million in the previous year. The company’s sales slumped from £1.26 billion to £772.6 million in the year ended 25 July 2021, representing a 38.4% year-on-year decline.

The shares of Wetherspoon are currently trading at GBX 1,025.00, down by 1.73% at 9:21 AM on Friday 1 October 2021. The company’s market cap stands at £1,342.86 million. The shares of Wetherspoon returned 25.25% to shareholders in the last one year.

Wetherspoon’s losses have been a result of the lockdown restrictions and HGV driver shortage that impacted supply.

Marston’s Plc (LON: MARS)

Marston’s is UK’s independent pub retailing and brewing business that operates through 1,500 pubs. Its joint venture Carlsberg Marston’s Brewing Company (CMBC) consolidated its secondary logistics network into a single in-house solution. Recently, Telereal Trillium purchased eight newly constructed Marston’s pubs from Aviva Investors for £21.23 million.

The shares of Marston’s are currently trading at GBX 82.05, up by 1.30% at 9:52 AM on Friday 1 October 2021. The company’s market cap stands at £513.66 million. The shares of Marston’s returned 84.91% to shareholders in the last one year.

The pandemic significantly impacted the company’s H1 performance. In H2, its pubs in England were allowed to reopen for outdoor trading on 12 April and in Scotland and Wales on 26 April. Subsequently, indoor trading with social distancing measures in place was allowed from 17 May, thereby impacting operations. However, with the majority of restrictions being lifted as of 19 July, about 70% of Marston’s pubs reopened for outdoor trading.

.jpg)