Summary

- Carnival’s most of the cruises have postponed their voyages for the next year

- Costa has introduced Covid-19 tests for its guests; becomes the first cruise company to obtain RINA certification

- The long-term prospects of the Carnival Group remain strong as its total revenue has grown from USD 15,714.00 million in FY2015 to USD 20,825.00 million in FY2019

A luxury British cruise line owned by Carnival Plc “Cunard” has reportedly extended its pause of operations from November 2020. The voyages planned by the company have been postponed until March 2021. Moreover, these voyages would be replaced with a programme of shorter duration European holidays for about two weeks commencing March 2021.

One of the other fastest-growing international premium cruise lines and tour providers owned by Carnival; Princess Cruises has extended its pause in cruise operations throughout Australia and New Zealand through the earlier deadline of December 2020. People seeking refund would get a refundable Future Cruise Credit (FCC) equivalent to the full amount of the cruise fare paid plus an additional non-refundable bonus FCC, which amounts to one-fourth of the cruise fare paid.

The company has also cancelled the pinnacle of cruise vacation experience, 2021 World Cruise voyages due to restrictions and limitations with border and port access determined by government and health authorities. Carnival owned P&O Cruises Australia has extended its pause in operations until December 2020. The cruise line is currently implementing necessary health & safety measures which would help in restoring confidence among the travellers.

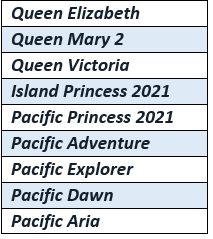

Below is a list of different cruise voyages cancelled by Carnival owned brands

Since March, none of Carnival’s cruise lines has sailed due to the novel coronavirus. Many of the employees are on furlough, while the remaining workforce would undergo a 20 per cent pay cut until November in the UK. The company has raised £5 billion by issuing fresh debt and equity in April. The company also accessed a £25 million loan under Covid-19 Corporate Financing Facility (CCFF) launched by the British government.

Since the start of the year, Carnival Plc has lost a lot of market capitalisation which could result in its exclusion from the London’s broader equity benchmark index, FTSE 100. However, the cruise providers are now leaving no stone unturned to infuse confidence in panic-stricken travellers. Carnival owned Italian company “Costa” has introduced Covid-19 tests for its guests. It became the first cruise company to obtain certification of the biological risk prevention system known as RINA Biosafety Trust Certification.

During the first half of 2020, Carnival’s revenue has nearly halved to US$ 5,529 million. As of now, the company is into losses. However, the long-term prospects of the Carnival Group remain strong. The company’s total revenue has grown from USD 15,714.00 million in FY2015 to USD 20,825.00 million in FY2019, giving approximately 7.29 per cent growth on a CAGR basis. The Company expects to have a negative impact on its financial results and liquidity due to the outbreak of the Coronavirus pandemic.

Carnival Plc (LON:CCL) has taken several actions to reinforce liquidity, such as a reduction in planned capital expenditure and non-priority operating expenses, while they are pursuing additional financing options. The Group reported a strong start of wave season with booking volumes for the three weeks ending January 26, 2020, was higher than the last year. Moreover, Carnival has a decent business model, which could sustain the development of the company and could also drive the growth for the company.

On 27 August 2020, at the time of writing, GMT 10:52 AM, CCL shares were trading at GBX 971, up by 0.21 per cent against the previous day closing price.

Do read: Covid-19 Impact-Travel Businesses Struggling for Finances During the Crisis

Impact on other cruise companies

It’s not only Carnival, other cruise companies are also facing the similar crisis, Germany-based tourism group, TUI AG’s all three Cruise operations remained suspended throughout the quarter, sticking to both UK and German government advice on cruising. On the operational front, TUI AG (LON:TUI) reported 98 per cent slump in group revenue for the third quarter of the fiscal year 2020.

The company has stated that reflecting business standstill for most of the quarter with partial operations successfully resumed from mid-May, the Group revenue slumped to €75 million in the quarter ended June 2020. The business suspension for most of the quarter, impairments triggered by COVID-19 and net costs arising from ineffective hedging contracts resulted in Q3 Group underlying EBIT loss of €1.1 billion.

On 27 August 2020, at the time of writing, GMT 10:53 AM, TUI shares were trading at GBX 321.10, down by 0.80 per cent against the previous day closing price.

Travel and Tourism Sector Continue to Remain Under Pressure

The travel sector has been among the worst-hit sectors during this unprecedented crisis induced by the novel coronavirus. As the nations across the globe underwent lockdown, travel restrictions were imposed to contain the spread of the deadly virus. The travel industry had never ever imagined such a scenario. The sector witnessed major job redundancies across segments of airlines, cruises, and other dependent sectors such as hospitality. The sector is also under immense pressure from refund seeking customers.

The sudden drop in confidence of the travellers has brought many related businesses on the verge of collapse, and many are likely to go into administration. Major cruise companies such as Carnival plc were making the headlines as travellers got infected with the deadly virus while travelling. Industry experts strongly believe that the holiday business would take a lot longer time to recover from the devastation caused by the novel coronavirus.

Do read: Two Travel & Leisure Stocks Trending on LSE – Carnival Plc & PPHE Hotel Group Ltd

Slight uptick in activity was expected for UK’s travellers given the prospects of air bridges and easing restrictions on social distancing. This is the peak season which businesses look forward to, as a lot of people usually plan holidays during this time of the year. Things look a bit gloomy for the Travel & Tourism sector in the near term, and the developments like this certainly deter the confidence of the battered industry. However, once a vaccine finally comes into existence, it would certainly support the industry as people will be encouraged for holidaying once again.