Summary

- Carnival PLC raised USD 900 million through the issue of Senior Secured Notes.

- Carnival PLC's revenue declined by 41.5 percent year on year in H1 FY2020.

- Carnival PLC would incur non-cash impairment charge related to the sale of two ships.

- PPHE Hotel Group has reopened 80 percent of its properties.

- PPHE Hotel Group revenue declined by 60.2 percent year on year in H1 FY2020.

- PPHE Hotel Group secured funding of £20 million from Santander UK.

Carnival PLC (LON:CCL) & PPHE Hotel Group (LON:PPH) are travel & leisure stocks listed on the FTSE 250. Based on 1-year performance, shares of CCL and PPH were down by about 74.51 percent and 39.55 percent, respectively. Shares of CCL were down by about 0.82 percent, whereas shares of PPH were up by around 1.42 percent, respectively from the previous closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1).

Carnival PLC (LON:CCL) – Suspended the US cruise start until 31 October 2020

Carnival PLC is a travel & leisure group that operates cruise. The Group has nine cruise brands under its portfolio that include Carnival Cruise Line, Princess Cruises and Holland America Line. Carnival is headquartered in Miami, and it is dually listed in New York Stock Exchange and London Stock Exchange. Carnival is included in the FTSE 250 and S&P 500 index.

Recent Events

- On 19 August 2020, Carnival raised USD 900 million through Senior Secured Notes. The Senior Notes are at a rate of 9.875 percent with semi-annual payments. The Notes are due in 2027 and were offered to qualified institutional buyers. The proceeds from the Notes would be used for general corporate purpose.

- On 18 August 2020, Carnival reported a ransomware attack that accessed the portion of the Group's information technology system.

- On 5 August 2020, Carnival said that it had suspended the US cruise start until 31 October 2020 in agreement with the Cruise Lines International Association (CLIA). It has cancelled all trips planned between 1 October 2020 and 31 October 2020 and the guests have been offered a full refund or cruise credits against the cancellation.

- On 29 July 2020, Carnival stated that it would incur non-cash impairment charge of close to USD 600 million to USD 650 million related to the sale of two ships. The charges would be incurred in the third quarter. On 10 July 2020, the Group announced that it would sell nine ships to improve the liquidity position other than the two ships that were recently considered for sale.

Six months results (ended 31 May 2020) as reported on 10 July 2020

Carnival reported revenue of USD 2,383 million in H1 FY20 that declined from USD 4,073 million a year ago. In H1 FY20, the passenger ticket contributed USD 3,680 million, and Onboard & other revenue added USD 1,849 million to the total revenue. The operating cost declined to USD 6,007 million in H1 FY20 from USD 6,301 million a year ago. Transportation and payroll-related costs constituted a significant portion of the operating cost. Carnival incurred an operating loss of USD 4,891 million in H1 FY20 against a profit of USD 902 million in H1 FY19. The net loss stood at USD 5,155 million in H1 FY20, whereas the Group earned a profit of USD 787 million in H1 FY19. The basic loss per share was USD 7.34.

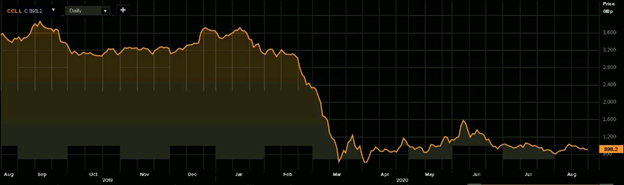

Share Price Performance Analysis

1-Year Chart as on August-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Carnival PLC's shares were trading at GBX 898.20 and were down by close to 0.82 percent against the previous closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1). CCL's 52-week High and Low were GBX 3,864.00 and GBX 581.00, respectively. Carnival had a market capitalization of around £9.14 billion.

Business Outlook

The travel and leisure industry is most impacted due to covid-19. The current situation hampered the financial and operational condition of the Group. Carnival suspended the operations of the cruise ships for guests due to the covid-19 outbreak; however, it is planning to re-start normal operations. The Group has sold a few cruise ships and raise funding in the recent past to support the business.

PPHE Hotel Group Ltd (LON:PPH) – Witnessed demand on weekend breaks

PPHE Hotel Group is a UK based hospitality group that owns brands such as art'otel®, Arena Hotels & Apartments® and Arena Campsites®. The Group has a portfolio of 37 hotels and resorts with close to 8,000 rooms and eight campsites. The Group has got a license from Radisson Hotel Group to develop and operate Park Plaza® brand in Europe, the Middle East and Africa. PPHE Hotel Group is domiciled in Guernsey, and it is included in the FTSE 250.

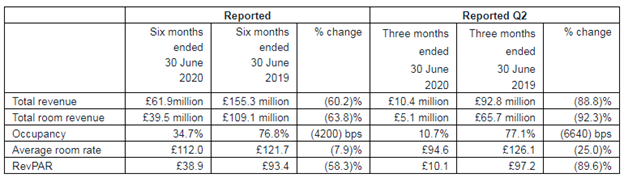

H1 FY2020 trading update (ended 30 June 2020) as reported on 28 July 2020

(Source: Group website)

In H1 FY20, the Group reported revenue of £61.9 million, which was down by 60.2 percent year on year from £155.3 million in H1 FY19. The total room revenue declined by 63.8 percent year on year to £39.5 million in H1 FY20 from £109.1 million a year ago. The occupancy rate dropped to 34.7 percent in H1 FY20 from 76.8 percent in H1 FY19. The average room rate was £112.0 in H1 FY20 that was £121.7 million in H1 FY19. Revenue per available room (RevPAR) was £38.9, which declined by 58.3 percent year on year from £93.4 in H1 FY19. As on 30 June 2020, PPHE Hotel Group had cash of £136.7 million. The Group secured funding of £20 million from Santander UK against Park Plaza London Waterloo property. It also got funding of £180 million to complete the construction of art'otel london hoxton, and the Group can withdraw close to £43 million out of this facility to meet the cash flow needs.

Operational Highlights

The Group has reopened eight out of ten hotels in the UK after the government lifted the restrictions. Park Plaza Westminster Bridge London benefitted from the short-term leisure demand as the hotel remained operational during the lockdown. The Group is operating five out of six properties in the Netherland, and its Park Plaza Victoria Amsterdam, located in the heart of Amsterdam performed better than its competitors. Six out of eight hotels have resumed operation in Germany and Hungary, whereas four hotels and all campsites have reopened in Croatia.

Share Price Performance Analysis

1-Year Chart as on August-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

PPHE Hotel Group's shares were trading at GBX 1,075.00 and were up by close to 1.42 percent against the previous closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1).

Business Outlook

As on 28 July 2020, the Group stated that it had reopened 80 percent of its properties, keeping in mind the safety measures. The demand was resilient for on weekend breaks. The Group is focused on long-term strategy, and it is confident of sustaining the challenging time given the strength of the balance sheet. It is also trying to meet the changing customer demands and has kept the room rates flexible. The primary goal is to increase the occupancy rate, and then the room tariffs could be revised as the travel picks up. The Group is also getting increased enquiry for future bookings.