Â

Pearson Plc

Pearson PLC (LON:PSON) is a British learning company, headquartered in London, United Kingdom. The group serves private and public institutions, governments, and individual learners in numerous countries to provide them with education products and services like test development, processing, and scoring services and a wide range of other education services. The group's products include a myriad of digital resources, apps, and textbooks, including Revel, ELT Courseware, PTE Academic, Edexcel, and others with the aim of helping learners increase their skills and employability prospects. The principal segments for management and reporting are differentiated by geographies: North America, Core and Growth

The shares of the company have their listing on the main market segment of the London Stock Exchange. There they trade with the ticker name PSON. The shares of the company also form part of the FTSE 100 index.

News Update

The company on 18 December 2019 announced that it is selling its remaining 25 per cent stake in Penguin Random House to Bertelsmann for a consideration of £530 million, and also simultaneously announced that of this it shall offer £350 million to shareholders through share buyback.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 663.60, up 3% compared to the previous close, at the time of writing of this report on the business day of 18 December 2019.

In the course of the past 52 weeks, the stock of the company has registered a high of GBX 1,030.00 and a low of GBX 619.60. The market capitalisation of the stock as on the day was £5.03 billion

Â

NMC Health Plc

NMC Health PLC (LON:NMC) is a United Arab Emirates (UAE) domiciled diversified health care company, which operates numerous healthcare facilities in the middle eastern country. The company, domiciled in Abu Dhabi, is involved in business sectors ranging from trading, information technology in addition to health care services. The company is top ranked amongst the largest fertility service providers in the world and the largest private healthcare group in the UAE.

The company is the first from Abu Dhabi to list on the London Stock Exchange. The shares of the company have their listing on the main market segment of the London Stock Exchange. There they trade with the ticker name NMC. The shares of the company also form part of the FTSE 100 index.

News Update

The company on 18 December 2019 came out with a response on the allegations being made by research firm Muddy Waters LLC regarding overstated reported values of the companyâs assets, cash balance, reported profits and understated debt levels.

The company in its response stated there is nothing much that the company has with itself that it can add at this point and further stated that the allegations made by Muddy Waters LLC appear principally unfounded, baseless and misleading containing many factual errors.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 1,749.00, approximately flat with respect to the previous close, at the time of writing of this report on business day of 18 December 2019.

In the course of the past 52 weeks, the stocks of the company have registered a high of GBX 3,059.00 and a low of GBX 1,450.00. The market capitalisation of the stock as on the day was £3.65 billion

Staffline Group Plc

Staffline Group Plc (LON:STAF) is a United Kingdom domiciled Recruitment and Human resources company. Headquartered in Nottingham and founded in the year 1986 the company was engaged in the recruitment services and outsourced human resource services to industry and services in the welfare to skills and work arena training. The Company operates two segments: PeoplePlus and Staffing Services. PeoplePlus includes welfare to commercial customers and central and local government. Staffing services give labour solutions to the logistics, food processing, driving, e-retail, agriculture, and manufacturing sectors under the various brandâs names like Staffline Express, Select Appointments, Staffline Agriculture, Diamond Recruitment, Staffline Onsite, Brightwork, and Driving Plus. The companyâs recruitment business operates from across 300 locations in Poland, Eire, and the United Kingdom.

The shares of the company have their listing on the AIM segment of the London Stock Exchange. There they trade with the ticker name STAF. The shares of the company also form part of the FTSE AIM All share index

News Update

The company on 18 December 2019 came out with an update that current CFO of the company Mike Watts has tendered his resignations and is being replaced by Daniel Quint as Interim CFO with immediate effect.

The resignation comes on the heels of the company disclosing that it had conducted a review of its accounting department and has found that for the prior year of 2018 costs had been under booked leading to an overstatement of profits by about £4.00 million.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 81.00, down 23.58% from the previous close, Â at the time of writing of this report on business day of 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 1,194.67 and a low of GBX 65.00. The market capitalisation of the stock as on the day was £73.07 million.

Ferguson Plc

Ferguson PLC (LON:FERG) is a United Kingdom domiciled seller of plumbing and heating commodities . The company mainly operates in the United States, the United Kingdom and Canada. The company serves the Repair, Maintenance and Improvement markets and hold strong positions in these markets. The company has around 35,000 Associates throughout the business, 2,259 branches internally and 45,000 suppliers manufacturing products across the world.

The shares of the company have their listing on the main market segment of the London Stock Exchange. There they trade with the ticker name FERG. The shares of the company also form part of the FTSE 100 index.

News Update

The company on 18 December 2019 came out with an update that Simon Oakland has been appointed as the interim CEO of Wolseley UK, which is soon to be demerged from Ferguson Plc. Simon is replacing Mark Higson who is set to remit office on 31 January 2020.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 6,932.00, down 0.5% from the previous close, at the time of writing of this report on business day of 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 7,028.00 and a low of GBX 4,594.00. The market capitalisation of the stock as on the day was £15.74 billion

Â

Bidstack Group Plc

United Kingdom-based Bidstack Group PLC (LON:BIDS) is a provider of a native in-game advertising company. The group delivers technology that assists video game companies and advertisers in inserting advertisements ad conducting campaigns into video games. The company supports game publishers and developers to monetise their games by integrating adverts naturally into the game environment. Advertisers use its technology to run targeted campaigns within these spaces, such as engaging their audiences and boosting their brands without breaking immersion.

The shares of the company have their listing on the AIM segment of the London Stock Exchange. There they trade with the ticker name BIDS. The shares of the company also form part of the FTSE AIM All share index.

News Update

The company on 18 December 2019 came out with an update that it will not able to meet its revenue targets for the year on account of delay in commitments that were expected to be recognised during the year.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 7.90, down 34.1% from the previous close, at the time of writing of this report on business day on 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 42.00 and a low of GBX 4.20. The market capitalisation of the stock as on the day was £29.38 million.

Â

Springfield Properties Plc

Springfield Properties PLC (LON:SPR) is a United Kingdom domiciled residential real estate company. The Company is focused on building a combination of private and cost-effective residential properties in Scotland. The Companyâs business is divided into two business verticals: Private Housing and Affordable contracts.

The shares of the company have their listing on the AIM segment of the London Stock Exchange. There they trade with the ticker name SPR. The shares of the company also form part of the FTSE AIM All share index.

News Update

The company on 18 December 2019 came out with an update that it has received conditional approval by The Environment and Housing Committee of Stirling Council for its 3042 home Durieshill village development project subject to completing a Section 75 agreement.

The grant represents a significant milestone for the project and the company.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 137.90, up 7.7% from the previous close, Â at the time of writing of this report on business day of 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 138.75 and a low of GBX 95.00. The market capitalisation of the stock as on the day was £123.33 million.

Â

Marshall Motor Holdings Plc

Marshall Motor Holdings Plc (LON:MMH) is engaged in the retailing passenger cars and commercial vehicles in the United Kingdom. The group trades new and used vehicles; and offers after-sales services, such as parts sales, body shop repairs, and servicing. The company has two main segments: Retail and Leasing. The retail segment includes ancillary services and sales of motor vehicles. The leasing segment includes service-led fleet management services. The companyâs retail automobile brands consist of BMW Motorrad, Hyundai, Land Rover, Volkswagen, SKODA, Nissan, Volvo, Smart, Audi, Ford Vans, Volkswagen Commercials, Mercedes-Benz, MINI, Peugeot, Mercedes-Benz Commercials, BMW, Jaguar, Vauxhall, Maserati, Seat, Kia, Honda, and Ford. The groupâ main attention is on leasing vehicles to end customers and fleet consumers. The Group operates 106 franchise dealerships across 27 counties in England.

The shares of the company have their listing on the AIM segment of the London Stock Exchange. There they trade with the ticker name MMH. The shares of the company also form part of the FTSE AIM All share index.

News Update

The company on 18 December 2019 came out with a trading update that it has acquired Eight Volkswagen Group UK Franchises from Jardine Motor Group UK Limited for a consideration for up to £22.3 million cash including £13.0 million in inventory.

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 150.00, down 2.60% from the previous close, at the time of writing of this report on business day of 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 178.00 and a low of GBX 131.00. The market capitalisation of the stock as on the day was £120.39 million.

Safestay Plc

United Kingdom-based Safestay PLC (LON:SSTY) is an owner and operator of a hostel company. The companyâs main activity consists of the operation of backpacker tourist hostels under the groupâs brand. The group provides accommodation for an array of guests, comprising from school groups, young adults and backpackers to families.

The shares of the company have their listing on the AIM segment of the London Stock Exchange. There they trade with the ticker name SSTY. The shares of the company also form part of the FTSE AIM All share index.

News Update

The company came out with an update on 18 December 2019 that it has acquired three hostels in Warsaw, Prague and Bratislava for a total consideration of â¬3.7 million from Dream group Management E.C.P. Ltd.

This companyâs capacity has increased in, all located in leading cities in Europe to more than 5,000 beds across 21 hostels

Stock Performance at the London Stock Exchange

The shares of the company traded on the London Stock exchange at GBX 30.50, down 8.9% from the previous close, at the time of writing of this report on business day on 18 December 2019.

In the course of the past 52 weeks the stocks of the company have registered a high of GBX 49.00 and a low of GBX 29.00 . The market capitalisation of the stock as on the day was £21.67 million.

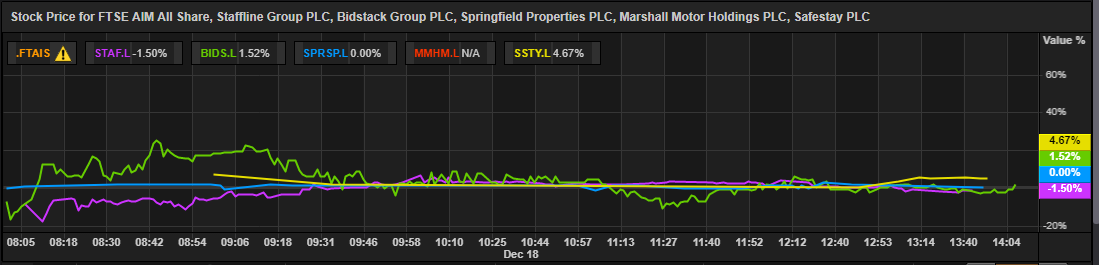

Comparative chart

FTSE 100 index with Pearson Plc, NMC Health Plc and Ferguson Plc

Source â Thomson Reuters

FTSE AIM All Share index with Staffline Group Plc, Bidstack Group Plc, Springfield Properties Plc, Marshall Motor Holdings Plc and Safestay Plc

Source â Thomson Reuters

Â