US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 18.40 points or 0.55 per cent higher at 3,381.40, Dow Jones Industrial Average Index expanded by 104.32 points or 0.38 per cent higher at 27,886.02, and the technology benchmark index Nasdaq Composite traded higher at 11,281.10, up by 113.59 points or 1.02 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The key indices of the US market traded in the green as the investors are hopeful over the stimulus package. The US weekly jobless claim was 837,000 for the week ended 26 September 2020 below expected claim of 850,000. Among the gaining stocks, Bed Bath & Beyond surged by about 34.9 percent after it reported quarterly earnings of 50 USD cents per share that were above the market's expectation. Beyond Meat was up by nearly 3.6 percent as it would sell its burger in Sainsbury stores in the UK. DraftKings gained around 3.5 percent after it signed a multi-year contract with Philadelphia Eagles. Starbucks was up by close to 1.5 percent after it increased the quarterly dividend to 45 USD cents from 41 USD cents. Shares of Pepsi popped up by around 0.6 percent after it reported quarterly earnings of USD 1.66 per share. Among the decliners, shares of Chevron and Coca Cola were down by around 1.8 percent and 0.4 percent, respectively on the Dow 30.

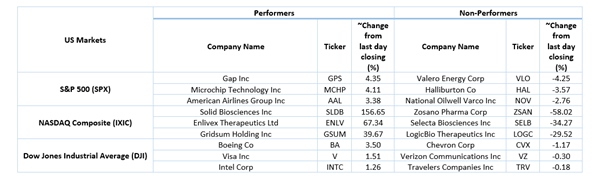

US Stocks Performance*

European News: The London and European markets traded in the green as the UK government is trying to avoid full lockdown to prevent job loss. The UK Manufacturing PMI was 54.1 for September 2020 that was below the expected PMI of 54.3. Meanwhile, the European Union initiated a legal case against the UK over the Internal Market Bill. Among the gaining stocks, shares of PCF rose by about 9.1 percent after it reported increased market share in H1 FY20. GVC Holdings gained by around 3.2 percent after it reported an update on German licensing and tolerance policy. Smith & Nephew nudged up by around 2.4 percent after it reported a slight recovery in the business. Avast moved up by close to 0.8 percent after it announced the interim dividend of 4.8 USD cents for H1 FY20. Among the decliners, Roll Royce plunged around 11.3 percent after it got approval from FCA for a rights issue of £2.0 billion. DCC was the second biggest loser on the FTSE-100 as it fell by nearly 6.3 percent.

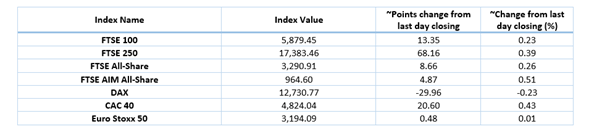

European Index Performance*:

FTSE 100 Index One Year Performance (as on 1 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); BP Plc (BP.).

Top 3 Sectors traded in green*: Utilities (+2.10%), Real Estate (+1.15%) and Financials (+0.52%).

Top 3 Sectors traded in red*: Energy (-3.08%), Industrials (-0.34%) and Consumer Cyclicals (-0.29%).

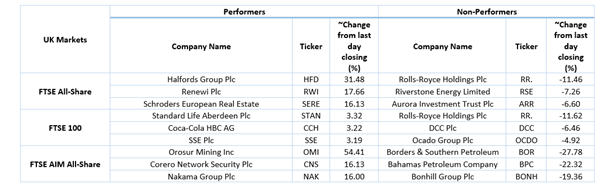

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $40.92/barrel and $38.73/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,913.90 per ounce, up by 0.97% against the prior day closing.

Currency Rates*: GBP to USD: 1.2890; EUR to GBP: 0.9110.

Bond Yields*: US 10-Year Treasury yield: 0.671%; UK 10-Year Government Bond yield: 0.247%.

*At the time of writing