US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 19.48 points or 0.55 per cent higher at 3,565.01, Dow Jones Industrial Average Index surged by 27.09 points or 0.09 per cent higher at 29,448.01, and the technology benchmark index Nasdaq Composite traded higher at 11,702.13, up by 148.28 points or 1.28 per cent against the previous day close (at the time of writing, before the US market close at 11:05 AM ET).

US Market News: The Wall Street traded in the green as vaccine hopes drive the market. Mortgage applications to buy a home in the US fell by 0.5% week on week, and it was up by 16% year on year. Among the gaining stocks, Lyft gained around 6.1% after it reported a revenue better than the expectation. Salesforce was up by approximately 3.4% and led the DOW 30 gain. Alibaba gained about 1.4% after the company starts an annual single-day event. Among the downward trending stocks, Aurora Cannabis plunged by nearly 20.0% after it announced plans to raise USD 125 million through a stock offering. AT&T was down by almost 1.1% after its media unit is expected to lay off 1,750 employees. Tencent Music slipped by close to 0.3% it highlighted an improvement in the retention rate of paying users.

US Stocks Performance*

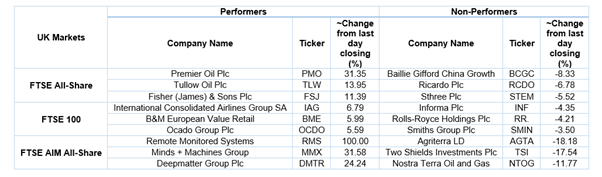

European News: The London and European markets traded in the green as the investors cheer up on vaccine optimism. The Europe and UK trade talks can go beyond mid-November 2020 deadline as per Ireland. Among the gaining stocks, shares of Flutter Entertainment was up by about 4.3% after it reported a 27% year on year increase in revenue in Q3. BAE Systems nudged up by around 2.3% after it highlighted full-year earnings per share slightly higher than the previous guidance. Coca Cola HBC gained about 0.8% after it reported an improvement in the trading environment in Q3. Among the decliners, Rolls Royce was down by around 4.5% on the FTSE-100 index. Informa fell by approximately 4.3% after the company released covid-19 action plan update.

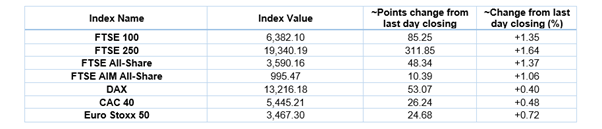

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 11 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Real Estate (+3.60%), Financials (+1.54%) and Healthcare (+1.53%).

Top Sector traded in red*: Basic Materials (-0.04%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $44.23/barrel and $41.95/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,861.30 per ounce, down by 0.80% against the prior day closing.

Currency Rates*: GBP to USD: 1.3207; EUR to GBP: 0.8915.

Bond Yields*: US 10-Year Treasury yield: 0.960%; UK 10-Year Government Bond yield: 0.407%.

*At the time of writing

.jpg)