US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 5.51 points or 0.14 per cent higher at 3,877.25, Dow Jones Industrial Average Index expanded by 36.36 points or 0.12 per cent higher at 31,092.22, and the technology benchmark index Nasdaq Composite traded higher at 13,780.66, up by 2.92 points or 0.02 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the green territory driven by another round of corporate earnings. According to The Bureau of Labor Statistics, the US employers had added 49,000 jobs during January 2021 compared to a decline of 227,000 jobs in December 2020. Among the gaining stocks, shares of Estee Lauder Companies jumped by 9.44% after its latest quarterly revenues came above estimates Pinterest shares grew by 9.29% after it had reported quarterly earnings more than the estimates. Shares of Regeneron Pharmaceuticals went up by 2.93% after it reported quarterly profit more than the consensus estimates. Among the declining stocks, Shares of Skechers USA plunged by 4.73% after its quarterly profit had missed the estimates. Snap shares went down by 2.33% after it had reported quarterly earnings more than the forecast.

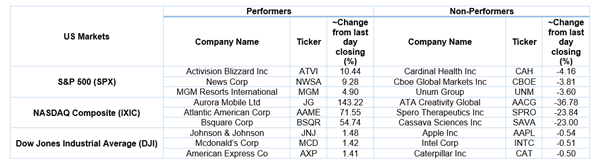

US Stocks Performance*

European News: The London and European markets traded in the green territory after the release of the latest US payrolls report. According to the latest Halifax house price index, the house prices in the UK slipped by 0.3% during January 2021 compared to December 2020. Among the gaining stocks, French Connection Group shares jumped by 71.25% after it had received two takeover approaches. Beazley shares jumped by 14.94% after it reported lower pre-tax loss than expected. Burberry Group shares went up by 2.65% after upgrading to “Neutral” by Goldman Sachs. Shares of Glencore had surged the most on FTSE 100. Among the decliners, shares of Johnson Matthey went down by 3.76% after downgrading to “underweight” by Barclays. Signature Aviation shares went down by 2.87% after Global Infrastructure Partners teamed up with Blackstone and Bill Gates in US$ 4.70 billion private jet deal.

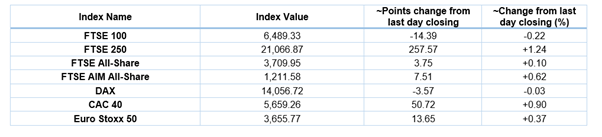

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 5 February 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Energy (+2.83%), Real Estate (+0.89%) and Consumer Cyclicals (+0.74%).

Top 3 Sectors traded in red*: Utilities (-1.86%), Industrials (-1.23%) and Healthcare (-1.13%).

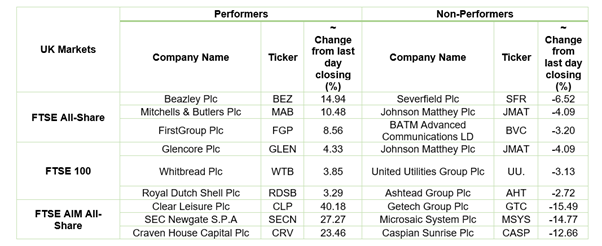

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $59.37/barrel and $56.79/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,812.95 per ounce, up by 1.21% against the prior day closing.

Currency Rates*: GBP to USD: 1.3729; EUR to GBP: 0.8768.

Bond Yields*: US 10-Year Treasury yield: 1.160%; UK 10-Year Government Bond yield: 0.496%.

*At the time of writing

.jpg)