The United Kingdom market closed higher on Friday (15th May 2020) with a monthly rise in China’s factory output. Even the FTSE 250 Index registered a growth of 1.66 per cent as China’s industrial production data jumped 3.9 per cent in April. Considering the current sentiments, we will discuss an aviation service company, Signature Aviation PLC (LON:SIG) along with a transport provider, National Express Group PLC (LON:NEX). On 15th May 2020, SIG released its AGM (annual general meeting) results, while NEX came up with brief trading update. Subsequently, the stock price of both SIG and NEX climbed 2.24 per cent and 13.28 per cent, respectively at the close of 15th May 2020. Let’s skim through the financial and operational position of these two Companies (SIG and NEX) and understand, what is bringing positivity to the market sentiments amid the widespread economic disruption.

Signature Aviation PLC (LON:SIG): USD 1 billion of Capital Returned to Shareholders in 2019

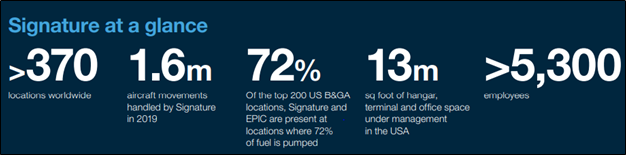

Signature Aviation PLC is a FTSE 250 listed aviation service company. The group operates with over 5,300 employees and covers around 370 locations in 5 continents. In 2019, the company handled 1.6 million aircraft movement. In October 2019, the group acquired IAM Jet Centre which has expanded five new sole sources for the company.

(Source: Company Website)

Segments at a Glance

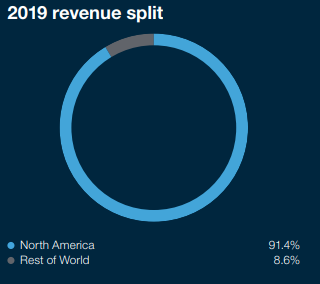

Geographically, the group splits its revenue into five regions, namely United Kingdom, Mainland Europe, North America and Rest of World. In 2019, the group generated around 91 per cent of revenue from North American operations.

Operationally, the group differentiated its business into two divisions – Signature and Discontinues operations.

(Source: Annual Report, Company Website)

Major Updates of 2020

- 15th May 2020: The company reported that it had 839,714,873 ordinary shares in the issue along with 10,883,843 shares held in treasury, as at 15th May 2020.

- 30th March 2020: The group suspended the final dividend for the financial year 2019 to preserve cash during uncertainties presented by the COVID-19 outbreak.

Trading Update (as on 15th May 2020) – Improvement in Flying in the First Thirteen Days of May

- The company announced a trading update for the period 1 January 2020 to 30 April 2020 and responded to the COVID-19 situation.

- The Group has stated that flying activity has improved in the first thirteen days of May 2020 to show a 66 per cent decline YoY. Whilst the flying activity tumbled 77 per cent in April 2020 as compared with the corresponding period of the last year.

- During the three months to 31 March 2020, the business continued to deliver better outperformance against the US B&GA (Business & General Aviation) market. As reported, US B&GA flight movements by the FAA (Federal Aviation Administration) decreased by 8.9 per cent, and like-for-like revenue in the Signature business (Fixed Base Operation (FBO) and TECHNICAir) was down by 7.5 per cent (on a leap year adjusted basis).

- Group’s revenue for the continuing (Signature FBO, EPIC and TECHNICAir) reduced by 72 per cent in April, while in the first four months of the year, it shows a decline of 28 per cent. On a like-for-like basis, the revenue tumbled 69 per cent in April 2020 and 24 per cent in the first four months of the year.

- In the light of COVID-19 pandemic, SIG has taken decisive management action to reduce costs, with the significant curtailment of capital expenditure. During the month of April, the Company has delivered a robust cash generation of USD 6 million.

- At the end of April 2020, the RCF (Revolving Credit Facility) was drawn by USD 49 million, leaving USD 351 million of undrawn facilities plus USD 74 million of cash held.

- The company has also stated that during the month of April 2020 the Group was cash flow positive by USD 6 million and at the end of April 2020 it had total facility headroom and cash of USD 425 million.

Share Price Performance

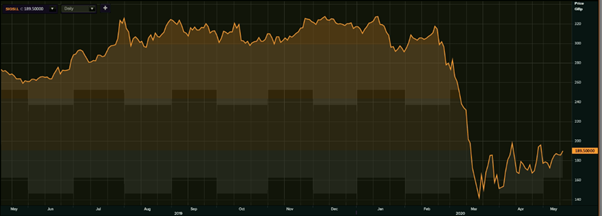

Daily Chart as of May 15th, 2020, after the market closed (Source: Refinitiv, Thomson Reuters)

SIG’s shares closed at GBX 189.50 on 15th May 2020. Stock's 52 weeks High is GBX 402.04 and Low is GBX 129.40. Total outstanding market capitalization stood at around GBP 1.57 billion.

Outlook - Short-Term Uncertainty Prevails but Decent Scenario for Long Term

The Company is going through a transformation phase and investing more towards quality of service at this crucial time. SIG has suspended its guidance and dividend payments later in the year. While it will provide further updates and guidance when the Group is in a position to do so. Signature Aviation will continue to monitor the COVID-19 situation closely. The USD 400 million unsecured RCF matures in March 2025. The Company has implemented several actions to best align the cost base with the decrease in flight activity across the FBO network.

National Express Group PLC (LON:NEX) – Operating with Robust Liquidity Position While Adopting Cash Preservatives

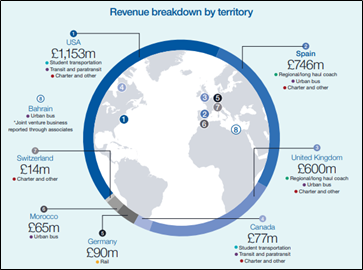

National Express Group PLC is a FTSE 250 listed public transport service company. It caters around 938 million passengers journeys each year with a fleet of more than 31,700 vehicles. The company employs around 51,000 people worldwide and having operations in eight countries.

(Source: Annual Report, Company Website)

How Does It Generate Value for its Shareholders?

-

Revenue Generation

- The group generated around 50 per cent of revenue from multi-year contracts (such as local authorities and schools).

- Further 37 per cent of revenue is generated through ticket sales to the public passengers.

- And, the remaining revenue is generated through on-board entertainment, private hire, and other ancillary services.

- Delivering Cash Flow: Company generated GBP 773 million of free cash flow, in the past five years and regularly converting the operating profiles into free cash flows.

- Delivering Return through Reinvestment: The company has reinvested GBP 701 million since 2015 to strengthen its position while returning 327 million through dividends over the past five years.

Significant Actions of the Recent Past:

- 6th May 2020: The company placed 102,347,729 fresh ordinary shares for raising the gross proceeds of nearly GBP 235 million.

- 5th April 2020: The company suspended the coach service due to lockdown restrictions, with immediate effect.

Trading Update (as on 15th May 2020) – Expecting Positive Cash Flow and Growth Trends

- NEX released an update on the trading performance for the month of April 2020, with the revenue for April 2020 stood at approximately 50 per cent against the corresponding period of the last year.

- The Group also made some positive developments in its key markets as it moves out of lockdown. National Express won the school bus contract in North America and had initiated start-up discussions for return to service with school districts.

- In Canada, the Group witnessed 80 per cent of students registered for immediate requirement school buses.

- In the UK, the Company has started selling tickets for coach services.

- National Express Group managed to generate positive EBITDA which was better than expectations.

- NEX had a strong cash collection in April and resulted in positive cash flow ahead of management’s expectations.

- The company reported decent liquidity position, with approximately undrawn committed facilities and a cash balance of £5 billion.

Share Price Performance

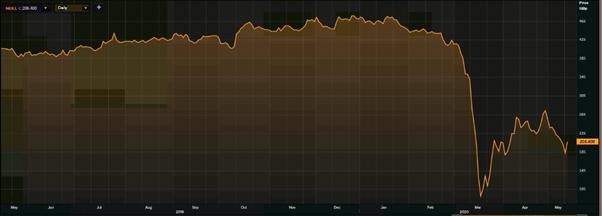

Daily Chart as of May 15th, 2020, after the market closed (Source: Refinitiv, Thomson Reuters)

NEX’s shares closed at GBX 206.40 on 15th May 2020. Stock's 52 weeks High is GBX 485.00 and Low is GBX 66.30. Total outstanding market capitalization stood at around GBP 1.27 billion.

Short Term Sentiments Showing Growth Trajectory

ALSA business and UK Coach division are well-positioned while North America business had shown robust growth. As the lockdown is removed in Spain and Morocco, NEX expects demand to increase in the coming weeks in both countries. To tackle the COVID-19 outbreak, the company is in talks with the banking group for short-term facilities and taking several actions to reduce its operating costs.