US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 8.69 points or 0.26 per cent higher at 3,303.30, Dow Jones Industrial Average Index expanded by 142.39 points or 0.53 per cent higher at 26,806.79, and the technology benchmark index Nasdaq Composite traded higher at 10,905.18, up by 2.38 points or 0.02 per cent against the previous day close (at the time of writing, before the US market close at 11:45 AM ET).

US Market News: The Wall Street opened in green as the key indices advanced. Meanwhile, the US total vehicles sales increased to 14.5 million in July 2020 from 13.1 million in June 2020. Among the gaining stocks, Boeing shares were up by about 1.6 percent after the company received guidance from the Federal Aviation Administration related to 737 Max jets. Ford Motor shares were up by close to 1.4 percent after the company announced that Jim Farley would replace the current CEO, Jim Hackett. Hyatt Hotels shares were up by about 0.9 percent after the company reported quarterly revenue above the market's expectation. Among the decliners, Microsoft shares were down by close to 1.9 percent amid the opacity over the company's acquisition of Tik Tok. Alphabet was down by about 0.3 percent after the EU initiated an investigation related to Google's purchase of Fitbit.

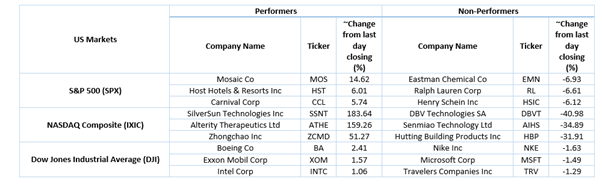

US Stocks Performance (at the time of writing)

European News: London markets opened in green, whereas the European markets opened in the red. As per the UK's Finance Ministry data, the Banks have lent close to £50.0 billion to the businesses under the Covid-19 support scheme and £33.8 billion to support the furloughed workers. The UK government's job retention scheme has supported close to 9.6 million workers. Among the gaining stocks, EasyJet surged by close to 9.2 percent after the company reported that it would operate 40 percent of its flying capacity in the Q4 FY2020. Direct Line Insurance was up by about 6.7 percent after the company announced the interim dividend for H1 FY20. BP was up by close to 6.5 percent, although the company reported a loss in earnings and slashed the dividend. Among the decliners, Babcock International plunged by around 10.0 percent after the company suspended the final dividend payment. Diageo was down by close to 5.1 percent after the company reported lower net sales for FY2020 impacted due to the Covid-19. IWG declined by about 1.8 percent after the company made Covid-19 related provisions of £126.7 million in H1 FY2020.

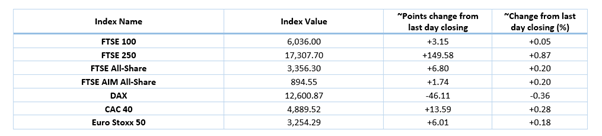

European Indices Performance (at the time of writing)

FTSE 100 Index Chart

1 Year FTSE 100 Index Performance (4 August 2020), before the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (BP.) BP PLC; (BT.A) BT GROUP PLC.

Sectors traded in the positive zone*: Energy (+3.64%); Telecommunications Services (+2.62%), and Financials (+0.34%).

Sectors traded in the negative zone*: Healthcare (-1.47%); Consumer Non-Cyclicals (-0.80%), and Basic Materials (-0.80%).

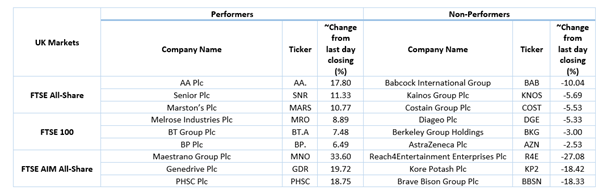

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $41.68 per barrel and $44.42 per barrel, respectively.

Gold Price*: Gold price was trading at USD 2,011.60 per ounce, up by 1.87% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.3053 and 0.9025, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.515 per cent and 0.074 per cent, respectively.

*At the time of writing