As per industry experts, in its Thursday meeting, the Bank of England will step up to bolster the British economy by providing additional stimulus of GBP 100 billion for its bond-buying programme. In March, BOE provided a package of GBP 200 billion.

Key macro factors which were trending today (as on 18th June 2020):

- The Office of National Statistics released the data for UK inflation. The UK Consumer Price Inflation fell to 0.5 per cent in May 2020 from 0.8 per cent in April. The low inflation was mainly driven by a fall in transport and recreation & culture sector.

- The rising cases in the US and resurgence of new coronavirus cases in China weakened the market sentiments, which dipped FTSE-100 by 0.55 per cent and it was trading at 6,218.85 (as on 18th June 2020, before the market close at 2:55 PM GMT+1).

Given the recent market developments and expectations, we will discuss two stocks - Grainger PLC (LON:GRI) in the real-estate sector and IWG PLC (LON:IWG) in the industrial sector. As on 18th June 2020 (before the market close at 2:55 PM GMT+1), both the stocks (GRI and IWG) were down by 0.69 per cent and 2.19 per cent, respectively. It is noteworthy that Grainger PLC will continue to pay an interim dividend when all other companies are preserving cash. Let us analyze the financial and operational position of both stocks in more detail.

Grainger PLC - Maintaining interim dividend payout during unprecedented times

Grainger PLC (LON:GRI) is a FTSE 250 company, headquartered in Newcastle upon Tyne. The Company designs, builds and operates rental homes across the UK and has close to 9,270 rental homes (3,225 regulated tenancies and 6,045 PRS) with the market value of the portfolio close to GBP 2.77 billion. It operates under two portfolio – private rented sector (PRS) and regulated tenancy. The regulated tenancy is the lease agreement where the tenant can reside for life and rent is below market level, on vacancy, the rental income and sales of these homes create significant cashflows.

The Company released its H1 FY2020 results ending 31st March 2020 on 14th May 2020

Financial Update - H1 FY2020

The residential house occupancy was 97.2 per cent in the period. At the end of March, leasing activity slowed due to the pandemic; however, it also restricted the movement of people which translated to low churn rate. Despite challenging conditions in the market, Grainger declared an interim dividend payout of 1.83 pence per share. The other key highlights were:

- The net rental income was GBP 37 million, and profit from sales was GBP 22.8 million in H1 FY20. The net rental income was up by 27 per cent; however, negated by 27 per cent fall in the profit of sales year on year.

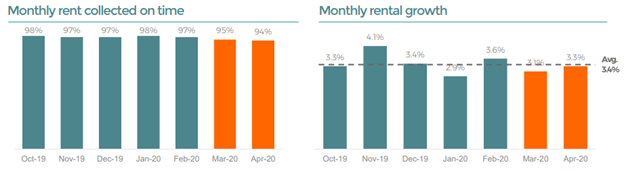

- The Company’s like-for-like (L4L) rental growth was 3.4 per cent in H1 FY20. In April 2020 the LFL rental growth was 3.3 per cent where PRS growth was 3.0 per cent, and regulated tenancy growth was 4.0 per cent.

Operational Update - H1 FY2020

Monthly rent collection for March and April 2020 was 95 per cent and 94 per cent, respectively. The Company continued the repair work across its portfolio of homes.

(Source: Presentation, Company Website)

Balance sheet strength

The Company has a robust financial position with a substantial balance sheet headroom as it raised fresh equity of GBP 187 million in February 2020. At the end of March 2020, the Company had a cash balance of GBP 198 million and a loan facility of GBP 329 million. The LTV (Loan to Value) was 32.9 per cent, which was lowest in six years.

Share Price Performance Analysis

Daily Chart as on 18th June 2020, before the market closed (Source: Refinitiv, Thomson Reuters)

The share price of Grainger PLC was trading at GBX 287.40 per share and was down by 0.21 per cent (before the market close at 12.49 PM GMT+1). GRI had its 52-weeks High and Low of GBX 341.80 per share and GBX 189.76 per share. The market capitalization of the Company was around GBP 1.94 billion.

Operational Portfolio and Future Pipeline

(Source: Presentation, Company Website)

Business Outlook

The Company has a pipeline of close to 8,536 homes with an asset value of approximately GBP 2.0 billion of which it has a secured pipeline for 4,213 homes worth GBP 1.0 billion. The Company has submitted the planning for three projects for its TFL JV for 761 homes for an investment of GBP 288 million. The TFL sites include Southall, Arnos Grove and Montford. Grainger has a capital expenditure of GBP 165 million over the next 12 months. In the near term, it expects to maintain LTV below target 40-50 per cent excluding reversionary surplus.

IWG PLC – Fresh equity raised to improve the liquidity position

IWG PLC (LON:IWG) – is a FTSE 250 listed company. The Company is a workspace provider and partners with franchisees and property owners worldwide to provide flexible workspace for businesses. It is currently operating at 3,405 locations in 29 countries with 31 franchise partners.

The Company released Trading Update for the Q1 FY2020 (ended 30th April 2020) on 27th May 2020

The key highlights of the update are given below:

- Despite COVID-19 impact in Asia in February and March, IWG delivered decent numbers in Q1 FY20.

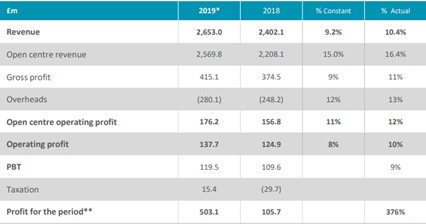

- The Company reported total revenue of GBP 692.6 million in Q1 FY20, which was up by 11.7 per cent at constant currency year on year. The open centre contributed GBP 684.8 million of the total revenue.

- In Q1 FY20, the open centre revenue increased by 17.7 per cent at constant currency year on year. The pre-2019 revenue was up by 7.6 per cent at constant currency, and workspace occupancy was 78.8 per cent up by 6.6 per cent when compared to the same period last year.

- In April 2020, the open centre revenue was up by 6.5 per cent at constant currency year on year. However, the pre-2019 revenue was down by 2.9 per cent at constant currency year on year in April 2020.

- The Company withdrew the proposed final dividend of 4.80 pence for FY19 to preserve cash.

Full Year Performance in FY2019 as reported on 3rd March 2020

(Source: Presentation, Company Website)

Balance Sheet Strength

As on 30th April 2020, the Company had a cash balance of GBP 387.7 million and an undrawn loan facility of GBP 131.3 million. The net debt was GBP 320.8 million. Also, the financial strength must have improved by the new share issue on 28th May 2020.

Fresh Equity Raised

- 28th May 2020, the Company issued 133,891,213 new shares for 239 pence per share. The new shares raised close to GBP 320 million in gross proceeds.

- The CEO Mark Dixon subscribed for 38,205,384 shares for approximately GBP 91.3 million.

Workspace centres and Franchise developments

- For the period, January to April, the Company opened 64 new centres with 2.1 million square feet space. The new centres cost GBP 46.7 million, net of partner contribution. In the same period, it closed 47 facilities.

- The new workspace centres planned to be opened over the year will cost GBP 100 million, net of partner contribution.

Share Price Performance Analysis

Daily Chart as on 18th June 2020, before the market closed (Source: Refinitiv, Thomson Reuters)

The share price of IWG PLC was trading at GBX 272.40, which was down by 3.81 per cent (before the market close at 12.45 PM GMT+1). The stock had a 52 weeks High and Low of GBX 470.40 per share and GBX 101.15 per share. The Company had a market cap of around GBP 2.85 billion.

Business Outlook

The Company believes the pandemic to have a significant impact on its business in Q2 FY 20. It anticipates slight improvement in business in H2 FY20; however, it will largely depend on how lock-down will ease globally. It will take measures to decrease costs and manage cash flows. The sales activity for the newer centres will be challenging. Amid the current situation, it has halted any action related to broad master franchise agreements, but it will retain its interest in the smaller franchising transaction. The Company will close a few workspace centres. This activity will result in a write-down of assets which are not fully depreciated. The profitability might also be impacted over the short term.