HIGHLIGHTS

- UK shares briefly returned to green after Wall Street began in positive territory

- CPI based inflation rate, excluding food and energy, in the US topped 4%

- FTSE 100 was traded at 7,142.54, up 0.17%, while FTSE 250 jumped over 0.70%

UK shares briefly returned to positive region with the benchmark FTSE 100 turning green after the leading stock indices on Wall Street jumped marginally with Nasdaq Composite leading the charge.

In the wee hours of trading, the NYSE-controlled Dow Jones Industrial Average traded largely unchanged, the broader S&P 500 jumped more than 0.20%, while the tech leader Nasdaq Composite registered a day’s high at 14,573.46, after rising over 0.60%.

Top Global Stories before the ASX opening bell

The market participants were apparently relieved after the annual inflation rate in the US witnessed a slight upward change, however, the rate scaled a fresh 13-year high of 5.4% in September as compared to 5.3% in August of 2021, data published by the US Bureau of Labor Statistics revealed.

Also Read | Just Eat shares hit new 52-week low even as orders rise by 25%

On a sequential basis, the inflation rate jumped to 0.4% with the underlying cost of shelter, food, energy, and new vehicles contributing majorly to the upswing. The decreasing costs of transportation services, used cars and trucks and medical care helped in counterbalancing the upsurge, but failed to alleviate the inflationary pressures. Meanwhile, the consumer price index based inflation rate, excluding food and energy, in the US topped 4% in September as compared to the same period a year ago.

The present month will remain susceptible to the upcoming macroeconomic actions as investors are waiting for major indicators to rejig their respective trade setups before the spending splurge period of Christmas.

The domestic markets hovered in the negative territory for most part of the day, barring the mid-cap barometer FTSE 250 as upbeat third quarter corporate earnings propelled the index with the shares rising up to 8%.

Also Read | Argo Blockchain, Capita & Darktrace: 3 tech stocks for long term growth

According to the latest data available with the London Stock Exchange, the headline FTSE 100 was trading at 7,142.54, up 0.17% from the previous close of 7,130.23, while FTSE 250 was oscillating 0.77% higher at 22,640.70, from the last close of 22,468.90.

Shares of Barratt Developments Plc (LON:BDEV), Taylor Wimpey Plc (LON: TW) and Johnson Matthey Plc (LON: JMAT) were the lead gainers, while the heavyweight stock of International Consolidated Airlines Group Plc (LON: IAG), BT Group Plc (LON: BT) and BP Plc (LON: BP) were the major laggards among the 101 constituents of FTSE 100.

Shares of Lloyds Banking Group Plc (LON: LLOY) and Glencore Plc (LON: GLEN) commanded the trading counters with the trading volumes of more than 118.54 million and 43.98 million, respectively.

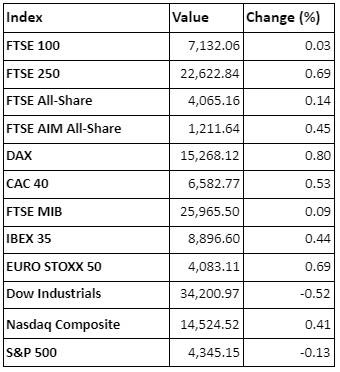

Major Markets @ 15:05 BST