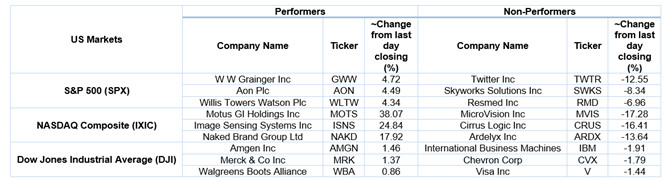

US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 25.26 points or 0.60 per cent lower at 4,186.21, Dow Jones Industrial Average Index dipped by 227.18 points or 0.67 per cent lower at 33,833.18, and the technology benchmark index Nasdaq Composite traded lower at 14,026.21, down by 56.33 points or 0.40 per cent against the previous day close (at the time of writing - 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after record highs achieved during the week. Among the gaining stocks, Restaurant Brands International shares jumped by around 2.37% after the Company had breached quarterly revenue estimates. Amazon shares went up by about 1.78% after the Company had reported record profits boosted by pandemic shopping. Among the declining stocks, Twitter shares plunged by about 12.41% after the social media giant had provided disappointing revenue guidance for the second quarter. Clorox shares went down by about 2.73% after the Company had reduced its full-year forecast due to high commodity and freight costs.

US Stocks Performance*

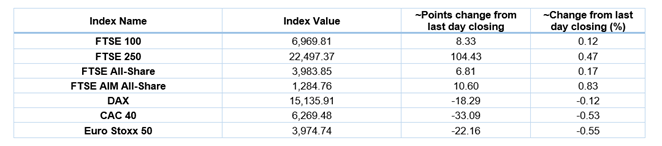

European News: The London markets traded in a green zone after the flurry of corporate earnings announcements made during the week. FTSE 100 advanced higher by around 0.41%, boosted by the earning updates of AstraZeneca and Smurfit Kappa. According to the latest Nationwide house price index, annual house price growth in the UK had reached 7.1% during April 2021, while the annual house price growth was 5.7% for March 2021. Moreover, the average UK house price rose by around 2.1% in April 2021 as compared to March 2021.

Covid-19 vaccine provider AstraZeneca shares rose by about 5.33% after the Company had reported revenue growth of around 15% during the first quarter of 2021. Moreover, the Company had forecasted a performance acceleration during the second half of the year.

Packaging Giant Smurfit Kappa had reported corrugated volume growth of approximately 7% during the first quarter of 2021 in both Europe and the Americas. Furthermore, the shares went up by around 3.88%.

Valve & instrumentation maker Rotork shares went down by about 3.38%, even after the Company had delivered improved trading performance during the first quarter of 2021.

Hikma Pharmaceuticals had stated that annual revenue from generic treatments would remain at the top range of the guidance. Moreover, the shares jumped by about 4.19%.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 30 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Barclays Plc (BARC); Lloyds Banking Group Plc (LLOY); BP Plc (BP.).

Top 3 Sectors traded in green*: Healthcare (+3.29%), Utilities (+1.78%) and Consumer Non-Cyclicals (+0.76%).

Top 3 Sectors traded in red*: Consumer Cyclicals (-0.29%), Financials (-0.27%) and Basic Materials (-0.06%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $66.56/barrel and $63.38/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,769.35 per ounce, up by 0.06% against the prior day closing.

Currency Rates*: GBP to USD: 1.3809; EUR to GBP: 0.8706.

Bond Yields*: US 10-Year Treasury yield: 1.629%; UK 10-Year Government Bond yield: 0.8405%.

*At the time of writing

.jpg)