US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 4.50 points or 0.12 per cent lower at 3,657.95, Dow Jones Industrial Average Index dipped by 56.61 points or 0.19 per cent lower at 29,767.31, and the technology benchmark index Nasdaq Composite traded lower at 12,315.01, down by 40.10 points or 0.32 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The Wall Street traded in the red as monthly private payrolls data reported below expectation. The private payrolls in the US increased by 307,000 in November 2020, which was below the expected increase of 410,000. The All Car sales in the US stood at 3.77 million in November 2020. Among the gaining stocks, Pfizer and BioNTech gained around 3.2% and 3.6%, respectively after their covid-19 vaccine got approval in the UK. Merck was up by about 0.6% after it sold its equity investment in Moderna. Among the decliners, shares of Salesforce plunged by nearly 9.5% after it agreed to buy Slack, which declined by around 2.9%. Walmart declined by close to 0.5% after it announced it is dropping its USD 35 online shipping minimum for Walmart+ members.

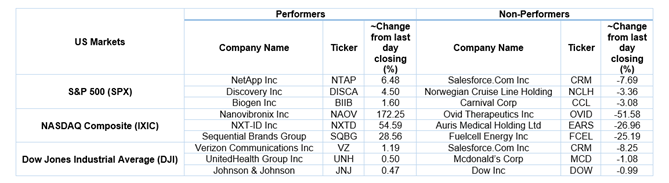

US Stocks Performance*

European News: The UK market traded in the green as UK regulators approved the Covid-19 vaccine. The UK becomes the first country to approve a covid-19 vaccine as shots developed by Pfizer and BioNTech get approved by regulators. As per the industry expert’s survey, the UK’s economy will contract in this quarter, and it will take two years for the GDP to reach the pre-covid level. Among the gaining stocks, shares of SpaceandPeople skyrocketed around 182.1% after it signed the agreement with owners of four Intu shopping centres for promotional sales and temporary retailing. Rio Tinto was up by about 4.3% and led the FTSE-100 gain. Among the decliners, Avon Rubber fell by about 7.6% after it posted a decline in adjusted earnings per share. IWG plunged by nearly 7.0% after it announced the launch of unsecured bonds of £300 million. Tesco slipped by around 1.8% after it decided to repay business rates relief. Wizz Air declined by approximately 0.2% after the company reported that it carried 0.5 million passengers at a load capacity of 21% in November 2020.

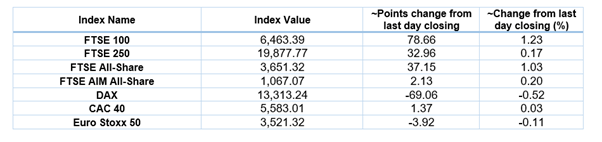

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); International Consolidated Airlines Group S.A. (IAG).

Top 3 Sectors traded in green*: Basic Materials (+2.77%), Energy (+1.51%) and Utilities (+1.06%).

Top 3 Sectors traded in red*: Consumer Cyclicals (-0.62%), Real Estate (-0.48%) and Consumer Non-Cyclicals (-0.21%).

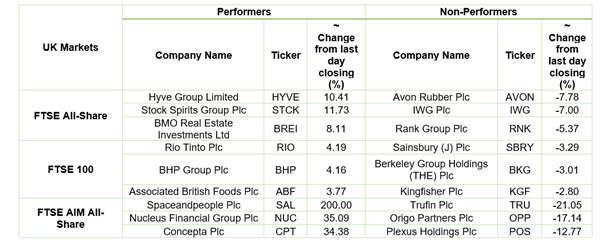

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $48.44/barrel and $45.52/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,830.15 per ounce, up by 0.62% against the prior day closing.

Currency Rates*: GBP to USD: 1.3354; EUR to GBP: 0.9057.

Bond Yields*: US 10-Year Treasury yield: 0.951%; UK 10-Year Government Bond yield: 0.350%.

*At the time of writing