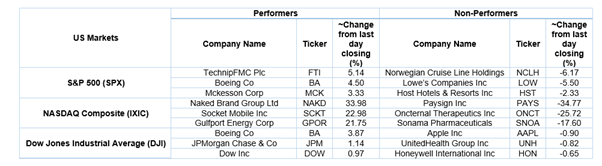

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 2.47 points or 0.07 per cent higher at 3,612.00, Dow Jones Industrial Average Index expanded by 84.60 points or 0.28 per cent higher at 29,867.95, and the technology benchmark index Nasdaq Composite traded lower at 11,870.64, down by 28.71 points or 0.24 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The key indices of Wall Street traded in green over vaccine hopes. The new home building starts in the US increased by 4.9% month on month in October 2020. The building permits in the US were reported at 1.545 million in October 2020 that was below the expected 1.560 million permits. Among the gaining stocks, BioNtech gained around 4.5% after the company said that their covid-19 vaccine is 95% effective. Boeing rose by about 2.9% after FAA approved the return of 737 Max. Shares of Target were up by around 2.7% after it reported quarterly earnings per share of USD 2.79 per share. Among the decliners, Lowe’s declined by about 5.2% after the quarterly earnings were below the consensus estimates. Apple slipped by 0.2% after it announced a new programme that would slash app store fees.

US Stocks Performance*

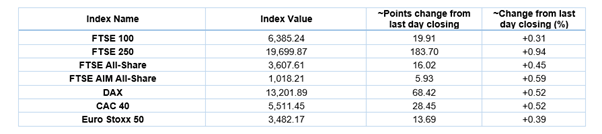

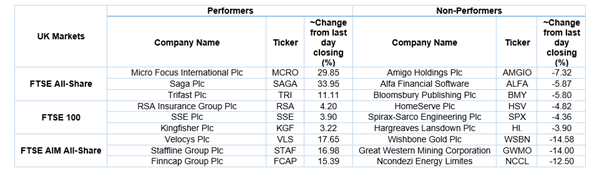

European News: The London and European markets traded in the green as the UK’s inflation increased by more than expected. The Core CPI in the UK increased by 0.2% month on month in October 2020, and it was above the estimate of 0.1%. The Core PPI output in the UK increased by 0.2% in October, and it was above the expected growth of 0.1%. Among the gaining stocks, SSE rose by close to 4.4% after it reported earnings per share of 67.7 pence. Croda International was up by around 2.3% after it acquired Iberchem. Aviva gained by about 0.4% after it completed the sale of shareholding in Indonesia. Among the decliners, Spirax-Sarco Engineering was down by around 4.3% after it announced that its full-year expectation remains unchanged. Kaz Minerals declined by about 1.5% after the company stated that the risk to the Baimskaya project has increased. Anglo American slipped by nearly 0.1% after it reported a USD 450 million sales cycle of De Beers diamond.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 18 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Utilities (+1.35%), Financials (+1.06%) and Energy (+0.77%).

Top 3 Sectors traded in red*: Real Estate (-1.14%), Industrials (-0.42%) and Consumer Non-Cyclicals (-0.25%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $44.70/barrel and $42.36/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,874.25 per ounce, down by 0.58% against the prior day closing.

Currency Rates*: GBP to USD: 1.3281; EUR to GBP: 0.8933.

Bond Yields*: US 10-Year Treasury yield: 0.888%; UK 10-Year Government Bond yield: 0.344%.

*At the time of writing