US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 1.65 points or 0.05 per cent lower at 3,508.80, Dow Jones Industrial Average Index contracted by 11.25 points or 0.04 per cent lower at 28,378.93, and the technology benchmark index Nasdaq Composite traded lower at 11,853.09, down by 37.84 points or 0.32 per cent against the previous day close (at the time of writing, before the US market close at 10:55 AM ET).

US Market News: The Wall Street traded in the red as Joe Biden moved closer to the US Presidential election win. The unemployment rate in the US fell to 6.9% in October 2020 from 7.9% in September 2020 as hiring reclaimed. Among the gaining stocks, shares of Coty surged by nearly 14.2% after it reported sales above expectation. Roku shares were up by approximately 11.7% after it reported a profit of 9 USD cents in the third quarter. CVS Health gained around 5.3% after it named Karen Lynch as the next CEO. Hershey gained by about 3.1% after it witnessed strong halloween sales. Marriott rose by close to 2.4% after it announced revenue in line with forecast. Among the decliners, ViacomCBS was down by around 2.2% after it posted quarterly earnings of 91 USD cents per share. UnitedHealth Group was down by 1.9% on DOW 30.

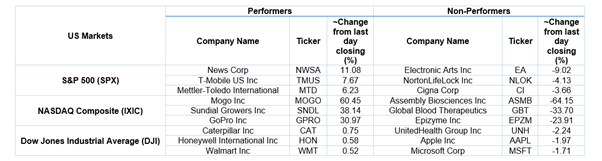

US Stocks Performance*

European News: The London and European markets traded in the green as the Bank of England states that there would be more than nine million people on furlough scheme during spring. Meanwhile, the UK’s Halifax House Price index increased by 0.3% month on month in October 2020. Among the gaining stocks, M&G led the FTSE-100 gain, and it was up by nearly 3.9%. Polymetal International gained around 3.1% after it announced an ore reserve estimate for Pesherny deposit. Premier Foods rose by about 1.7% after it reported disposal of Hovis joint venture. Beazley moved up by approximately 1.5% after it reported a 16% increase in gross written premium. Among the decliners, RSA Insurance declined by around 2.6% after it got a takeover offer from Intact Financial Corp and Tryg A/S. Aveva was down by close to 2.8% after it announced the rights issue to fund the acquisition of OSIsoft.

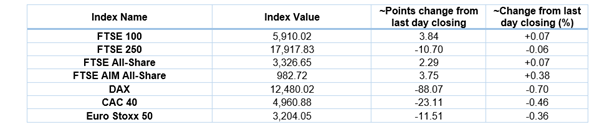

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 6 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Basic Materials (+1.92%), Financials (+1.15%) and Energy (+0.51%).

Top 3 Sectors traded in red*: Utilities (-0.91%), Technology (-0.57%) and Real Estate (-0.53%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $39.62/barrel and $37.30/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,952.55 per ounce, up by 0.30% against the prior day closing.

Currency Rates*: GBP to USD: 1.3155; EUR to GBP: 0.9030.

Bond Yields*: US 10-Year Treasury yield: 0.822%; UK 10-Year Government Bond yield: 0.282%.

*At the time of writing