US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 66.96 points or 2.02 per cent higher at 3,377.20, Dow Jones Industrial Average Index expanded by 599.84 points or 2.23 per cent higher at 27,524.89, and the technology benchmark index Nasdaq Composite traded higher at 11,150.87, up by 193.25 points or 1.76 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The key indices of Wall Street traded in the green over the hopes of US Presidential elections. The factory orders in the US increased by 1.1% month on month in September 2020 above the expected 1.0% growth. Among the gaining stocks, shares of Ferrari moved up by close to 5.0% after it said that the 2020 results would be near the upper-end range. Wayfair was up by close to 3.0% after it posted a quarterly profit of USD 2.30 per share. Humana gained by around 2.3% after it raised the outlook for Medicare Advantage membership. Jazz Pharmaceutical rose by nearly 2.1% after the drug maker increased the full-year forecast. Among the decliners, Cirrus Logic fell by around 3.2%, although the company reported better than expected earnings. Amazon was down by around 0.6% on Nasdaq 100.

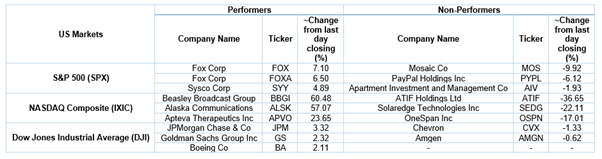

US Stocks Performance*

European News: The London and European markets traded in green as the investor’s sentiment improve. The self-employed people in the UK are expected to get 80% support of their pre-crisis profit as stated by the UK’s Prime Minister. Among the gaining stocks, shares of Crest Nicholson surged by about 15.7% after it forecasted earnings ahead of market’s expectations. G4S moved up by nearly 4.1% after it rejected a takeover proposal from Allied Universal Security Services. Wizz Air gained by around 3.4% after it reported lower passenger numbers in October 2020. Senior PLC was up by around 0.2%, although it said that its revenue is unlikely to bounce back before 2022. Among the decliners, Amigo Holdings plunged by around 21.2% after it gives up a plan to resume new lending until 2021. Associated British Foods was down by close to 0.8% after it reported a 40% decline in full-year earnings.

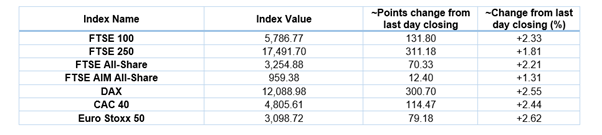

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 3 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Barclays Plc (BARC).

Top Sectors traded in green*: Financials (+3.34%), Basic Materials (+2.95%) and Energy (+2.54%).

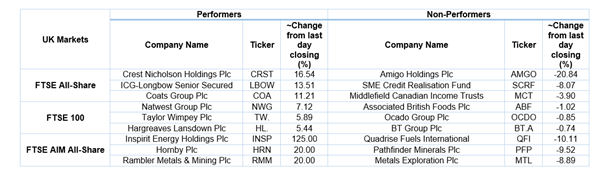

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $39.73/barrel and $37.67/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,910.15 per ounce, up by 0.93% against the prior day closing.

Currency Rates*: GBP to USD: 1.3043; EUR to GBP: 0.8978.

Bond Yields*: US 10-Year Treasury yield: 0.887%; UK 10-Year Government Bond yield: 0.271%.

*At the time of writing