The British and the European markets retreated today (before the market close on 4th June 2020) post topping the three-months high yesterday. The following triggers dominated the market movements:

- As per IHS Markit, the UK Construction PMI (Purchasing Managers' Index) rose to 29.9 in May from 8.2 points in April.

- The cost of UK’s emergency spending is likely to be GBP 132.5 billion from a previous estimate of GBP 123.2 billion, as per the Office for Budget Responsibility.

- The European Central Bank provided the additional aid of €600 billion for the battered economy.

Considering the above-stated market sentiments, we will discuss two stocks which are operating in ‘Aerospace & Defence’ sector - BAE Systems PLC (LON: BA.) and Senior PLC (LON:SNR). As on 4th June 2020 (before the market close at 3.10 PM GMT), BA. stock was down by around 0.16 per cent, while SNR jumped over 19.7 per cent. Let’s skim through the financial and operational position of both the Companies to better understand the stock movements.

BAE Systems PLC (LON: BA.) – Awarded Several Contracts Recently to Stay Buoyant

BAE Systems PLC is a provider of technology solutions for defense, aerospace and security markets. The Group has an established position in maritime, air, cyber and land domain. The Group operates with five operating segments, namely Electronic Systems, Cyber & Intelligence, Platforms & Services, Air and Maritime. The business operations are geographically split into 4 main regions – the US, UK, Saudi Arabia, Australia, and Other International markets. It has a workforce of around 85,800 people in over 40 countries. The Company’s stock has been listed on the London Stock Exchange since 11th February 1981, and currently, it is trading as a constituent of FTSE 100 index.

(Source: Annual Report, Company Website)

Recent Significant Developments – Reflecting Contracts, Acquisition and Bond Issuance

- 2nd June 2020: The Company secured a contract from Lockheed Martin for its for DARPA’s Squad X program.

- 26th May 2020: BAE Systems won a GBP 350 million contract from the UK Ministry of Defence.

- 4th May 2020: The Group completed the acquisition of Airborne Tactical Radios business of Raytheon Technologies Corporation, for a consideration of USD 275 million. The transaction was funded by the existing cash resources of the BAE Systems.

- 8th April 2020: The Group affirmed that the Financial Conduct Authority has approved the bond issue of U.S.$1,300,000,000 notes (maturing in 2030, 3.400% interest per year).

Market Update – Increasing Production to Support Recovery of Economy

On 3rd April 2020, BAE Systems released an update of Covid-19 impact on the market performance. The Group is focused on ensuring the health and the safety of its employees and the safety of its facilities. The Company is working closely with its suppliers and customers to increase the level of production and with a reduced interruption in the supply. The Group remained in a healthy position with its large order backlog. Some additional Highlights are stated below that cover more information on this update:

- The Group has taken multiple steps to become well-positioned to take maximum benefits once the situation stabilises. The Company has been closely monitoring the situation and enabled remote access for a significant number of employees and reduced operational performance in multiple sites.

- The Company has also released new working procedures in its facilities to ensure social distancing. In the Q1 of the financial year 2020, the Group’s performance remained in line with the expectations and in Q2 BAE Systems started facing material disruptions.

- The Company has taken a series of steps to reduce its costs and preserve cash.

- The Group has efficient liquidity and Revolving Credit Facility of GBP 2 billion to offset the financial impact. The board has decided to postpone the dividend payments until the situation becomes clearer.

Financial Highlights (FY19) - Good Set of Results, Underpinned by Enhancing Operational Performance

On 3rd April 2020, the Company published its Annual report, with robust demand for the BAE’s capabilities, products and services. Some Other Highlights:

- Led by growth in its business and its portfolio strengths, the Company’s revenue grew by 7 per cent to GBP 20,109 million in FY2019 as compared to GBP 18,407 million in FY18.

- Underlying earnings per share increased by 7 per cent to 45.8p in FY2019 against 42.9p in the fiscal year 2018.

- Net debt reduced to GBP 743 million in FY2019 against GBP 904 million in FY2018.

- The order intake was GBP 18.4 billion, and order backlog stood at GBP 45.4 billion.

Share Price Performance Analysis

Source: Refinitiv, Thomson Reuters) - Daily Chart as of June 4th, 2020, before the market close

BA’s shares were trading at GBX 514.30 on 4th June 2020 (before the market close at 2:44 PM GMT+1). Stock's 52 weeks High is GBX 672.80 and Low is GBX 428.60. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 16.48 billion.

Business Outlook

In 2020, the Company is expecting a mid-single-digit growth in underlying EPS. Free Cash Flow generation is targeted at £3.5-£3.8 billion in 2020-2022 with accelerated UK pension deficit funding plan. Strategically, the Group took several measures to bolster the portfolio growth. Research and development activities, diversified operations and growth in revenue are the major strengths of the Group. Moreover, the contracts and agreements, the international market for Unmanned Aerial Vehicles (UAVs), expanding cybersecurity market and strategic acquisitions would provide growth opportunities for the Company. BAE System has a substantial order backlog and stays focused on robust programme performance to deliver a viable business model with improved fiscal performance.

Senior PLC (LON:SNR) – Bolstered Liquidity with Covid Corporate Financing Facility and Covenant Waiving

Senior PLC designs, manufactures and sells high technology systems and components for the OEM (original equipment manufacturers) in the aerospace, defence, power & energy, and land vehicle industry. The Company has operations in 13 countries with 30 businesses. It operates through two business segments, namely Aerospace and Flexonics. Geographically, operations are predominantly located in Europe and North America. It was listed on the London Stock Exchange since 16th February 1947, and currently, it is trading as a constituent of FTSE 250 index.

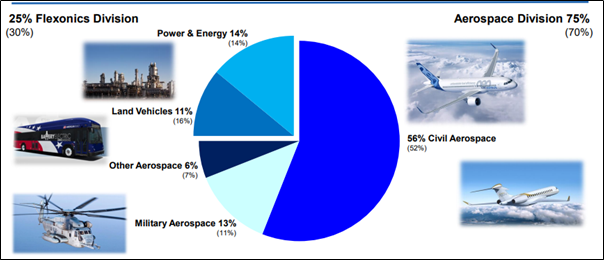

(Source: Presentation, Company Website)

Glimpse of Business Segments

- Aerospace: As of FY2019, the division employs 5,309 people and contributed around 75 per cent of the Group revenue.

- Flexonics: As of FY2019, the division employs 2,248 people and contributed around 25 per cent of the Group revenue.

Significant Recent Actions to Combat the COVID-19 Uncertainties

- 2nd June 2020: The Group confirmed that the eligibility for the Covid Corporate Financing Facility coupled with covenant relaxation, will provide the required financial flexibility.

- 28th April 2020: The Company announced a contract extension for supplying engines airfoils, with MTU Aero Engines. The contract has been extended until 2031, which reflects a long-term relationship with MTU.

Market Update – Substantial Headroom of Liquidity to Mitigate Short-Term Disruption

On 24th April 2020, the Company provided the COVID-19 and Trading Update. The highest priority of the Company is the Health and Safety of the employees. In the light of COVID-19 scenario, the Executive Directors, the Chairman and the Non-Executive Directors are reducing their salaries and fees by 20 per cent for a three-month period, and the situation will be reviewed at the end of that period. Other Highlights are stated below:

- On 31st December 2019, the committed borrowing facilities stood at GBP 305 million, with the Group had headroom of GBP 159 million under these committed facilities, net debt of GBP 230 million and average maturity of 4.4 years.

- For the three months ended 31 March 2020, the trading was marginally ahead of the anticipations coming into the current year.

- The defence and industrial power & energy aftermarket businesses are healthy, which partially offset the adverse impact of COVID-19.

- While macro-economic recovery is projected over the medium-term, the pace and duration of recovery stay unknown. Therefore, guidance for 2020 stays suspended.

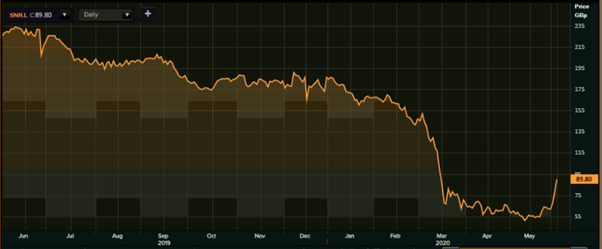

Share Price Performance Analysis

Source: Refinitiv, Thomson Reuters) - Daily Chart as of June 4th, 2020, before the market close

SNR’s shares were trading at GBX 89.80 on 4th June 2020 (before the market close at 2:48 PM GMT+1). Stock's 52 weeks High is GBX 236.40 and Low is GBX 45.13. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 324.45 million.

Business Outlook

For civil aerospace, the outlook is supported by an increase in air traffic. Boeing, Airbus and Independent forecasters are predicting air traffic increase in excess of 4 per cent per annum over the next 20 years. Senior PLC will be expecting to return to progress in 2021 and is taking firm actions to restructure the business. The Group entered the year 2020 with a continued focus on cost, efficiency and cash generation and a strong balance sheet. COVID-19 is causing significant disruptions to the end markets and its respective supply chains, with customer demand falling as activity levels have reduced. Meanwhile, the Group is focused on technology innovation and operational excellence, which would help them to capture additional market share.