Summary

- The UK government has stated that it would spend £705 million on border infrastructure.

- The UK government would expedite the immigration and visa process for the health and social care workers from January 2021.

- G4S expects six months performance ended June 2020 to be better than the market consensus, underpinned by resilient business performance in June 2020.

- G4S would pay a financial penalty of £38.5 million to the UK Serious Fraud Office (SFO) for three offences of fraud between August 2011 and May 2012.

- Luceco may reinstate the dividend at the interim stage provided the liquidity and profitability remains strong.

- Luceco's adjusted operating profit could decline £0.75 million per month of lock-down if the lock-down reoccurs in the second half of FY2020.

Given the above market conditions, we will review two industrials stocks - G4S (LON:GFS) & Luceco PLC (LON:LUCE). The shares of both GFS and LUCE were trading up by 10.41 percent and 11.51 percent, respectively (as on 13 July 2020, before the market close at 1.30 PM GMT+1). Let's review their financial and operational updates to understand the stocks better.

G4S (LON:GFS) - G4S suspended the final dividend payment for FY2019.

G4S PLC is a UK based security services Group. The Group classifies the services under Secure Solutions, Risk Consulting & Security Technology Solutions, Retail Technology Solutions and Conventional Cash. The Group has operations in 85 countries and has close to 533,000 employees.

Five months trading update (ended 31 May 2020) as reported on 17 June 2020

The Group revenue was down by 1 percent year on year for the five months and was down by 7 percent in April and May. The Secure solutions revenue was £2,574 million in the period and contributed 90 percent of the Group’s pro-forma revenue. The Cash solutions revenue was down by 16 percent to £187 million, mainly due to the impact of lock-down on the retail and commercial banking segment. The Secure solutions revenue performance advanced in the Americas and Asia by 6 percent and 2 percent, respectively, whereas it declined by 6 percent in Europe & the Middle East market. The Cash Solutions revenue is expected to improve as the lock-down gets eased. The Group won contracts worth £1.2 billion that would support the business performance in 2020 and beyond. The Group is focusing on providing technology-enabled security solutions.

G4S has suspended the final dividend payment for FY2019, and it has deferred tax payment of £100 million to FY21 to preserve cash. As on 31 May 2020, the Group had liquidity of £1.5 billion including cash and overdraft facilities of £0.9 billion and an undrawn credit facility of £0.6 billion.

G4S Care and Justice Services agreement with the UK Serious Fraud Office

The G4S Care and Justice Services (UK) Limited entered into a Deferred Prosecution Agreement (DPA) with the UK Serious Fraud Office (SFO). G4S would pay a financial penalty of £38.5 million in addition to £5.9 million related SFO's cost. The penalty is due to three offences committed in 2011 and 2012 related to financial reporting to the UK Ministry of Justice.

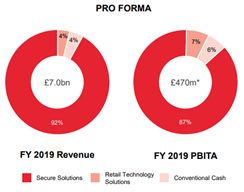

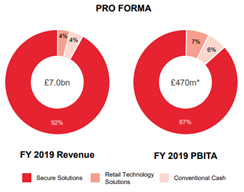

G4S Financial Performance in FY2019 and Addressable Market for Security Solutions

(Source: Company Website)

Share Price Performance

1-Year Chart as on July-13-2020, before the market close (Source: Refinitiv, Thomson Reuters)

G4S PLC's shares were up by 9.08 percent against the previous day closing and trading at GBX 130.30 (as on 13 July 2020, before the market close at 3.31 PM GMT+1). Stock 52-week High and Low were GBX 223.50 and GBX 69.92, respectively. The Group had a market capitalization of £1.85 billion.

Business Outlook

The Group delivered a resilient performance in June and thus expecting underlying earnings to be better than the market consensus for the first six months. The market consensus for an adjusted profit before tax is £159 million, and earnings per share were 4.3 pence. For the whole year 2020, the Group expects steady net cash flow.

Luceco PLC (LON:LUCE) - Company product demand improves post-lock-down

Luceco is engaged in manufacturing and distributing wiring accessories, LED lighting and portable power products. The Company own brands, such as British general, Kingfisher lightings, Masterplug. Luceco operates in 73 countries and has close to 1,600 employees.

Six months trading update (ended 30 June 2020) as reported on 13 July 2020

The revenue was down by 14 percent year on year; however, the performance has slightly picked up post ease in lock-down. The Company's performance in the UK was resilient due to omni-channel sales, by the end of June, the sales were close to 90 percent of that achieved in the previous year. The gross margin improved by 3.5 percent to close to 38.5 percent compared to last year due to better sourcing and efficient manufacturing. The margins are expected to strengthen further in the second half of FY20. The adjusted operating profit improved by £1.8 million from the first half of FY19 to £9.0 million as the control over overheads costs offset the pandemic related disruption. The adjusted operating margin was 12.5 percent. The adjusted free cash flow was £10.0 million that reduced the net debt by £4.7 million; the net debt was £22.7 million at the end of the reporting period. The Company did not use any tax deferral or lending scheme by the government. Company may reinstate the dividend at the interim stage provided the liquidity and profitability remain strong

FY19 Annual results (ended 31 December 2019) as reported on 23 April 2020

For full-year FY19 the Company reported revenue of £172.1 million, which was up by 5 percent year on year. LED lighting and portable power generated revenue of £54.2 million and £42.6 million, respectively. Ross, which is a range of audiovisual products, reported revenue of £5.2 million. The adjusted free cash flow was £18.9 million that reflected over 100 percent conversion of operating profit growth to cash.

Financial result for FY19

(Source: Company Website)

Share Price Performance

1-Year Chart as on July-13-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Luceco PLC's shares were up by 13.31 percent against the previous day closing and trading at GBX 115.60 (as on 13 July 2020, before the market close at 3.20 PM GMT+1). Stock 52-week High and Low were GBX 154.00 and GBX 39.00, respectively. The Company had a market capitalization of £164.02 million.

Business Outlook

The Company estimates that for full-year FY20, assuming no further lock-down in the UK and stable supply-chain in China in the second half of FY20, the operating profit should beat the analyst consensus or should be close to £18.0 million same as FY19. In the event of lock-down in the second half of FY20, the adjusted operating profit would decline by £0.75 million per month of lock-down. The Company has withdrawn the full-year guidance, and it has suspended dividend from maximizing financial headroom. The future investment opportunities may include product development, manufacturing excellence, fulfilment capability and IT enhancement.