US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 85.35 points or 2.52 per cent lower at 3,305.33, Dow Jones Industrial Average Index contracted by 703.19 points or 2.56 per cent lower at 26,760.00, and the technology benchmark index Nasdaq Composite traded lower at 11,112.56, down by 318.80 points or 2.79 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The Wall Street traded in the red as the covid-19 cases continue to rise. The mortgage applications in the US increased by 1.7% week on week. Among the gaining stocks, Tupperware shares skyrocketed by close to 31.1% as it witnessed increased sales due to home food storage. General Electric gained by nearly 7.7% after it posted a quarterly profit of 6 USD cents per share. Garmin rose by around 0.3% it reported healthy demand for devices for boating and outdoor activities. Among the decliners, United Parcel Service fell by about 5.6% after it reported earnings per share of USD 2.28 per share. Blackstone declined by 3.8%, although it reported revenue better than the estimates. Boeing was down by around 3.4% as it reported a loss of USD 1.39 per share.

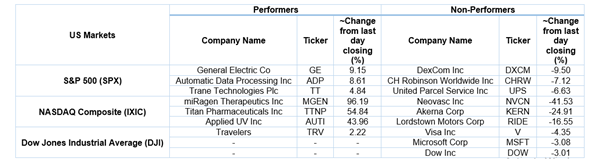

US Stocks Performance*

European News: The London and European markets traded in the red as the covid-19 rising cases, and uncertainty over vaccine development weighs down. The data released by the British Retail Consortium showed that the shop price index fell by 1.2% year on year in October 2020; the data reflect the discounting for non-food items. Meanwhile, Rishi Sunak stated that he would announce a 1-year recovery plan on 25 November 2020. Among the gaining stocks, Kaz Minerals rose by nearly 9.5% after it announced that it would be acquired in an all-cash deal by a consortium led by Oleg Novachuk. Next gained by around 4.3% after it upgraded the profit guidance for full-year. Aston Martin was up by close to 2.3% after it stated that its total share for £125 million capital raise was subscribed. Among the decliners, shares of Rolls Royce plunged by close to 61.2% on the FTSE-100. Carnival was down by 4.4% after Prince Cruise announced an extension of pause. Grainger fell by nearly 1.9% as its CFO Vanessa Simms has decided to step down.

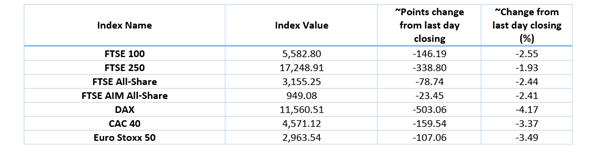

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 28 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Rolls-Royce Holdings Plc (RR.); Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in red*: Energy (-3.49%), Basic Materials (-3.43%), and Financials (-2.89%).

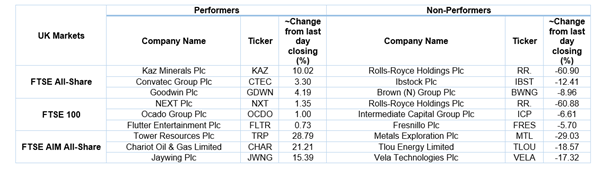

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $39.48/barrel and $37.27/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,879.05 per ounce, down by 1.72% against the prior day closing.

Currency Rates*: GBP to USD: 1.2987; EUR to GBP: 0.9049.

Bond Yields*: US 10-Year Treasury yield: 0.769%; UK 10-Year Government Bond yield: 0.208%.

*At the time of writing