US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 41.94 points or 1.28 per cent higher at 3,311.90, Dow Jones Industrial Average Index expanded by 389.49 points or 1.47 per cent higher at 26,891.09, and the technology benchmark index Nasdaq Composite traded higher at 11,000.61, up by 89.02 points or 0.82 per cent against the previous day close (at the time of writing, before the US market close at 11:45 AM ET).

US Market News: The key indices of the Wall Street traded in green as the US Presidential elections remain in focus. The US Manufacturing PMI came at 59.3 in 2020, which was above the forecast of 55.8. Among the gainers, Marathon Petroleum was up by close to 5.6% after it posted loss below the market’s consensus. AMC Network increased by around 4.8% after it said that it expects to have 5 million to 5.5 million paid subscribers for streaming video by the end of 2020. Clorox gained by around 4.9% after reporting quarterly earnings of USD 3.22 per share. Estee Lauder rose by nearly 3.7% after the cosmetic maker announced a dividend of 53 USD cents per share. Among the decliners, Henry Schein and Amazon fell by around 2.7% and 0.8%, respectively on Nasdaq100.

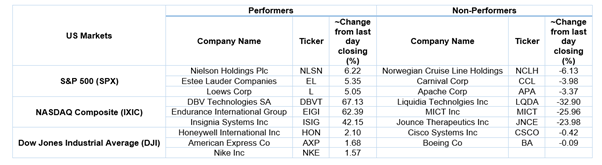

US Stocks Performance*

European News: The London and European markets traded in green after Rishi Sunak said that the UK might lift the lockdown in early December. The IHS Markit Manufacturing Index (PMI) in the UK declined to 53.7 in October 2020 from PMI of 54.1 in September 2020. Among the gaining stocks, Ocado was up by around 9.8% after it bought two robotics companies for USD 287 million. Polymetal International increased by nearly 2.3% after the company agreed for USD 125 million Green Loan. Easy Jet moved up by about 0.7% after the company is looking for options to strengthen its finances. AstraZeneca rose by close to 0.4% after it stated that it had started an accelerated review of the potential covid-19 vaccine. Among the decliners, GVC fell by about 1.8%after it warned about the losses if the gambling stores remain closed for the entire November. Associated British Foods was down by close to 0.2% after it said that it might incur a loss of £375 million due to lockdown.

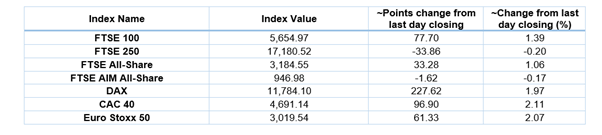

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); BP Plc (BP.).

Top Sectors traded in green*: Energy (+2.39%), Industrials (+1.86%) and Basic Materials (+1.76%).

Top Sectors traded in red*: Utilities (-0.35%) and Real Estate (-0.29%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $38.91/barrel and $36.72/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,893.75 per ounce, up by 0.74% against the prior day closing.

Currency Rates*: GBP to USD: 1.2903; EUR to GBP: 0.9011.

Bond Yields*: US 10-Year Treasury yield: 0.840%; UK 10-Year Government Bond yield: 0.215%.

*At the time of writing