US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 34.14 points or 0.81 per cent higher at 4,235.70, Dow Jones Industrial Average Index surged by 165.47 points or 0.48 per cent higher at 34,714.00, and the technology benchmark index Nasdaq Composite traded higher at 13,818.96, up by 186.12 points or 1.37 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone after the release of jobless claims data. Only 266,000 jobs were created in the month of April. Among the gaining stocks, Bill.com Holdings shares surged by around 14.35% after the Company had reported better-than-expected sales for the latest quarter. Roku shares climbed by about 12.18% after its quarterly earnings per share came out to be better than the consensus estimates. Dropbox shares went up by about 2.12% after the average revenue per user came out to be better than the forecast for the latest quarter. Among the declining stocks, Beyond Meat shares dropped by about 3.88% after the Company had reported a loss of 42 cents per share for the first quarter.

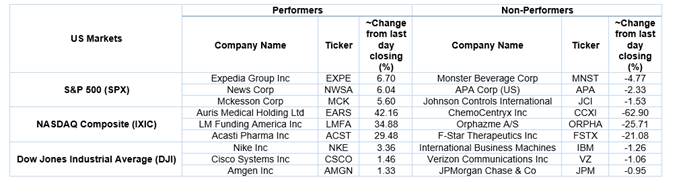

US Stocks Performance*

UK Market News: The London markets traded in a green zone driven by strong commodity prices boosted by hopes of a strong economic recovery. FTSE 100 advanced higher by around 0.76% and breached the 7,100 milestone. The IHS Markit/CIPS construction PMI (“Purchasing Managers Index”) came out to be 61.6 during April 2021, while it was 61.7 in March 2021.

Intercontinental Hotels Group shares rose by about 0.95% after the Company had reported improvement in the trading performance during the first quarter.

Anglo American had expected to resume operations at its Moranbah North coal mine in Australia in May after safety inspections. Moreover, the shares grew by around 3.80%.

Meggitt shares climbed by around 7.54% amid media reports that US-Based Woodward would be looking to acquire the Company.

British Airways owner International Consolidated Airlines Group shares went up by about 0.87%, even after the Company reported a first-quarter operating loss of nearly 1.06 billion euros and pulled full-year guidance amid the Covid-19 uncertainty.

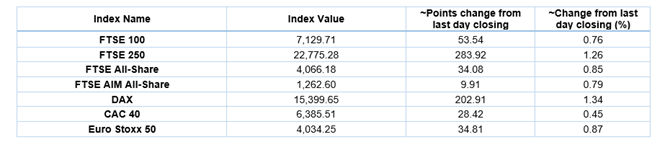

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 7 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Glencore Plc (GLEN); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Utilities (+1.00%), Basic Materials (+1.00%) and Industrials (+0.83%).

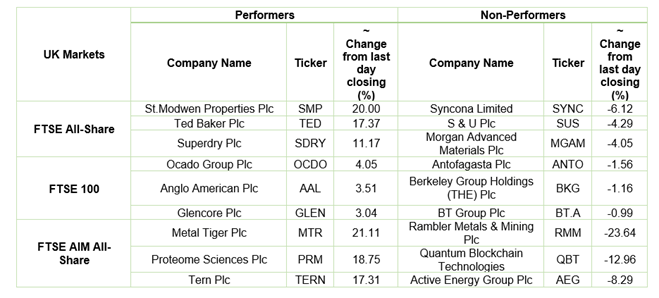

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.27/barrel and $64.84/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,832.45 per ounce, up by 0.92% against the prior day closing.

Currency Rates*: GBP to USD: 1.3992; EUR to GBP: 0.8690.

Bond Yields*: US 10-Year Treasury yield: 1.577%; UK 10-Year Government Bond yield: 0.7730%.

*At the time of writing