Summary

- Boohoo Group announced its interim results for the six-month period that ended on 31 August 2020. The group revenue rose by 44 per cent as compared to H1 2019.

- The British online fashion firm believes that it remained strongly placed for leading the fashion e-commerce space internationally.

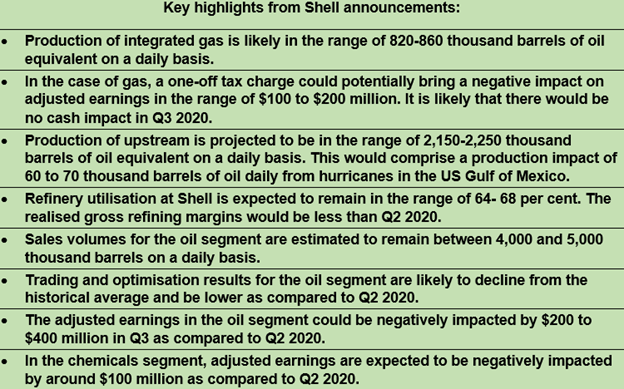

- Royal Dutch Shell updated its Q3 2020 outlook from the Q2 earning report released at the end of July 2020.

- Shell has announced that it will cut up to 9,000 jobs before the end of 2022 due to the impacts of the coronavirus-led crisis.

- The oil giant could save up to £1.95 billion per year if it can cut costs. It plans to increase investments in a low-carbon energy future.

In two of the earnings announcements from companies listed on the London Stock Exchange (LSE) that came on 30 September 2020, Boohoo Group plc (LON:BOO) released its interim results for the six-month period that ended on 31 August 2020. Royal Dutch Shell plc (LON: RDSA) presented an update to its Q3 2020 outlook that the oil and gas company included in the Q2 earning report released in end-July 2020. We bring the details of the announcements from the two companies along with a state of affairs at Boohoo and Shell.

Boohoo’s road to success

Boohoo, one of the major British fashion retailers, has a vision to lead the fashion e-commerce market globally. It sells clothes, shoes and accessories, both on its online portal as well as its retail outlets. In its interim earnings report, the retailer reported revenue of £816.5 million, up 44 per cent from £564.9 million recorded for the same period in 2019.

There is a strong revenue growth across all geographical markets and brands within the company. The growth within the country stood at 37 per cent as compared to its global growth at 55 per cent, including 83 per cent from the United States. Around 47 per cent of the revenue came from international operations, which was 44 per cent in 2019.

Boohoo is known as an inclusive brand that targets mainly the young and value-orientated customers. The company said that due to change in consumer behaviour in the present times, it was able to acquire new customers in the first quarter. The retailer informed about completing the minority shareholding in PrettyLittleThing, a British fashion retailer. Boohoo additionally acquired and integrated Oasis and Warehouse brands, famous British brands that mainly target fashion forward shoppers.

Boohoo presented a strong balance sheet with a net cash of £344.9 million in H1 2020 as compared to £207.3 million in H1 2019. The operating cash flow of around £147 million was substantially up from £55.9 million reported in the corresponding period in 2019. The retailer posted a net cash flow of £99.5 million for the period as compared to £15.5 million in H1 2019.⯠It is to be noted that Boohoo did not participate in the government’s financial support schemes to support jobs or its businesses.

Boohoo, which started operations in 2006, grew rapidly in the UK and overseas with its unique products like its menswear category -- boohooMAN. The fashion retailer said that it has decided to incorporate recommendations provided by Alison Levitt QC, which had conducted an independent review based on the working conditions of its supply chain in Leicester.

Sources said the company has identified various flaws in its Leicester supply chain as a result of the review that began in early July and would implement a series of suggestions around governance and compliance to improve its supply chain.

Besides, the report mentioned that the company did not generate profit from them and its business model was not based on exploiting the workers in Leicester.

Also read: Earnings preview: What all should the Cineworld shareholders know?

Also read: Independent Review Identifies Flaws in Boohoo’s Leicester Supply Chain

As the online fashion retailer continued to increase its market share in all key geographical markets, it was optimistic about the future prospects. Group revenue growth for the current year (till 28 February 2021) is expected to be around 28% to 32%, up from approximately 25% as previously guided. The adjusted EBITDA margin for the year will be around 10%, up from the 9.5% to 10% as previously guided.

Having made a good start in the second half of the year, Boohoo feels it was prudent to plan well for the upcoming economic uncertainties that might result in lower consumer spending. There could be an increase in capital expenditure due to automation in some of its facilities and IT-related projects to improve efficiency.

Stock performance of Boohoo Group plc

On 30 September 2020, at 13.41 PM, the company’s stock (LON:BOO) was trading at £370.20 down 5.08 per cent from its previous day’s close of £390.00.â¯The 52-week low high range was recorded as 157.50 and 415.00. With a market capitalisation of £4,909.71 million, the stock provided a positive return on price, which was plus 30.39 per cent on a year-to-date (YTD) basis. The total volume of shares traded at the time of reporting was recorded at 17,983,923.

Shell updates its third quarter 2020 outlookâ¯

On 30 September 2020, Royal Dutch Shell plc presented an updated to its Q3 2020 outlook that it gave in the Q2 earnings report released at the end of July 2020. For the third quarter, the corporate segment adjusted earnings are estimated to be a net expense at the lower end of the $800-$875 million. It is to be noted that this does not include the key impact of currency exchange effects.

Also read: Oil Demand Outlook Stays Weak: Focus On BP, RDSA, And TLW

Also read: BP Plc Marks Debut to Offshore Wind Market in A Strategic Partnership with Equinor

Shell to axe 9,000 jobs

The oil and gas major announced that it plans to cut up to 9,000 jobs before the end of 2022 due to the uncertainty of the coronavirus-led crisis. This is would be the core of a significant corporate overhaul to remain competitive in the global transition to clean energy. The Anglo-Dutch oil giant could potentially save up to £1.95 billion ($2.5 billion) per year from the cost-cutting measures.

The decision comes as Shell has plans for making additional investments in a low-carbon energy future. It is evident that the company is struggling due to the current pandemic that significantly reduced demand for oil.

The global energy and petrochemical giant felt that an organisation restructuring was crucial at this stage. Shell would generate additional savings from work from home, less traveling and dependence on contractors - some of the new norms which were adopted due to the pandemic. Earlier in 2020, Shell announced to cut its dividendâ¯for the first time after World War II. Due to a record fall in the international oil prices, Shell reported a net loss of £14.1 billion ($18.3 billion) for Q2 2020.â¯

Stock performance of Royal Dutch Shell plc

On 30 September 2020, at 13.46 PM, the company’s stock (LON:RDSA) was trading at £987.20 up 0.35 per cent from its previous day’s close of £983.80.â¯The 52-week low high range was recorded as 970.80 and 2,342.50. With a market capitalisation of £40,347.99 million, the stock provided a negative return on price, which was minus 56.40 per cent on a year-to-date (YTD) basis. The total volume of shares traded at the time of reporting was recorded at 2,266,344.