Summary

- Cineworld would release its H1 results on 24 September 2020.

- Investors would come to know how the group’s theatres performed as they operated with reduced capacities and lesser number of films released.

- Analysts predicted a sharp decline in revenue, indicating a loss as theatres were shut for majority of the duration in H1 2020.

- Another lockdown and delay in the release of blockbuster movies are likely to impact the company’s recovery in H2 2020.

Cineworld Group plc (LON: CINE) would announce its H1 results on 24 September 2020 and cover the first six months of financial updates for the year. The earnings report would provide the investors with an opportunity to understand the business performance of the theatres after being reopened after the coronavirus lockdown. The performance would present an idea of the confidence that the audiences have to visit the theatres during the pandemic.

Revenue and earnings forecast

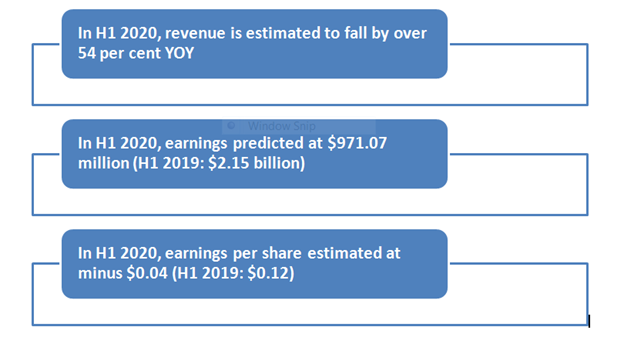

As Cineworld’s theatres were closed for majority of the interim period and started to reopen only in end-June 2020, it is likely that the H1 results would not present good numbers. Some analysts have expected the company’s revenue to fall by over 54 per cent on a year-on-year (YOY) basis, considerably pushing the stock to a loss.

For H1 2020, analysts have predicted the earnings to be around $971.07 million as compared to $2.15 billion reported in H1 2019. The earnings per share for H1 2020 are estimated at minus $0.04 as compared to $0.12 in H1 2019. For H2 2020, the group’s revenue is forecasted to be $1.07 billion. However, the estimations would be revised after the company releases its H1 results.

Key things to look at in the analyst’ estimation for H1 2020

The company’s H1 results would be a significant factor for the share price and the investors would either buy or sell the shares accordingly. Though there has been a recovery in the share prices of Cineworld since the outbreak of the coronavirus pandemic in mid-March 2020, many experts believed that it remained below the price it demanded at the beginning of 2020.

Stock performance of Cineworld

On 23 September 2020, at 11.28 AM, the company’s stock was trading at £49.46 up 12.03 per cent from its previous day’s close of £44.15. The 52-week low high range was recorded as 21.38 and 232.10. With a market capitalisation (Mcap) of £606.09 million, the stock provided a negative return on price, which was minus 79.93 per cent on a year to date (YTD) basis. The total volume of shares traded at the time of reporting was recorded at 8,725,137.

Also read: Government plans ‘SEAT out to help out’ scheme, Cineworld to be impacted positively

Also read: Arts and Culture Receive Government Aid Worth Nearly 2 Billion Pounds

Key parameters to be looked at

Given the expectations on H1 results due to shutdown of the theatres, the focus would shift to the company’s capabilities of recovering at a time when it is bound to run its theatres with reduced capacity, lesser film releases, and constant threat of being forced to shut down once again in case of a likely second wave of Covid-19 infections.

A weaker revenue and earnings report for H2 could compel Cineworld to take tough measures on downsizing its estates or axe jobs. The company is already under debt, availed support schemes provided by the government, and has suspended dividend payouts. Given the difficulties and sharp decline in share prices, there are speculations that the company could be taken over by a bigger film studio looking for vertical expansion. Several experts believed that the due to the coronavirus-led crisis, the company would perform better in private hands.

Cineworld finished 2019 with a net debt of $3.5 billion and when combined with lease liabilities, this figure rose to more than $7.6 billion, suggesting leverage was significantly higher than its three times adjusted earnings target. Cineworld secured extra liquidity in May 2020 and believed that it would offer the company adequate headroom to assist it even if the cinemas remained shut till end of 2020.

Impact of the coronavirus-led crisis

In end-August 2020, Cineworld had said that many shows at its theatres had been sold out and the company was noticing that the customers were returning to the theatres. The company stressed that the customers felt safe to visit the theatres during the pandemic because of the effective measures that it had adopted regarding Covid-19 safety. Since the theatres have been operating at reduced capacities, the sold-out shows offer some respite that demand has been picking up, though at a slow pace.

As the film production has also taken a beating due to the pandemic, it would show its impact on Cineworld and other theatre companies. Some blockbuster releases have not been able to do much business and recover their production costs. Many production companies are deciding on exclusive release of their films on streaming services.

Cinemas require audiences so that film studios are confident of releasing their films. At the same time, audiences would return to the theatres if they get to watch blockbuster movies. This situation could be problematic for Cineworld and others during the pandemic as big movies are likely to be released with a delay.

Cineworld had accepted that it suffered particularly in those US states that remained closed. With recent spike in the Covid-19 infections, there is a possible threat of a second lockdown in some countries. This would hurt the industry and further lower the confidence of the studios. The studio would increasingly release its movies on streaming sites. Given this scenario, projections from analysts suggested that Cineworld’s earnings and revenue in H2 2020 might not be any better than the first half of the year.

Additionally, Cineplex Inc. of Canada has sued Cineworld after it backed out of buying the entertainment theatre chain when the coronavirus crisis began. In August 2020, AEW, one of the Cineworld’s landlords, is reported to have taken it to the court regarding an issue on rent for its sites in the UK that were withheld during the pandemic. AEW is a global real estate investment management company.

Cineworld operates around 787 cinemas across 10 countries. In mid-June 2020, the company reopened its theatres in Poland the Czech Republic, considered as its smaller markets. In the UK and Ireland, Cineworld reopened its sites at the end of July 2020. However, the company’s major focus remains the United States (US) that comprises for more than 75 per cent of its earnings.

In 2017, Cineworld had purchased Regal Entertainment of the US with 7211 screens at 549 theatres across 42 states. In the US, Cineworld started to reopen its theatres in early August 2020 in some states. As the lockdown measures vary from one state to another, many theatres are still closed, including key markets like the New York and California.

.jpg)