US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 7.78 points or 0.17 per cent higher at 4,487.32, Dow Jones Industrial Average Index surged by 47.95 points or 0.14 per cent higher at 35,383.66, and the technology benchmark index Nasdaq Composite traded higher at 14,994.40, up by 51.80 points or 0.35 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a green zone due to a positive shift in momentum for investors’ sentiments in China. Among the gaining stocks, Best Buy (BBY) shares went up by about 6.99% after the top-line revenue and bottom-line profitability came out to be more than the consensus estimates for the second quarter. Cara Therapeutics (CARA) shares rose by about 5.60% after it had received the US FDA nod for the Korsuva injection. Cigna (CI) shares grew by around 2.33% after the Company announced a stock repurchase agreement worth approximately USD 2.0 billion. Advance Auto Parts (AAP) shares went up by around 0.76% after the Company raised full-year sales forecasts.

UK Market News: The London markets traded in a green zone boosted by the strong performance of heavyweight mining stocks.

John Wood Group shares dropped by about 1.16% after the Company had shown a significant reduction in the top-line revenue during the first half and subsequently forecasted full-year revenue lower than the prior year.

FTSE 250 listed Spectris shares rose by around 1.06% after the Company had agreed to sell the NDC Technologies unit to Nordson for approximately USD 180 million. Moreover, the Company will use the proceeds to strengthen the balance sheet.

PureTech Health had reported encouraging clinical trials pipeline with two Phase 2 and four Phase 1 trials along with the announcement of interim results. Moreover, the shares went up by around 0.42%.

Essensys shares grew by around 0.23% after the Company had shown a marginal rise in recurring revenue during FY21. Moreover, the full-year revenue grew by around 2%.

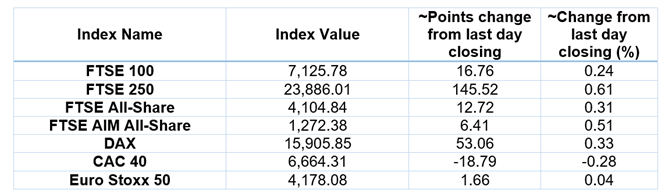

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 24 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Glencore Plc (GLEN).

Top 3 Sectors traded in green*: Basic Materials (+1.68%), Energy (+1.10%) and Consumer Cyclicals (+0.84%).

Top 3 Sectors traded in red*: Healthcare (-1.58%), Real Estate (-0.87%) and Consumer Non-Cyclicals (-0.84%).

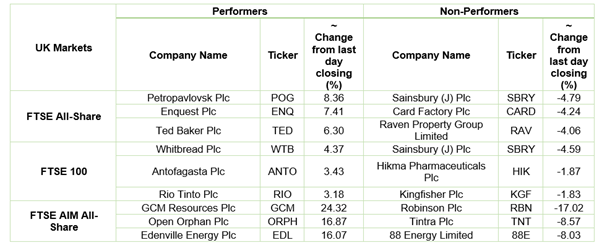

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.44/barrel and $67.55/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,807.45 per ounce, up by 0.06% against the prior day closing.

Currency Rates*: GBP to USD: 1.3728; EUR to USD: 1.1747.

Bond Yields*: US 10-Year Treasury yield: 1.287%; UK 10-Year Government Bond yield: 0.5440%.

*At the time of writing