Summary

- Mears Group won the maintenance contract of close £120.0 million in H1 FY2020.

- Mears Group had an order book of £2.7 billion in H1 FY2020.

- Mears Group highlighted pickup in the maintenance work in June and July 2020.

- Essensys reported revenue of £22.4 million for FY2020.

- Essensys placed new shares to raise close to £7.0 million in April 2020.

- Essensys would start the second phase of international expansion in H1 FY2021.

Mears Group PLC (LON:MER) & Essensys PLC (LON:ESYS) are two AIM-listed stocks. MER is an industrials stock, and ESYS is a technology stock. MER and ESYS had a market capitalization of around £138.13 million and £80.43 million, respectively. The 1-year return of MER and ESYS was close to -52.60 percent and -5.38 percent, respectively. MER and ESYS was up by approximately 1.60 percent and 0.82 percent, respectively from the last closing price (as on 19 August 2020, before the market close at 2:00 PM GMT+1).

Mears Group PLC (LON:MER) – No interim dividend announced for H1 FY2020

Mears Group PLC is a UK based company that provides housing and care services to the public and private sector. The Company categorizes the business under Maintenance, Development and Management segment. Mears Groups is included in the FTSE AIM All-Share index.

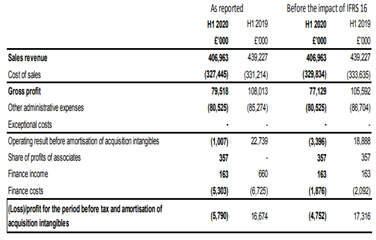

Interim result (ended 30 June 2020) as reported on 18 August 2020

(Source: Company website)

In H1 FY20, the Company reported revenue of £407.0 million that was lower than £439.2 million a year ago. The revenue was supported by the contract extension of Asylum Accommodation and Support Contract (AASC) in FY19. Mears Group reported operating loss £6.7 million in H1 FY20 from an operating profit of £18.1 million in H1 FY19. The adjusted operating loss before amortization of acquired intangible assets was £1.0 million during the reported period. The normalized earnings per share were negative 4.28 pence in H1 FY20. As on 30 June 2020, the order book stood at £2.7 billion as few of the contracts were extended. The Company won the maintenance contract of close to £120.0 million in H1 FY20 that includes a contract of £85.0 million with Exeter and £21.0 million contracts with both Hammersmith and Fulham. The maintenance tenders with live bids have value close to £450.0 million where the Company can participate. The Company would dispose of the Domiciliary Care business, and it would receive £4.0 million on completion of the transaction. At the end of the reporting period, Mears Group had net debt of £62.1 million and abstained from announcing the interim dividend. The Company would resume the dividend once the economic condition is back to normal. The Company increased its borrowing facility to £192.7 million from £170.0 million.

Performance by business activity

Maintenance division and Development division reported revenue of £261.7 million and £9.6 million, respectively, and posted an operating loss of £0.9 million and £3.6 million, respectively. Management division generated revenue of £135.7 million and an operating profit of £3.8 million. Mears Group would reduce the business activity in the Development segment and would exit the projects that require a huge amount of working capital.

Share Price Performance Analysis

1-Year Chart as on August-19-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Mears Group PLC's shares were trading at GBX 127.00 and were up by close to 1.60 percent against the previous closing price (as on 19 August 2020, before the market close at 2:00 PM GMT+1). MER's 52-week High and Low were GBX 323.00 and GBX 115.40, respectively. Mears Group had a market capitalization of around £138.13 million.

Business Outlook

The Company highlighted that the maintenance work has picked up after the economy reopened and it was 25 percent and 42 percent of the normal level at the end of June 2020 and July 2020. The maintenance bid has been deferred due to the pandemic, but the Company had a reasonable win rate for contracts. Mears Group has withdrawn from the under-performing contracts. The Company offers essential services, and thus it would play a critical role in the revival of the UK economy.

Essensys PLC (LON:ESYS) - The balance sheet remains debt-free

Essensys is a UK based technology company that provides software-as-a-service (SaaS) platforms and cloud services. Connect and Operate are two SaaS platforms provided by the Company. Essensys is included in the FTSE AIM All-Share index.

Trading statement for the financial year ended 31 July 2020 as reported on 18 August 2020

In FY20, the Company reported revenue of £22.4 million, which increased by 9 percent year on year from £20.6 million in FY19. The recurring revenue contributed 86 percent to the total revenue, and it was £19.3 million in FY20 up by 18 percent year on year from £16.3 million in FY19. The recurring revenue from the US business was £8.0 million that increased by 43 percent year on year from £5.6 million a year ago. Essensys stated that the adjusted EBITDA would be as per market expectation. At the end of the reporting period, Essensys did not have any debt on the balance sheet and had net cash of £8.4 million. As on 31 July 2020, it had 419 live sites for Connect SaaS platform that increased by 17 percent year on year. The business conditions remained challenging due to the covid-19 but still the Company managed to deliver 15 new Connect sites in Q4 FY20. The Company generated sales pipeline for STEP and Smart Access in H2 FY20, two newly launched products. STEP software provides tenant solution to traditional landlords, and Smart Access offers touchless access control.

Placement of new shares

On 9 April 2020, the Company raised close to £7.0 million through the placement of 4,635,762 new shares. The new shares were issued at 151 pence per share.

Share Price Performance Analysis

1-Year Chart as on August-19-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Essensys PLC's shares were trading at GBX 153.75 and were up by close to 0.82 percent against the previous closing price (as on 19 August 2020, before the market close at 2:00 PM GMT+1). ESYS's 52-week High and Low were GBX 250.00 and GBX 100.00, respectively. Essensys had a market capitalization of around £80.43 million.

Business Outlook

The Company is confident about the long-term performance that is underpinned by the recurring revenue and the future pipeline. The conditions would remain challenging, but the resilient business model would help to sustain the volatility. Essensys had 26 contracts for new Connect sites that it would deliver in H1 FY21. The main focus of the Company is expanding the customer base and customer sites. The Company has started the first stage of the international expansion plan after fundraising in April 2020. It has grown the sales team in the US and plans for the second stage of expansion that includes regions such as Europe and APAC in H1 FY21.