Summary

- The aerospace & defence company ran into losses worth £5.4 billion during the first half of 2020

- The jet maker expects the market to return to pre-Covid levels only by the year 2022

- Overall outlook of the battered aviation sector remains gloomy

The rapid spread of the pandemic has pushed the global economy into a severe slowdown. UK’s GDP shrank by 20.4 per cent during April to June 2020 quarter, according to the Office of National Statistics (ONS).

Due to coronavirus induced lockdowns and travel bans, the aviation & travel businesses have been impacted drastically. Furthermore, the airlines have reduced orders of newer aircrafts and engines. The jet engine & aircraft makers have suffered as a result. The operations of these companies came to a screeching halt as the pandemic washed up the shores of UK. Moreover, the assembled parts like engines and wheels or the new aeroplanes need storage and are raising the storage and handling costs of these aircraft manufacturers.

Do read: Bank of England Now Confirms United Kingdom to Enter Deepest Recession In 300 Years

The suppliers of the aviation sector have been hit really hard due the economic impact of the coronavirus crisis. Rolls Royce Holdings (LON: RR.) has shown a decline in its financial performance for the first half of the financial year 2020. The FTSE 100 engine maker expects the market to remain uncertain despite the recent economic recovery and easing of travel restrictions.

Rolls Royce believes that for the aircraft manufacturing sector, the business recovery will commence only from the end of H2 2020, derived from a gradual recovery in civil aviation. The jet maker expects the majority of Power Systems end markets to recover by the end of 2021, and revenues would reach normal levels not before the year 2022.

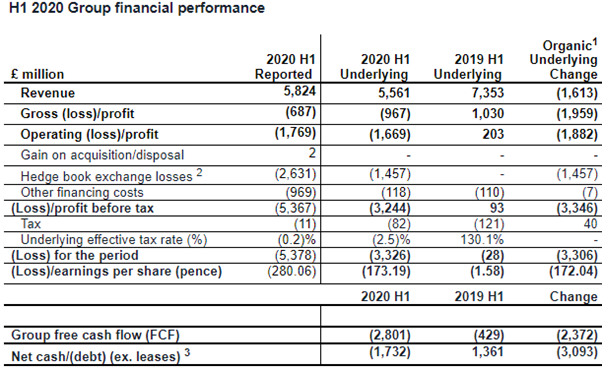

The jet maker expects large engine deliveries to increase gradually beyond 2022. The underlying revenue in 2020 is expected to be 25-30 per cent below 2019 data, with free cash outflow of around £4 billion, liquidity of £6 billion and net debt will increase to £3.5 billion approximately. The jet maker is targeting to return to positive free-cash generation by H2 2021 and free-cash outflow in 2021 to be significantly lower than 2020.

Rolls Royce- Business Highlights H1 2020

(Company filings, London Stock Exchange)

Due to the impact of the covid-19 crisis that resulted in one-off charges in Civil Aerospace of £1.2 billion, the underlying operating loss stood at £1.7 billion, while the reported operating loss stood at £1.8 billion. In the first half of the financial year 2020, the reported revenue declined by 26 per cent to £5.8 billion, while underlying revenue declined by 24 per cent to £5.6 billion. Due to significant working capital outflows and 47 per cent lower large engine flying hours, the company reported free cash outflow of £2.8 billion in H1 2020. The company’s loss before taxation was recorded at £5.4 billion during the first half of 2020.

Do read: Rolls-Royce Holdings Plc May Follow Suit to Axe Jobs

On the liquidity front, the jet maker has a cash balance of £4.2 billion as on 30 June 2020, along with RCF (revolving credit facility) of £1.9 billion. The company also announced term loan backed by UKEF (UK Export Finance) for £2 billion in July and finalised in August. The company expects free cash outflow of around £1 billion in the second half of 2020, driven by the acceleration of cost mitigations.

The aerospace & defence company has accelerated cost mitigations plans to reduce Free cash outflow in the second half of the financial year 2020. To reduce the impact of Covid-19 crisis, Rolls Royce has launched ‘fundamental restructuring of civil aerospace’, including consolidation of global facility footprint and reduction in headcount, to achieve annual pre-tax savings of £1.3 billion by 2022 end.

.png)

How is the aviation sector getting impacted?

The pandemic has wreaked havoc in the aviation space, and the businesses might continue to suffer with the social distancing guidelines in place. The 14-day period of mandatory quarantine imposed on the travellers coming to UK could actually be the final nail in the coffin for the aviation sector. The stringent guidelines would deter travellers coming into the country. This might also impact the businesses of the fleet owners, aircraft manufacturers, and other suppliers.

The first segment to bear the brunt is the passenger airlines. These businesses witnessed a lot of job redundancies during the unprecedented crisis. In addition, they were also burdened with parking and maintenance charges.

The coronavirus pandemic has indirectly impacted the jet makers and their suppliers. As most of the fleets are grounded, the demand for new aircrafts and engines has plummeted drastically. This has strangulated the revenue streams for most of these businesses.

Do read: Aviation Sector Eyeing Revival Once Out of the Coronavirus Catastrophe

There was a slight ray of hope for the battered sector as UK announced ‘Air Bridges’ with select European nations earlier in June. This is the peak season when most of the Britons love to travel. However, with a sudden rise in coronavirus cases, France is now removed from the UK’s travel corridor list by the British government. France is a popular holiday destination for Britons. Spain, another hot favourite destination was removed from travel corridor list in last week of July. These factors are adding further injury to the already struggling aviation sector.

To sum up, a slight uptick in the economic activity was expected for UK’s aviation businesses with reference to engine overhauls and additional maintenance given the prospects of air bridges along with easing of travel restrictions. This is the peak season which businesses look forward to as a lot of people usually plan holidays during this time of the year. However, due to a surge in coronavirus infections, countries are being left out of air bridges. This would certainly deter the confidence of the already battered industry. Things look a bit gloomy for the battered sector in the near term. The jet maker expects the market to return to pre-Covid levels by 2022.