Summary

- US President Joe Biden’s budget proposal, released on Friday, includes new reporting requirements for crypto investors, which means the US Treasury Department would require additional information surrounding cryptocurrency assets by financial institutions.

- Bitcoin – the world’s largest cryptocurrency - dropped 7% to US$35,800 in the hours following Biden’s proposed budget report.

- Bitcoin’s recent plummet from record highs could be due to several factors, including recent criticisms surrounding crypto mining and its negative impact on the environment.

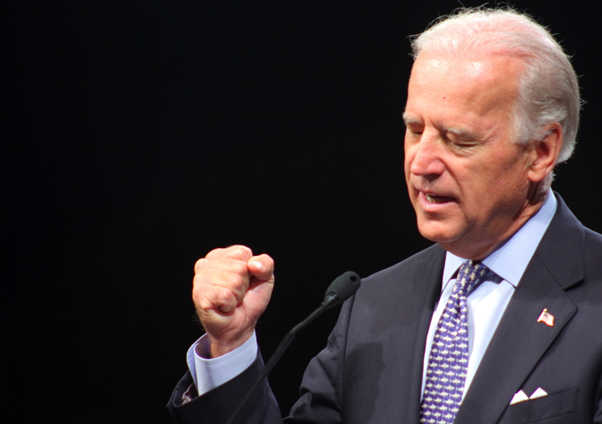

US President Joe Biden’s budget proposal, released on Friday, includes new reporting requirements for crypto investors, requiring crypto exchanges to provide information about crypto assets.

Friday’s budget proposal would mean the US Treasury Department necessitates additional information surrounding cryptocurrency assets by financial institutions.

Source: © Dersankt | Megapixl.com

The proposal comes amidst recognition from the US government surrounding the growing problem of tax evasion by those investing in crypto assets. The reforms hope to combat the current trend of investors using offshore crypto exchanges and digital wallets to avoid paying capital gains tax (CGT).

A second proposal, outlined in the budget report, aims to introduce “comprehensive financial account reporting”, which would require financial institutions to submit figures on transfers above US$600 in an effort to achieve tax compliance.

Budget Report’s Immediate Impact on Crypto

On Friday, President Biden’s report proposed US$6 trillion in spending for the fiscal year 2022 and likely to go up to US$8.2 trillion by 2031.

The spending outlined in the report aims to stimulate the US economy following the financial effects of the COVID-19 pandemic, which saw many US businesses close down due to the implementation of strict lockdown rules.

In the aftermath following the release of President Biden’s budget report, the bull market appeared to be unaffected as the economic outlook remains positive.

However, the same cannot be said for the crypto market, with Bitcoin suffering another crash on Friday following the release of the report.

Source: © Elnur | Megapixl.com

The world’s largest cryptocurrency dropped 7% to US$35,800 in the hours following Biden’s proposed budget report. The drop follows a significant blow for the embattled digital currency, which saw it plummet from a US$65,000 record high in April. The price has recovered a bit and currently sits at US$36,822.73.

Bitcoin’s recent plummet from record highs could be due to multiple factors, including the recent revelation that crypto mining (and its required energy usage) is harmful to the environment.

A report released by the Cambridge Center for Alternative Finance found that Bitcoin mining requires the same amount of energy annually as some small countries.

Tesla Chief Executive and billionaire Elon Musk pointed towards Bitcoin’s energy-consuming mining issues as the reason for Tesla’s decision to cease accepting Bitcoin as payment for their vehicles earlier this month.