Summary

- COVID-19 emerged as the worst crisis for the superpower United States, with total cases at 6,958,632 and deaths at 202,329, as on 25 September CDC data.

- At the onset of pandemic, unemployment scenario was worse than the levels seen during the Great Depression period. The pandemic has sent the economy into a new recession, cancelling out almost all the gains in employment made over the last decade in just few months.

- Recently, on 23 September, Federal Reserve Chairman Jerome Powell urged for another fiscal support from Congress to address impacts of the ongoing global crisis.

- To address the impacts of COVID-19, the government has released huge stimulus packages.

The ongoing Global Virus Crisis (GVC) has hit world economy hard, with many businesses shattered, bleak employment scenario amid increasing layoffs and pay cuts, and growing infection cases and deaths. Undoubtedly, this is a period of enormous uncertainty where nobody knows how long this crisis is going to last.

America is the worst-hit country with maximum impact of the COVID-19 pandemic. The world’s largest economy faced its worst crisis in the form of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2).

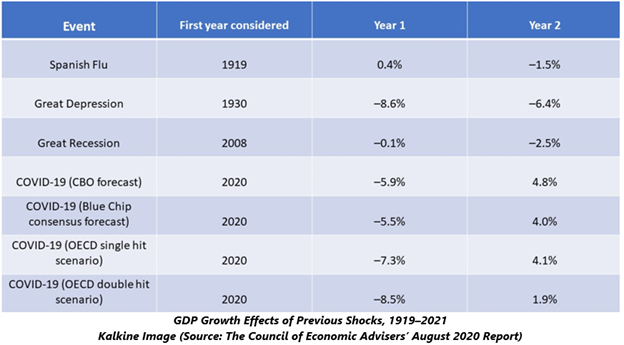

The crisis has emerged as the US’ worst macroeconomic shock since the 1930s. The precautionary measures required to combat the spread of this deadly virus are equally dangerous for the economy, so it is a dual crisis of lives and livelihoods.

Must read: US entering ‘deepest recession’ ever with record claims filed for jobless benefits

As per last updated data by the Centers for Disease Control and Prevention (CDC) on 25 September 2020, total cases in the US stood at 6,958,632 with 42,340 new cases. The data highlighted that the total number of deaths in the US due to COVID-19 was 202,329 with 918 new deaths.

In the US, the pandemic pushed hospital system to its limits, and the superpower country felt its extremely painful impacts.

Federal Reserve Urges More Financial Support from Congress

On 23 September 2020, Federal Reserve Chairman Jerome Powell pushed for another fiscal support from Congress to address impacts of the ongoing global crisis. Mr Powell has highlighted the need for a direct financial support, stating that a loan might not be the right solution as it could be challenging for many borrowers to repay.

On 24 September 2020, global stocks experienced declines, as several Federal Reserve officials stated that the US economy would stumble without additional stimulus support.

In the US, Democrats and Republicans have been gridlocked over financial package talks since July 2020. The death of US Supreme Court Justice Ruth Bader Ginsburg has exacerbated these talks, and many expects that a stimulus plan agreement is unlikely before 3 November 2020 presidential election.

Reportedly, both the party leaders are unwilling to support a second round of fiscal support in a stand-alone bill. Democrats are pressurising for a package worth USD 2.2 trillion, and the White House is at USD 1.3 trillion.

Also read: Pfizer to Roll Out COVID-19 Vaccine Just Before the US Election

Unemployment Worse Than The Great Depression

No country around the globe, including the US, was prepared for the unprecedented crisis, which unfolded devastating effects. When the world entered the lockdown period to keep the virus at bay, economic structure began to crumble.

International borders got sealed, and businesses were not able to function as before. Some of the sectors, like aviation, hospitality, travel and tourism found themselves worst-hit due to negligible demand for their services. The nature of these industries is such that they could not transfer their operations to the new norm of the work from home environment.

In March 2020, weekly unemployment insurance (UI) spiked to 6.9 million in just two weeks from 282,000 at the week ended 14 March 2020. The unemployment stood at a level not witnessed since the Great Depression period, as the peak in UI claims was more than the Great Recession's peak.

Also read: Double-dip Recession: A possibility in the US?

US Govt's Previous COVID-19 Relief Packages

On 8 August 2020, President Trump provided up to USD 44 billion from the Disaster Relief Fund to support those who lost employment. Other measures announced included continued student loan payment relief and deferred collections of employee social security payroll taxes.

The Government announced the USD 483 billion Paycheck Protection Program and Health Care Enhancement Act, including:

- USD 321 billion for additional forgivable Small Business Administration (SBA) loans and guarantees to aid small businesses.

- USD 62 billion for SBA to provide grants and loans to assist small businesses.

- USD 75 billion for hospitals.

- USD 25 billion for virus testing expansion

USD 2.3 trillion Coronavirus Aid, Relief and Economy Security Act was announced for one-time tax rebates to individuals, expand unemployment benefits, food safety net for the most vulnerable, prevent corporate bankruptcy, etc. The amount accounted for nearly 11% of GDP,

Other packages included USD 192 billion Families First Coronavirus Response Act and USD 8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act.

Bottom line: The unprecedented crisis is far from over now, and the world economy is undergoing a depressive phase. The US-China ties have deteriorated during the pandemic, and the upcoming US presidential election seems to be a turning point on the future course of the country.

Good read: How did the economy get affected by the pandemic?