Summary

- Canada’s economic response plan for coronavirus has started bearing positive results

- Insolvencies fell by record 45.4 percent in Q2 against the same period a year ago.

- Federal government had announced a C$ 82 billion fiscal stimulus plan for consumers and businesses to weather the coronavirus.

Canada’s economic response plan and fiscal stimulus measures deployed to soften the blow of the pandemic seems to be bearing fruit. While tens of thousands of establishments shut down in the months of March and April, consumer and business insolvency figures declined by record numbers in first and second quarters.

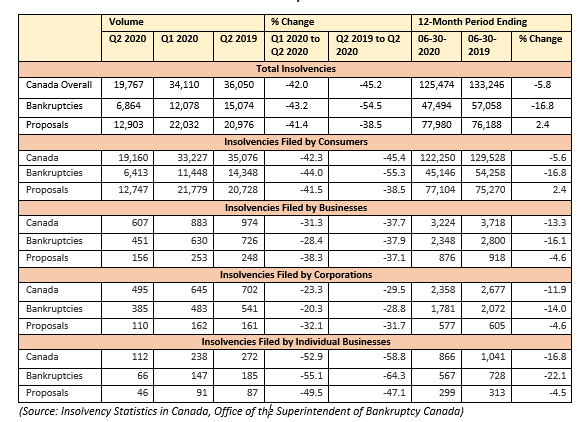

Just over 19,700 companies filed for insolvency by the end of the second quarter following increased fiscal and regulatory support amid the coronavirus pandemic that shuttered global economies. Insolvencies fell 45.4 percent in Q2 against the same period a year ago and 42 percent as compared to the previous quarter, data released by the Office Superintendent of Bankruptcy (OSB) on Wednesday shows.

Of the total 19,767 insolvencies in the second quarter, there are 6,864 bankruptcies and 12,903 proposals. Q2 consumers insolvencies declined by 42.3 percent quarter-on-quarter (QoQ) and 45.4 year-on-year (YoY). Business insolvencies dropped by 31.3 percent QoQ and 37.7 YoY in Q2.

The continued capital infusion by the federal government through pandemic support programs, low interest rate maintained by the Bank of Canada and suspended court proceedings in the wake of virus’ spread have contributed to this sharp decline in insolvencies.

Insolvency Stats

Business Closures

Over 88,000 businesses faced closures in April, more than double the numbers in the same month last year, as enterprises struggled to stay afloat amid the pandemic.

Data released by Statistics Canada on Wednesday shows 88,187 and 59,869 businesses closed in April and March this year, respectively, as compared to 39,078 and 38,219 in the corresponding time frame last year, respectively.

Most closures were observed in Ontario, Quebec and Nova Scotia on a year-over-year (YoY) basis. However, on month-over-month (MoM) scale, maximum closures were recorded in Canada's three largest census metropolitan regions: Toronto, Montréal and Vancouver. New openings declined by nearly 25 percent over the same period during April.

Accommodation and restaurants, personalized services and retailers were hit hard as demand waned and social distancing measures were implemented due to the coronavirus pandemic.

One in seven small and medium enterprises are at a risk of closure because of pandemic, while just one in four small businesses have started making normal sales, says the Canadian Federation of Independent Business (CFIB). Over 150,000, or 14 percent of Canadian businesses, are actively considering bankruptcy, added the body.

When organizations or establishments are no longer able to continue operations, it results in a business closure. Closure could be due to bankruptcy or lack of funds or lack of sales. Insolvency, on the other hand, arises due to financial distress and the company’s inability to pay back debts. It is a legal process wherein companies file under the Bankruptcy and Insolvency Act (BIA) and must meet the required paperwork.

Federal Support

As businesses struggled due to the economic uncertainty caused by the coronavirus, the Canadian government announced a C$ 82 billion-fiscal stimulus or 3.5 percent of the gross domestic product (GDP). The stimulus included C$ 27 billion aid for consumers and businesses and C$ 55 billion tax payment deferral.

Meanwhile, the OSB also introduced short-term relief measures in March. Consumers have been granted a three-month extension for deferred payments between March 13 to December 31. An extended timeline was also granted for creditors’ and mediations’ meetings and for referring bankruptcy matters to the court.

When a business or individual files for bankruptcy in Canada under the Bankruptcy and Insolvency Act, the OSB puts a temporary stay against any proceedings against the company by creditors and appoints a licensed insolvency trustee to deal with creditors.

Though the overall Q2 numbers show a positive market momentum, the number of insolvencies in June this year went up by 4.7 percent as compared to May. Bankruptcies rose by 8.0 percent and proposals surged by 2.9 percent. Retail, arts, entertainment and recreation sectors witnessed the greatest number of insolvencies.

However, the June 2020 figures declined significantly from the corresponding quarter of the previous year, down 41.1 percent. The overall number of insolvencies had decreased in the months of April and May, before the June spike.