Summary

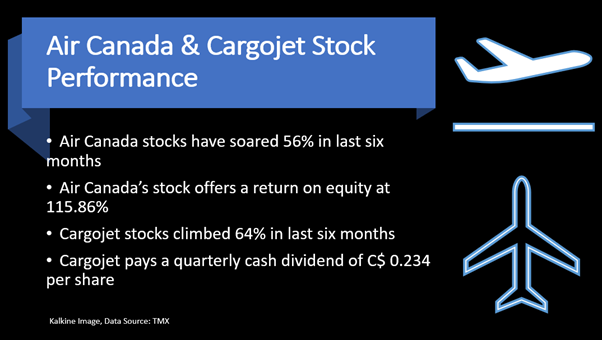

- Air Canada stocks swelled nearly 56 per cent in the last six months.

- The Air Canada Pilots Association (ACPA) has agreed to the amendments made to their contract that will allow the airline to enhance its cargo business.

- Stocks of freight carrier Cargojet Inc climbed over 64 per cent in the last six months.

- Cargojet is expecting to transport record volumes of goods during this holiday season.

Top national airline Air Canada (TSX:AC) released a statement on November 27 saying that it is looking to convert some of its retired Boeing 767-300ERs carriers to cargo flights. Following this news, Air Canada stocks began to trend on the Toronto Stock Exchange. Meanwhile, Canada’s leading air freight Cargojet (TSX:CJT) recently said that with many regions experiencing a second round of lockdown, it is expecting to transport record volumes of goods during the holiday season this year.

The Air Canada Pilots Association (ACPA) has agreed to the amendments made to their contract that will allow the airline to enhance its cargo business.

With more people staying indoors and opting for online shopping amid the pandemic this year, e-commerce trades soared from C$ 21.5 billion in 2019 to C$ 36.2 billion in 2020 between March and September, as per Statistics Canada. This is a surge of 68 per cent rise, said the study.

Let us delve into the recent stock performances of Air Canada and Cargojet.

Air Canada (TSX:AC)

Current Stock Price: C$ 24.86

The national carrier operates up to 100 international, all-cargo planes weekly. With its pilots ratifying to the changes in their contracts, Air Canada is set to enhance its cargo business across global logistics operations, as per the company’s exchange filings.

Air Canada’s current market capitalization stands at approximately C$ 7.37 billion.

Air Canada Stock Performance

Air Canada stock recovered nearly 104.6 per cent in the last eight months since the pandemic-led market crash in March. The stock grew over 38 per cent in the last three months nearly 56 per cent in the last six months.

While the scrips are down about 49 per cent this year, they shot up nearly 69 per cent in the month of November.

The airline stock currently has an average trading volume of 7.25 million for the last 10 days and that of 54.3 million in the last 50 days.

Air Canada offers a positive return on equity (ROE) of 115.86 per cent and a positive return on assets (ROA) of 11.59 per cent. The stock’s price-to-book (P/B) ratio is 4.294, price-to-cash flow (P/CF) ratio is 22.8 and its debt-to-equity (D/E) ratio is 2.06, according to the TMX data.

Air Canada Financial Highlights

The company posted a negative EBITDA of C$ 554 million in its third quarter of 2020, a sharp fall compared to C$ 1.472 billion in the third quarter of 2019.

The airline also recorded an operating loss of C$ 785 million in Q3 2020, led by a decline of 88 per cent in its total revenue from passenger carriers in the latest quarter.

Air Canada held unrestricted liquidity of C$ 8.189 billion as of September 30, 2020.

Cargojet Inc (TSX:CJT)

Current Stock Price: C$ 217.12

Cargojet Inc is Canada's largest premium overnight air freight service provider, claiming to transport over 8 million pounds of shipment weekly. The air transport company manages its network around North America and selected global destinations. It currently operates a fleet of 28 carriers.

Cargojet Inc Stock Performance

Stocks of Cargojet Inc climbed over 64 per cent in the last six months and nearly 23 per cent in the last three months. Since the March lows, the stocks regained almost 187 per cent in the following eight months.

Cargojet scrips have recorded a growth of nearly 109 per cent this year.

The company records a market cap C$ 3.38 billion at the moment. It pays a quarterly cash dividend of C$ 0.234 per share, which currently holds a dividend yield of 0.431 per cent, as per the TMX data. Its dividend growth for the last three years has been 7.05 per cent, while for the last five years it has been 10.23 per cent.

Cargojet’s price-to-book (P/B) ratio is 17.083, debt-to-equity (D/E) ratio is 2.73, and the price-to-cash flow (P/CF) ratio is 13.60, as per data on the TMX portal.

Cargojet Financial Highlights

Cargojet Inc registered total revenues of C$ 162.3 million in the third quarter of 2020, compared to C$ 117.4 million in Q3 2019. The company also reported an adjusted free cash flow of C$ 59.3 million in Q3 2020.

The freight airline saw an adjusted EBITDA of C$ 78.1 million in the third quarter ending September 30, 2020, up from C$ 39.1 million in Q3 2019.

Cargojet reported an overall decline of C$ 92 million in its net-debt on a year-to-date (YTD) basis.