Summary

- Companies are using traditional logistic channels and have embraced technology like never before to ensure their delivery targets are met in these challenging times

- Cargojet (TSX:CJT) and Kinaxis (TSX:KXS) are two trending logistic stocks in the market these days.

- Cargojet stocks are up 115% YTD, while Kinaxis stocks have gained over 100%.

Covid-19 pandemic disrupted and stalled many business activities across the globe. Logistics and supply chain industry was impacted as well. But the industry kept working as usual, adapting to the new normal within days of the outbreak, which made governments impose a lockdown. Meeting deliveries and supply chain commitments became much easier with the help of advanced technologies and artificial intelligence tracking systems.

Companies are using traditional logistic channels and have embraced technology like never before to ensure their delivery targets are met. Amidst these troubled times, logistic stocks picked up momentum and started trending not just in Canada, but worldwide. Here are the two trending logistic stocks, investors need to watch out for - Cargojet Inc. (TSX:CJT) and Kinaxis Inc. (TSX:KXS).

Cargojet Inc. (TSX:CJT)

Current Stock Price: C$222.30

Cargojet Inc is a cargo service provider that operates domestic overnight cargo network between 14 cities in Canada. The company also provides dedicated aircraft to customers to fly between points in Canada and USA on an ACMI (Aircraft, Crew, Maintenance and Insurance) basis. Cargojet stock ranked among the top 30 performing stocks for 2020 for the second year in a row on TSX30 list by the Toronto Stock Exchange.

CJT STOCK PERFORMANCE

Cargojet Inc has a current market capitalization of C$3.46 billion. The scrips have gained by 115.13 per cent this year. As per TSX data, the profit-to-book (P/B) ratio of the company is 15.589 and profit-to-cash flow (P/CF) ratio is 15.70. The company reports negative return on equity and assets. It distributed quarterly dividend payout of C$0.234 and currently yields 0.421 per cent. The dividend growth trends have been positive over both three-year and five-year period, as per the TSX data.

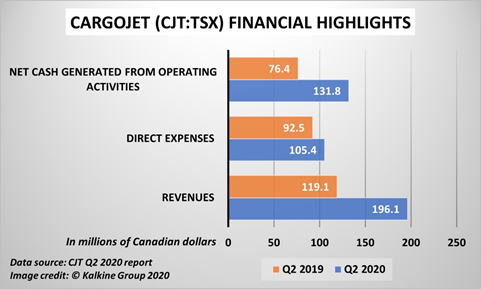

CJT FINANCIAL HIGHLIGHTS

The company financial results report revenue growth of C$196.1 million for the second quarter ending June 30, 2020, in comparison to C$119.1 million in the same period last year. The gross margin for Q2 2020 was C$90.7 million, as compared to C$26.6 million in Q2 2019. The adjusted EBITDA for Q2 2020 is C$91.1 million, as compared to C$37.5 million in the same period last year.

The work-from-home economy and e-commerce channels contributed to majority of Cargojet’s domestic revenues in 2020, especially during the times of lockdown when B2B activities came to a standstill. The company has increased the revolving credit limit from C$510 million to C$600 million, with the maturity date being extended to July 16, 2025.

Kinaxis Inc. (TSX:KXS)

Current Stock Price: C$201.84

Kinaxis (TSX:KXS) is a Canadian software company providing sales and operations planning (S&OP) and supply chain management solutions for the logistics industry. Besides Canada, the company also serves the markets of Europe, North America, and Asia Pacific regions. With economies opening post lockdown, the company entered a partnership with Wipro to transform supply chain operations digitally.

Based on increase in stock performance over a three-year period, the company ranks in the TSX30 list of top performing stocks in 2020 on the Toronto Stock Exchange.

KXS STOCK PERFORMANCE

The company has a current market capitalization of C$5.43 billion. Kinaxis stocks gained 101.79 per cent year-to-date and earnings-per-share (EPS) is C$1.36. The stock’s profit-to-equity ratio is 149.20. Over the last three years, the Kinaxis stock performance has increased by nearly 180 per cent. The company’s profit-to-book ratio (P/B) ratio is 15.43 and profit-to-cash flow (P/CF) ratio is 68.60. Positive return on equity and return on assets are offered by the company of 11.59 per cent and 7.77 per cent respectively..

KXS FINANCIAL HIGHLIGHTS

The company’s total revenue for the second quarter ended 30 June 2020 increased to US$ 61.37 million, up 45 per cent from US$42.35 million in the same quarter a year ago. The gross profit increased by 56 per cent in Q2 2020 to reflect US$ 45.73 million, as compared to US$ 29.36 million in Q2 2019. The company reports adjusted EBITDA of US$ 22.47 million, as compared to US$11.55 million in the same period last year. The cash from operating activities increased by 252 per cent in Q2 2020 to US$ 30.81 million from US$ 8.76 million in Q2 2019.