Highlights:

- GURU Organic Energy Corp. (TSX:GURU) serves organic products to its customers in Canada.

- Israel-based Else Nutrition is focused on developing plant-based food and nutrition products.

- During the trading session on Thursday, the VERY stock had a stellar run as it gained 18.2 per cent.

The plant-based food market has grown tremendously over the past few years, and it isn't expected to slow down from here. Some analysts believe that the demand for plant-based products could increase as more people become aware of animal rights and environmental issues.

Also Read: Lightweights in 2022: 5 junior Canadian stocks to buy in May

In Canada, several companies are exploring the new sector, and some of them trade publicly in equities markets. We have compiled a list of five vegan stocks and here's why you may consider exploring them:

GURU Organic Energy Corp. (TSX:GURU)

The Montreal-based wellness company serves organic products to its customers in Canada and the United States. Some of its products are GURU Organic Energy and GURU Energy Water, and they are believed to be vegan-friendly products.

The GURU stock closed at C$ 10.13 per share on May 12, and its market cap was C$ 327.6 million. GURU Organic posted record Q1 2022 revenue and said it amounted to around C$ 7 million, up from C$ 6.6 million in Q1 2021.

In March, the Montreal-based company expanded its presence in the US through a direct store delivery network agreement with Buffalo Market, Pint Size Hawaii, and DPI Specialty Foods.

Else Nutrition Holdings Inc. (TSX:BABY)

Israel-based Else Nutrition is focused on developing plant-based food and nutrition products for infants and toddlers. The company also makes products for children and adults.

Else Nutrition was started to make products that can serve as an alternative to dairy products. The organic grocer, Lassens, recently announced launching all Else Nutrition products across all its stores.

In 2021, the company's revenues increased 219% year-over-year (YoY) to $4.7 million, and it had a cash balance of $25.5 million.

At market close on May 12, the BABY stock was up by 0.9 per cent and priced at C$ 1.18 per share.

The Very Good Food Company Inc. (TSXV:VERY)

During the trading session on Thursday, the VERY stock had a stellar run as it gained 18.2 per cent and closed at C$ 0.325 apiece. The food technology company develops and sells plant-based meat and other food products to its customers.

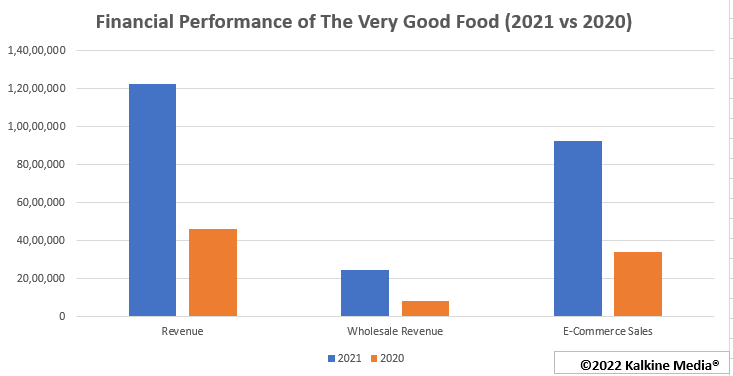

The Very Good Food Company's revenue jumped 164% YoY to C$ 12.3 million in 2021. Meanwhile, the Q4 2021 revenue climbed 70% YoY to C$ 4.3 million.

Notably, the e-commerce revenue increased 174% YoY in 2021 and amounted to C$ 5.9 million.

Komo Plant Based Foods Inc. (CSE:YUM)

Komo Plant develops and sells plant-based frozen meals. The company recreates vegan versions of traditional meaty and cheesy classics sold online and through direct store sales.

On May 5, Komo said it had established a US Cold Storage partnership, and before that, the company had expanded its distribution across Ontario, Maritimes, and Quebec.

Komo Plant's monthly revenue hit an all-time high in February after recording US$ 100,000 in revenue, representing an increase of 46 per cent from the best sales month in December 2021.

Odd Burger Corporation (TSXV:ODD)

Odd Burger is a food technology company that offers plant-based protein and dairy alternatives to its customers in Canada. The products are distributed through franchised fast-food restaurant locations.

The company's first-quarter revenue soared around 79 per cent compared to the previous quarter and amounted to C$ 687,156.

The ODD stock was priced at C$ 0.315 per share at the end of the trading session on May 12.

Also Read: Activision soars as Berkshire ups stake: Does Buffett own TSX stocks?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.