Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

K & G Law LLP Now Offers US Work Visa Virtual Consultations for U...

July 08, 2025 05:37 AM EDT | By News File Corp

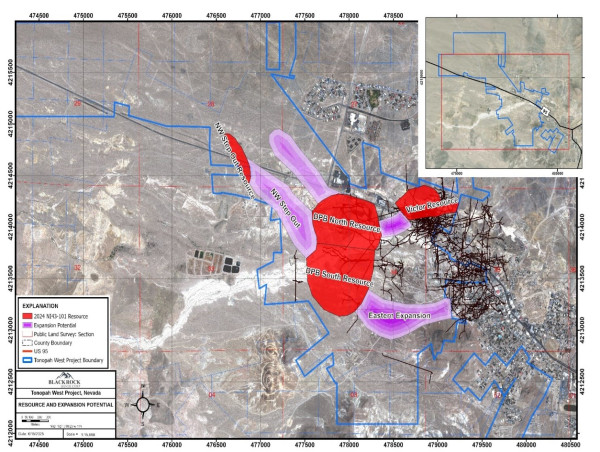

Blackrock Silver Drills 10.12 Metres of 467 g/t AgEq and Establis...

July 08, 2025 05:00 AM EDT | By News File Corp

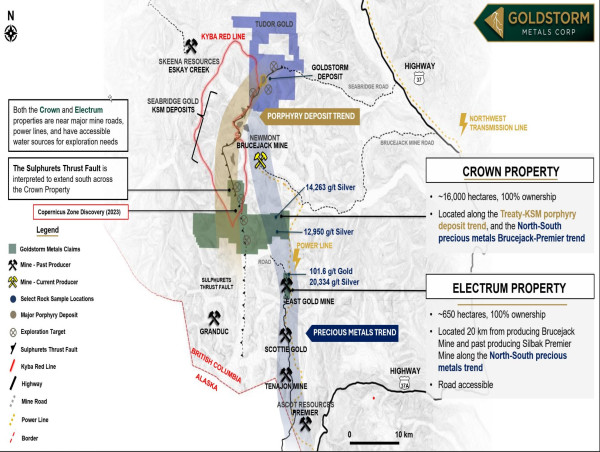

Goldstorm Metals Initiates 2025 Exploration Program Targeting the...

July 08, 2025 05:00 AM EDT | By News File Corp

Starcore Announces Spin-Out of African Properties

July 08, 2025 02:30 AM EDT | By News File Corp

Pacific Bay Minerals Ltd. Announces $2 Million Private Placement...

July 08, 2025 02:22 AM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|