Highlights

- Metro reported a sales growth of 1.9 per cent year-over-year in Q2 2022

- MRU stock swelled by almost 18 per cent in 12 months

- EMP.A stock spiked by over five per cent in nine months

Canadians can explore quality consumer defensive stocks like Metro (TSX: MRU) and Empire (TSX: EMP.A) to manage economic pressure that could arise from recession risk.

Consumers worldwide are worried that higher prices could make central banks impose further increases on interest rates that could slow down economic activities and affect Gross Domestic Product (GDP), leading to market instability.

In such circumstances, a long-term approach could help investors in making healthy investment choices that could add value to their portfolios. Hence, here are two TSX consumer stocks that are known to pay quarterly dividends.

Metro Inc (TSX:MRU)

Metro announced it would eliminate single-use plastic shopping bags at its food and pharmacy stores in September 2022. The large-cap company also said this action supports its Corporate Responsibility Plan for 2022-2026, which aims to minimize overpackaging and single-use plastic.

Metro added that this step would prevent the circulation of over 330 million plastic bags yearly. The Canadian grocery company reported a sales growth of 1.9 per cent year-over-year (YoY) in the second quarter of FY2022.

As of now, Metro pays a quarterly dividend of C$ 0.275. MRU stock swelled by almost 18 per cent in 12 months. According to Refinitiv, Metro appears to be on a mixed trend since March, with a Relative Strength Index (RSI) of 57.41 on July 5.

©Kalkine Media®; ©Garis Studio via Canva.com

Empire Company Ltd (TSX: EMP.A)

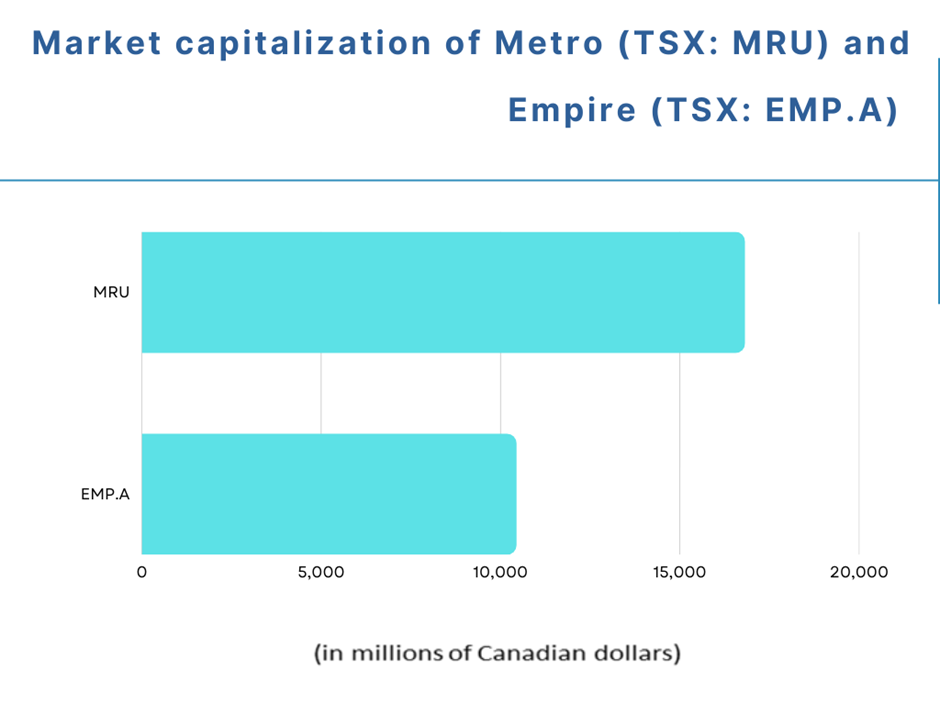

Empire is set to deliver an increased quarterly dividend of C$ 0.165 on July 29 compared to C$ 0.15 paid on April 29. The retail company reported that its revenue climbed by C$ 920.8 million to C$ 7.84 billion in Q4 2022. The C$ 10-billion market cap company posted a net profit surge of C$ 6.6 million in the latest quarter compared to the prior year's quarter.

EMP.A stock spiked by over five per cent in nine months. As per Refinitiv, Empire held an RSI value of 47.22, nearing the moderate level of 50, on July 5.

Bottomline

Recession risk could affect consumers' behaviour and, in turn, impact the stock prices of Metro and Empire. However, these TSX stocks belong to the consumer defensive sector, due to which they could see a limited impact. Also, they provide dividend income, which can be an added bonus for investors.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.