Highlights

- In the last one year, Cineplex stock has surged by a whopping 116 per cent.

- It has also climbed by around 54 per cent in 2021.

- The Toronto-based company has said that its movie theatres and entertainment venues have reopen in full capacity in the country.

Cineplex Inc (TSX:CGX) saw its business crumble under the weight of the COVID-triggered lockdowns for better part of the last two years, leaving its shareholders worried.

However, the movie theatre and entertainment venue franchise seems to be on its path to recovery at the moment, especially if one were to take note of its recent stock market performance and latest financial result.

So, is Cineplex rising from the ashes? Let’s find out.

Also read: McLaren IPO: When is the race car manufacturing company going public?

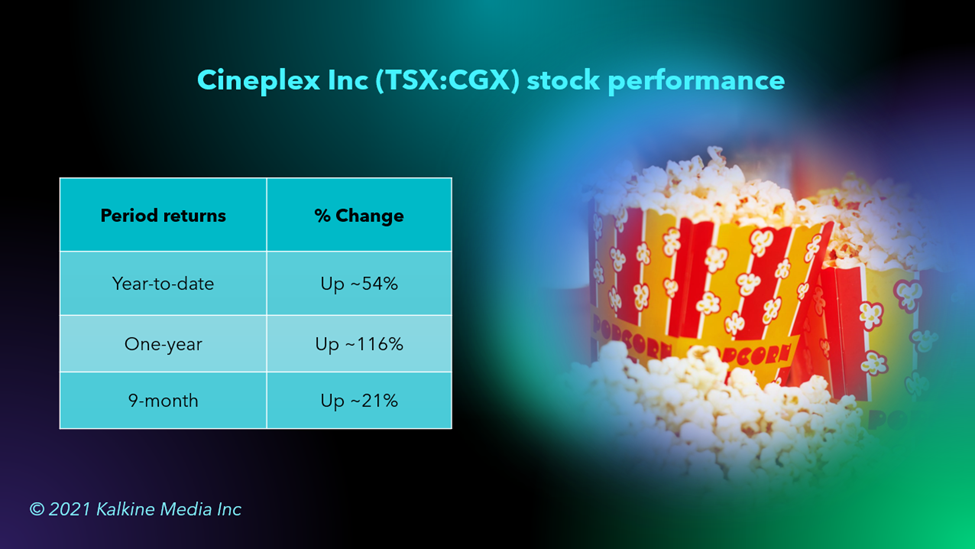

Cineplex Inc (TSX:CGX) stock performance

Cineplex, known to be one of Canada’s top entertainment companies, incurred massive losses as the lockdown rules saw public places like movie theatres and entertainment venues remain shut for days on end through 2020.

As a result, its stock price nosedived to record lows, falling to a 52-week low of C$ 7.1 apiece on November 16, 2020.

But as times changed amid the vaccination campaign, Cineplex slowly reopened its business. Its stock price, in turn, also improved.

In the last one year, Cineplex stock has surged by a whopping 116 per cent. It has also climbed by around 54 per cent in 2021.

It is worth noting that since hitting its 52-week low, CGX stock has grown by nearly 101 per cent in exactly a year.

Also read: TradeStation SPAC: When & where to buy the fintech player's TRDE stock?

Cineplex Inc latest financials

While the Canadian movie theater chain continued to incur loss in the third quarter of 2021, its net loss had notably shrunk to C$ 33.6 million from that of C$ 121.2 million in Q3 2020.

In its latest quarterly results released last week, on November 11, the Toronto-based company said that its movie theatres and entertainment venues have reopen in full capacity in the country.

Its performance in the latest quarter is likely to have improved on the back of relaxed lockdown measures, which saw its occupancy levels continue to expand.

Cineplex has also seen its average monthly net cash burn shrink from a whopping C$ 24 million in the second quarter of this year to C$ 2.9 million in Q3 2021.

Bottomline

Despite its improvement since the pandemic lows, Cineplex stock is still significantly undervalued as compared to its pre-COVID levels.

For instance, CGX was priced at C$ 24.21 on November 15, 2019. Two years later, it is still about 41 per cent below that point.

While there is no certainty that the entertainment stock will find its way back to its pre-pandemic levels, it presently seems to be on a recovery mode. And if its business keeps improving, CGX stock could eventually rise high from the ashes of its pandemic losses.