Highlights

- Bluechip stocks fetch higher returns in the long run and are, generally, a safe option for equity investments.

- One of the companies listed below posted a return on equity (ROE) of 20.89 per cent.

- One of them held a dividend yield of 6.568 per cent.

Investment in bluechip stocks is considered a safe way to earn higher returns in the long run because these companies are well established with market capitalizations in the billions and are known for their regularity in dividend pay-outs. These companies have years of experience in their respective fields and strong fundamentals to withstand tough market situations.

Also read: 5 TSX midcap stocks to buy

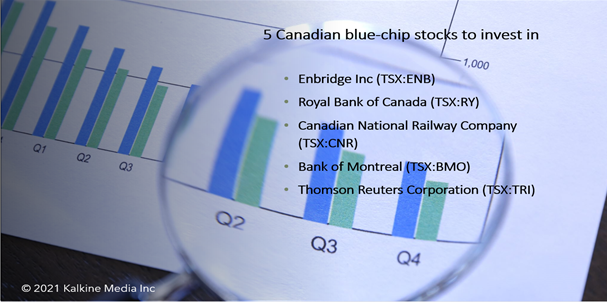

Let us look at some of the Toronto Stock Exchange’s (TSX) bluechip stocks.

1. Enbridge Inc. (TSX:ENB)

The 103 billion market cap firm Enbridge Inc. is the owner and operator of liquid pipelines, gas storage systems and other midstream assets across Canada, the United States and the Gulf of Mexico.

The Alberta-based oil and gas firm noted a surge of nearly 32 per cent in the past year and a year-to-date (YTD) growth of almost 25 per cent. Its stock closed trading at C$ 50.85 apiece on Monday, October 4, down by approximately one per cent from its 52-week high of C$ 51.34 (September 8).

At the time of writing, Enbridge held a price-to-earnings (P/E) ratio of 16.80, price-to-cash flow ratio (P/CF) ratio of 10.9, and return on equity (ROE) of 10.71 per cent with a dividend yield of 6.568 per cent. It posted a five-year average dividend growth of 9.96 per cent.

The firm, in its latest quarter, posted adjusted earnings of C$ 1.4 billion up from that of C$ 1.1 billion in the same quarter a year ago. It also stated a distributable cash flow (DCF) of C$ 2.5 million in Q2 2021 compared to that of C$ 2.4 billion in Q2 2020.

2. Royal Bank of Canada (TSX:RY)

Royal Bank of Canada also known as RBC is one of the largest banks in Canada. RBC provides fully integrated financial services in the United States, Canada, Australia, Asia, Japan, United Kingdom and other countries.

On Monday, October 4, the bank’s scrip wrapped up at C$ 126.20 apiece, noting a fall of almost six per cent from its 52-week high of C$ 134.23 on August 25. Its stock jumped by nearly 34 per cent in the past year and surged roughly 21 per cent on a YTD basis.

RBC posted a P/E ratio of 11.90, a return on equity of 18.68 per cent, and a dividend yield of 3.423 per cent with a five-year average dividend growth of 6.3 per cent on this day.

The bank recorded a 34 per cent year-over-year (YoY) growth in its net income to C$ 4.3 billion in the third quarter of 2021.

3. Canadian National Railway Company (TSX:CNR)

The railroad giant Canadian National Railway Company operates a transcontinental rail line network across North America.

The company saw its stock close at C$ 147 per share on October 4, roughly nine per cent below its 52-week high of C$ 161.15 (September 7). Its stock climbed by more than 12 per cent in the last three months and grew about five per cent on a YTD basis.

The Quebec-based company stood at a market capitalization of 104.22 billion on this day, with a P/E ratio of 26.30, ROE of 20.89 per cent and a dividend yield of 1.673 per cent. Its five-year average dividend growth rate was 10.76 per cent.

The company posted a 12 per cent YoY growth in revenue amounting to about C$ 3.6 billion and an increase of 76 per cent YoY in its operating income of C$ 1.38 billion in Q2 2021.

Also read: Royal Bank (TSX:RY) & CIBC (TSX:CM): 2 bank stocks to buy

4. Bank of Montreal (TSX:BMO)

The Bank of Montreal provides a diversified range of financial services from banking, investment and wealth management solutions to capital markets.

BMO’s stock surged more than 64 per cent in the past year and increased by nearly 12 per cent in the last six months. On October 4, its stock wrapped up at C$ 127.20 almost four per cent below its 52-week high of C$ 132.35 (August 25).

At the time of writing, its P/E ratio stood at 11.90, with a ROE of 13.39 per cent, dividend yield of 3.333 per cent and a five-year average dividend growth rate of 10.43 per cent.

The bank posted a YoY increase of 85 per cent in its net income to C$ 2.27 billion and recovery of credit losses valued at C$ 70 million in Q3 2021.

5. Thomson Reuters Corporation (TSX:TRI)

Thomson Reuters Corporation is a business service firm that provides information and innovative solutions to clients from multiple sectors, such as news and media, corporates, government, etc with headquarters in Toronto.

On October 4, the firm’s scrip closed at C$ 137.70 apiece, down by more than nine per cent from its 52-week high of C$ 152.03 (September 13). Its scrip soared by about 33 per cent in the last nine months.

Its P/E ratio stood at 8 with an ROE of 17.46 per cent, return on assets (ROA) of 9.63 per cent and its dividend yield was 1.476 per cent.

Thomson Reuters posted a YoY growth of nine per cent in its revenue to US$ 1.53 billion in Q2 2021.

Also read: Nuvei IPO: How to buy the Canadian fintech stock as it plans US debut?

Bottom line

Investors generally prefer to invest in bluechip stocks to earn stable returns irrespective of fluctuations in the stock market. These stocks generally fetch higher returns in the long run and are suitable for investors with a low or medium risk profile, however, some risk does exist.