Highlights

- Central banks in developed countries have aggressively increased interest rates.

- Due to rising inflation and interest rates people are bracing for a recession.

- The market volatility is increasing and TSX has entered correction.

Some experts and researchers are increasingly ringing the economic alarm as the Toronto Stock Exchange (TSX) has entered a correction zone. On June 13, the S&P/TSX Composite Index fell 2.63 per cent to 19,742.56 points, putting the Canadian index in correction territory, meaning it is now down 10 per cent from its all-time high achieved earlier in 2022.

Also Read: 5 TSX uranium stocks to buy as demand for Canada supplies rise

Central banks in developed countries have aggressively increased interest rates to tackle rising inflation. Some investors are frightened because of this policy route, which is linked with other troubling factors.

In this article, we will look at five defensive stocks listed on the TSX that have the potential to keep you safe through the rest of 2022 and beyond.

Metro Inc. (TSX:MRU)

Spending money on groceries cannot be cut as they are necessary for every household. Metro is among the top grocery retailers in Canada and now has a large drugstore presence after it acquired Jean Coutu.

Despite the decline in the market, the MRU stock continues to trade near its 52-week high of C$ 73.5 per share. At market close on June 13, the MRU stock closed at C$ 68.34 apiece after declining 1.1 per cent.

Metro's sales increased 1.9 per cent year-over-year (YoY) to C$ 4,274.2 million in Q2 2022. Meanwhile, the net earnings climbed 5.3 per cent YoY to C$ 198.1 million in the same period.

Toronto-Dominion Bank (TSX:TD)

It is one of the largest banks in the country and could benefit from the rising interest rates. Toronto-Dominion is known as one of the best dividend-paying stocks, and it has announced a quarterly dividend of C$ 0.89 per common share, payable in July.

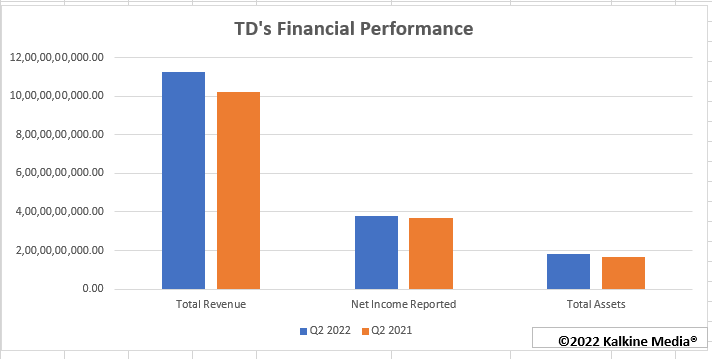

In Q2 2022, the Canadian bank's reported diluted earnings per share were C$ 2.07 compared to C$ 1.99 in Q2 2021. Also, TD's profit increased as the net income grew to C$ 3,811 million from C$ 3,695 million in the same comparable period.

During the trading session on June 13, the TD stock declined 1.4 per cent and closed at C$ 90.31 per share.

Franco-Nevada Corporation (TSX:FNV)

It is a royalty and investment corporation focused on precious metals, and most of its revenue comes from gold, silver, and other precious metals.

Franco-Nevada has a diverse portfolio of assets in the United States, Canada, and Australia. They vary as per commodity, revenue kind, and project stage.

The company said it achieved strong financial results in Q1'22 as its revenue increased by 10 per cent YoY to US$ 338.8 million and net income increased to US$ 182 million, representing an increase of six per cent YoY.

Waste Connections Inc. (TSX:WCN)

Waste Connections is North America's third-largest integrated solid waste and recycling provider, with 91 active landfills. The company entered Canada after merging with Progressive Waste in 2016.

As the company is involved in waste management, it is highly unlikely that its operations would be affected due to inflation or interest rates.

In the first quarter of this year, Waste Connections' revenues increased to US$ 1,646.255 million, up from US$ 1,395.942 million in Q1 2021.

The WCN stock was priced at C$ 154.1 per share on Monday after declining by around 2.4 per cent. In June, the company distributed a quarterly dividend of US$ 0.23 per unit to the shareholders.

Canadian National Railway Company (TSX:CNR)

The Canadian National Railway runs from coast to coast, passing through Chicago to the Gulf of Mexico. In May, the company filed the necessary documents with regulatory authorities in Canada and the US as it is looking to issue around C$ 6 billion of debt securities in both countries.

Canadian National holds a huge rail network and plays an essential role in maintaining a supply chain of various goods. At market close on Monday, the CNR stock was priced at C$ 138.94 per share.

Also Read: DOL & FTS: 2 TSX stocks to buy as World Bank warns of stagflation

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.