Highlights

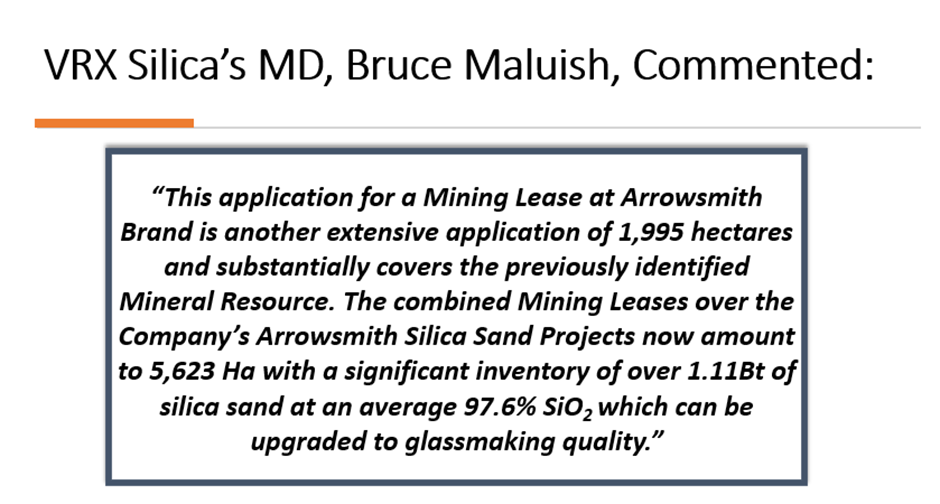

- VRX has been granted a mining lease at Arrowsmith Brand Silica Sand Project.

- The area of the granted mining lease (M70/1418) is 1,995 hectares, taking the total mining lease area at the Arrowsmith Silica Sand Projects to 5,623 hectares.

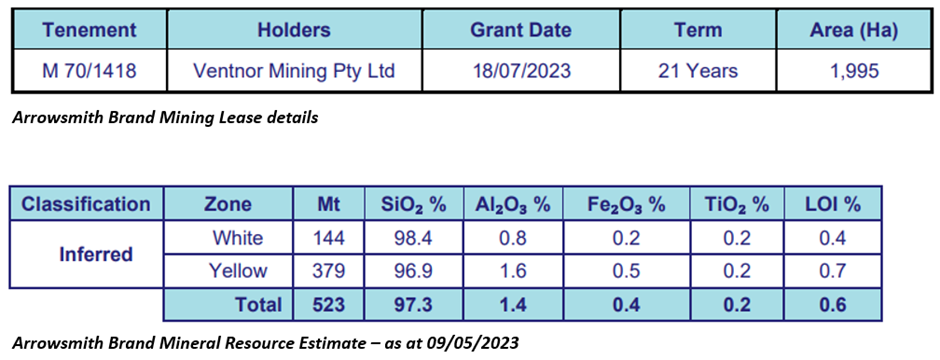

- It covers Mineral Resource Estimate for silica sand within the Mining Lease boundary of 312 Mt @ 97.2% SiO2.

- Tests undertaken earlier suggest that the resource can be upgraded to glassmaking quality.

Pureplay silica sand company VRX Silica Limited (ASX: VRX) announced to have secured Mining Lease – M70/1418 at its Arrowsmith Brand Silica Sand Project. This is the fourth mining lease at the project.

The asset is located 270km north of Perth in the VRX Silica Arrowsmith Silica Sand Projects precinct.

Details of the Mining Lease

The granted mining lease covers an area of 1,995 hectares. It also covers portions of and wholly within the exploration licence E7,5027. The Arrowsmith Brand Mining lease is contiguous with and to the south of M70/1389 – the Arrowsmith North Mining Lease.

A part of the Mineral Resource Estimate previously announced for the Arrowsmith Brand project of 523 Mt at 97.3% SiO2 is included in the Mining Lease, informed VRX.

Image source: company update

What’s ahead?

The company plans to progress the project by employing a well-developed process that has been deployed at other silica sand projects which are currently in development.

VRX shared that the activities include marketing studies, further metallurgical work, mine planning studies and environmental studies. These activities are expected to lead to scoping and pre-feasibility studies.

VRX share price performance

Triggered by the update, VRX shares registered a rise of 6.06% to trade at AU$0.18 per share at the time of writing on 19 July 2023. The company has a market cap of AU$ 92.46 million.