Highlights

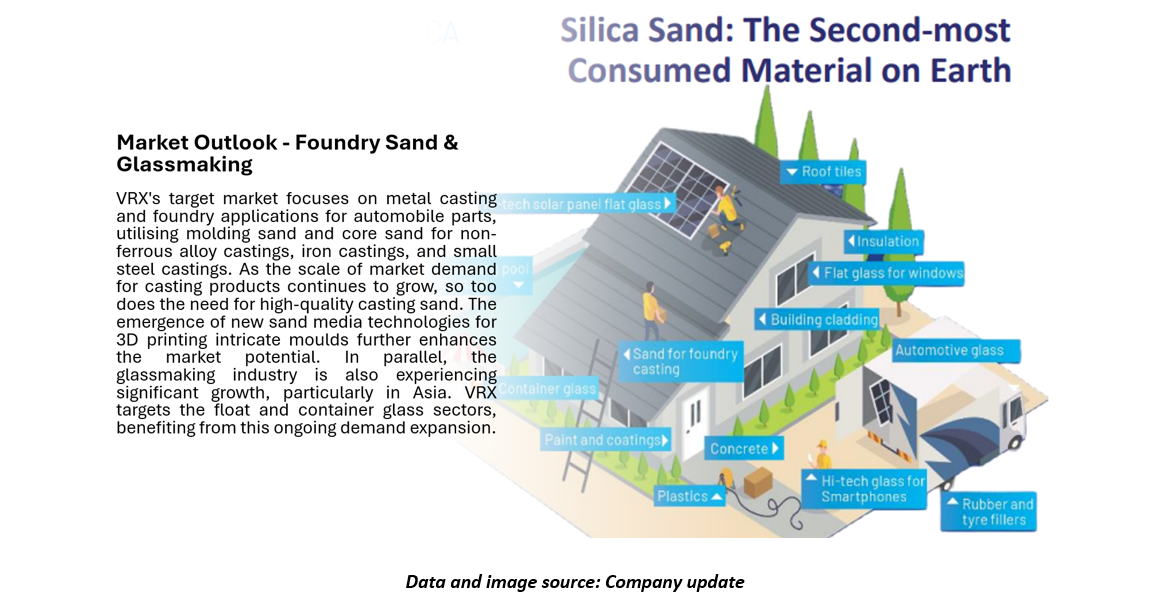

- VRX targets the expanding market for high-quality casting sand, driven by the increasing demand for automobile parts and 3D printing technologies.

- The Arrowsmith North project has a mine life exceeding 100 years and is expected to start production after approvals in 2025.

- The updated Bankable Feasibility Study for Arrowsmith North reveals an NPV10 of AUD 167mn.

- VRX’s Muchea project has been included in the 2024 Critical Minerals Prospectus, highlighting its significance in the global silica supply chain.

Silica sand, the second-most consumed material on Earth, is critical to a wide range of industries from construction and glass manufacturing to electronics and renewable energy. As global demand for this resource continues to grow, the world is currently grappling with a severe sand supply crisis. ASX-listed VRX Silica Limited (ASX:VRX), a pure-play silica sand company, is advancing its portfolio of silica sand projects aimed at meeting the global demand. The company operates five large-scale, high-grade, and low-impurity silica sand projects, each designed to operate independently and supply processed material to diverse markets.

Arrowsmith North Silica Sand Project: Strategic Location and Long-Term Potential

The Arrowsmith North Silica Sand project, wholly owned by VRX, is strategically positioned to capitalise on its proximity to port and rail infrastructure. With a potential mine life exceeding 100 years, the project is supported by a substantial JORC-proved and Probable Reserve of 221 million tonnes at 99.5% SiO2 purity. The long-term scale of this project positions it as a key player in the global silica sand supply chain.

Approvals and Timeline for Development: Environmental and mining approvals for the Arrowsmith North project are expected by Q2 2025, with the project expected to progress toward final offtakes and financing thereafter. The project is currently awaiting the final Ministerial consent following the completion of the appeals process, with a decision expected by April 2025. All other key approvals are also anticipated in Q2 2025. Production is anticipated to commence 8-12 months after the final environmental approvals, financial close, and Final Investment Decision (FID) are secured.

Updated BFS Reveals AUD167mn NPV10: The updated Bankable Feasibility Study (BFS) for the Arrowsmith North project, completed in March 2024, revealed an ungeared NPV10 of AUD167 million, based on 25 years of mining from its extensive +100-year reserve. An independent technical review by AMC Consultants is nearing completion to support the final financing process for the project.

Muchea Project Gains Critical Minerals Spotlight

The Muchea project, also 100% owned by VRX, is a large-scale, high-grade silica sand operation with low impurity content. It has a JORC Indicated and Inferred Resource of 208 million tonnes at 99.6% SiO2 purity, with the potential for a mine life exceeding 100 years. Production at Muchea is expected to follow the Arrowsmith North project, subject to EPA approval. The project is fully permitted with a granted mining lease and miscellaneous licences for access. The Muchea project is included in the 2024 Critical Minerals Prospectus published by Austrade.

In addition, VRX has received a grant from the Western Australian Innovation Attraction Fund (IAF) to explore the production of silica flour. A 1-tonne sample has already been successfully tested by a specialist laboratory in Germany, with additional samples sent to potential buyers.

The scale and strategic positioning of VRX’s silica sand projects offer long-term opportunities not only for the export of silica sand but also for potential glass manufacturing and other downstream industries in Western Australia. VRX’s commitment to developing high-quality, low-impurity silica sand is aligned with growing global demand, particularly for critical applications in construction, electronics, and renewable energy sectors.

The share price of VRX was AUD 0.046 on 04 April 2025.