Highlights

- Vanadium Resources (ASX: VR8, FRA: TR3) wrapped up the Definitive Feasibility Study on its Steelpoortdrift Vanadium Project in H1.

- The study confirmed that the project holds economics and technical viability to deliver 484,000t of vanadium pentoxide over 25 years.

- For its planned Salt Roast Leach Plant, the company picked a 135-hectare site and inked an option agreement.

- SPD’s Mineral Resources now stands at 680Mt averaging 0.70% V2O5 at a cut-off grade of 0.45% V2O5 and Measured Mineral Resources is at 145Mt averaging 0.72% V2O5.

The first half of FY23 saw Vanadium Resources Limited (ASX:VR8, FRA: TR3) moving forward with full gusto to develop its flagship Steelpoortdrift Vanadium Project (SPD) in South Africa. The SPD, VR8 says, is one of the largest and highest-grade vanadium deposits in the world.

The reported period saw major developments including encouraging Definitive Feasibility Study (DFS) outcomes, updated mineral resource and ore reserve estimates, and acquisition of a new property.

Data source: company update

Key activities towards developing Steelpoortdrift Vanadium Project

- Impressive Steelpoortdrift DFS numbers

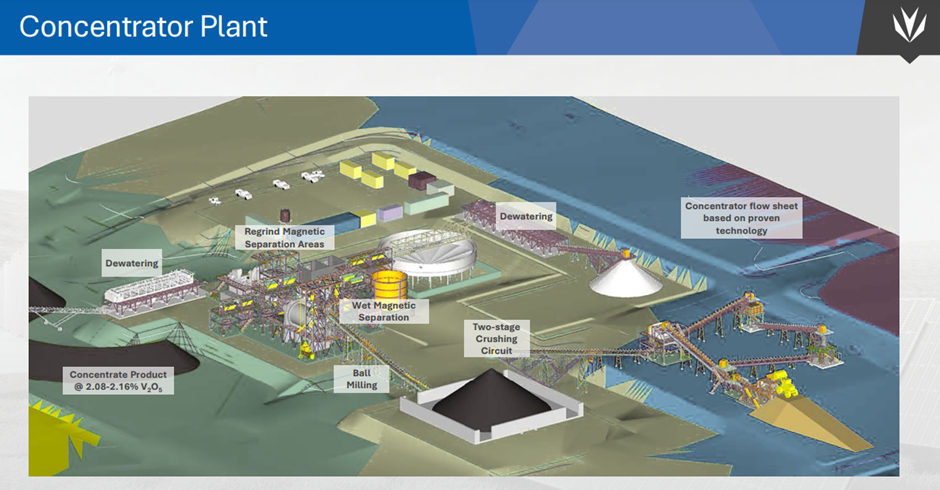

According to the company report, DFS results confirmed that the project holds strong economics as well as technical viability to deliver 484,000t of V2O5 flake over 25 years. The study confirmed the ‘SPD’s potential to be a world-class, large-scale and low-cost vanadium producer with competitive Opex and Capex metrics’.

Because of the high-grade quality of the mineralisation and the low Capex requirement of US$211 million, the company believes that the project will be able to produce an annual free cashflows of US$152 million with a payback period of 27 months.

- The project’s Mineral Resource and Ore Reserve estimates have been updated to 680Mt at 0.70% V2O5 at a cut-off grade of 0.45% V2O5, and to 76.86Mt at 0.72% V2O5, respectively, after considering geology reinterpretation, enhanced block model and Life of Mine plan.

- The period saw the signing of an option agreement for the acquisition of a 135-hectare industrial site for the planned Salt Roast Leach (SRL) Plant. The property within the mining hub of Steelpoort in the Eastern Bushveld Igneous Complex and is within a 15km radius of the SPD Mine Site.

Image source: Company update

- A leading independent corporate finance advisory boutique, HCF International Advisors Ltd has been welcomed onboard as debt funding advisor for better arrangement of debt finance for the project development.

- Advance-level talks are underway with multiple potential strategics, commodity traders, offtake parties, and debt financiers for formal construction funding process.

- Mining executive and financier, Mr John Ciganek was appointed as MD (Managing Director) and CEO (Chief Executive Officer) of the company during the half-year period.

Stock price performance

VR8 shares were spotted trading at AU$0.075 midday on 29 March 2023, with an uptick of over 4% from the last close. The company shares have recorded a jump of more than 25% in the year-to-date period.