Highlights

- Antimony prices surged 250% in 2024, driven by China’s export ban and global supply shortages.

- Resolution Minerals has acquired three new projects in NSW and QLD, targeting high-grade antimony and gold.

- LiDAR survey has identified 791 historic mine workings across 70+ known prospects at Drake East.

- Resolution Minerals will launch field mapping and rock chip sampling across historic workings to prioritise high-value targets in 2025.

Resolution Minerals Ltd (ASX:RML), a resource explorer focused on antimony, gold and copper, is strategically positioning itself to benefit from a surging antimony market. Antimony prices skyrocketed by 250% in 2024 due to global supply shortages, prompting the company to acquire three promising projects across New South Wales and Queensland.

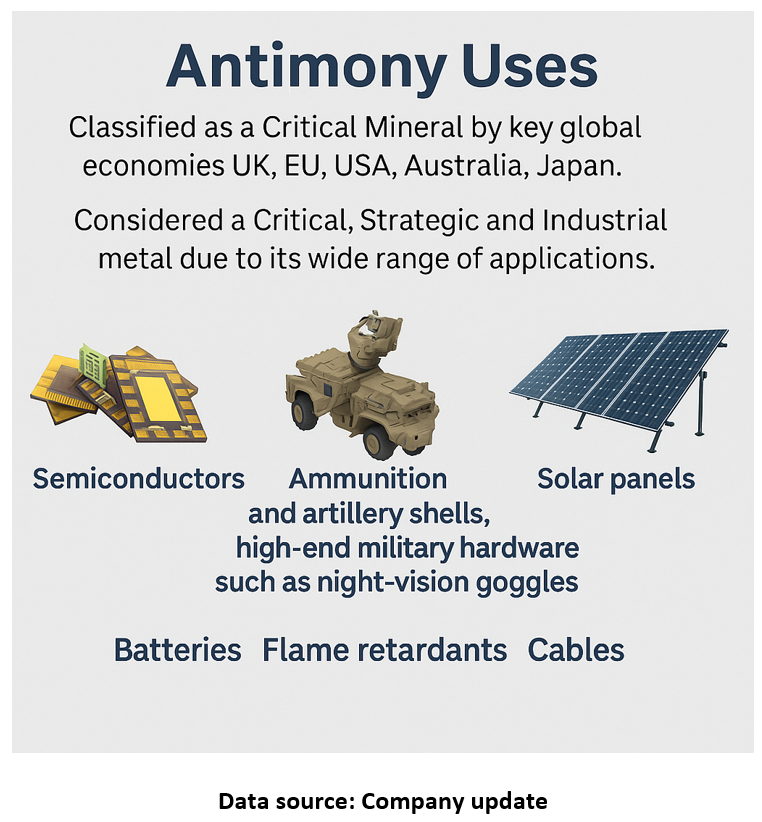

Antimony Market Outlook

China currently dominates the global antimony supply chain, producing over 50% of the world’s output. However, recent export restrictions have slashed Western access by 30%, exacerbating the already tight supply. Additionally, strategic stockpiles in Israel, the US, NATO, and Russia are rapidly depleting, increasing concerns about future availability.

According to Bloomberg, the price of antimony reached a high of US$50,250 per tonne in February 2025.

New Project Acquisitions

To capitalise on market conditions, Resolution Minerals has acquired three key projects with potential for antimony and gold exploration:

- Drake East Antimony-Gold (NSW) - The project is located adjacent to ASX-listed Legacy Minerals’ Drake Project, which hosts 24 antimony occurrences. The Drake East Project is home to multiple antimony and gold prospects, including the well-documented Mosquito Creek Antimony-Gold Reef and Ball & Smiths Lode. The project has already yielded high-grade mineral samples, with gold assays reaching up to 60.9 g/t Au, silver samples up to 214 g/t Ag, and antimony concentrations reaching 5.72% Sb.

Drake East has a historical record of mining activity, with Bucklands Reef previously producing 100 tonnes at an average grade of 32.6 g/t Au. Additionally, the project hosts a placer gold deposit, though it is currently a non-JORC compliant resource.

- Spur South Gold-Copper (NSW) – The project is situated within the highly prospective Lachlan Fold Belt and is surrounded by major deposits but remains significantly underexplored. Despite its promising location, no previous drilling has been conducted on the tenements, leaving considerable room for new discoveries. Magnetic surveys have identified a 4km+ strike zone, highlighting potential for future exploration.

- Neardie Antimony (QLD) - Underground rock chip sampling at the Neardie Antimony Mine returned assays of up to 19.5% Sb. Resolution Minerals believes that significant extensions of high-grade antimony may be present, not only along strike and at depth, but also in parallel systems.

LiDAR Survey Results - Drake East Project

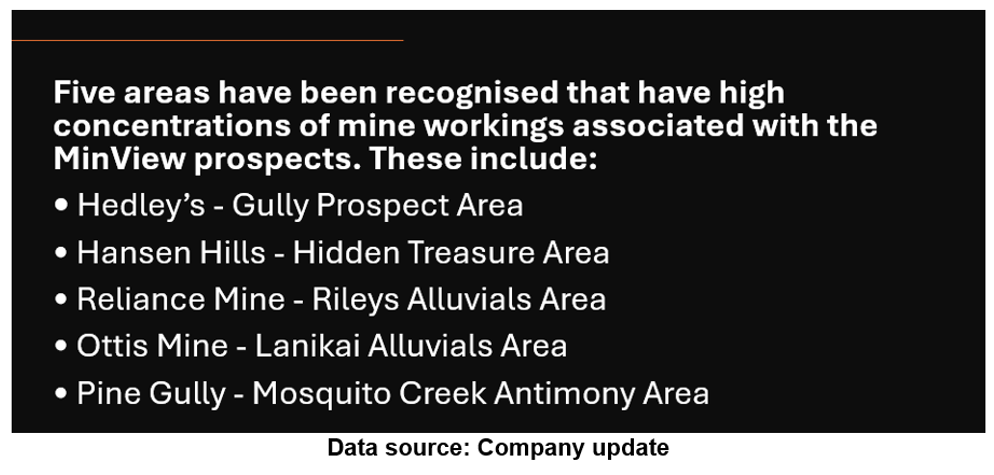

A recent report for the Light Detection and Ranging (LiDAR) survey at the Drake East Project revealed extensive exploration opportunities at the project, identifying 15 antimony, 50 gold, and three copper prospects spread across a 15km-wide area.

The LiDAR interpretations have identified 791 historical mine workings including 742 pits, 33 shafts, and 16 adits, confirming extensive historical mining activity. These are spread over the 70 MinView mineral prospects, known to occur within the project.

Next Steps and Exploration Plans

Looking ahead, the company plans to ground-truth the significant mine workings. The upcoming plans include a desk-top review of approximately 800 mine workings, 70 MinView mineral prospects and assess the placer gold potential. Furthermore, the company plans to conduct a field mapping and geochemical rock chip sampling for high-priority targets.

With strategically located assets and rising demand for antimony, Resolution Minerals is eyeing to become a key player in the supply chain of this critical mineral. The company’s upcoming exploration initiatives aim to unlock value across its newly acquired projects as global markets seek stable, non-Chinese sources of supply.

RML shares traded at AU$0.008 per share on 22 April 2025.