Highlights

- Catalina Resources aims to raise up to AUD 2.27 million through its non-renounceable entitlement offer.

- The funding boost is expected to enhance Catalina’s balance sheet for drilling and potential acquisitions.

- Pareto Capital to manage the placement of remaining shortfall shares.

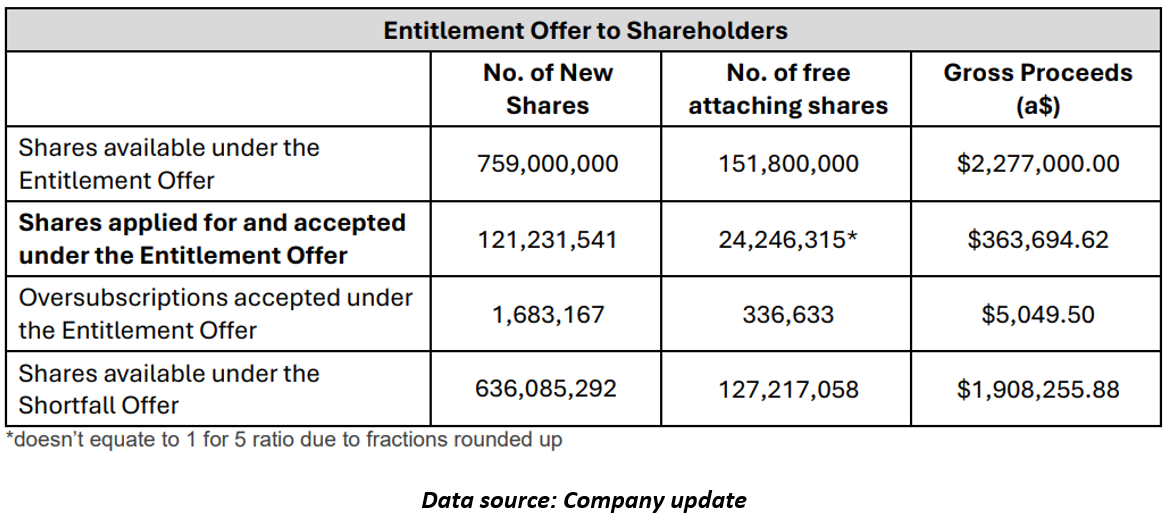

Catalina Resources Ltd (ASX:CTN) has announced an update on its non-renounceable pro-rata entitlement offer, which aims to raise approximately AUD 2.27 million. The company has confirmed the acceptance of applications from eligible shareholders for both entitlements and additional shares, resulting in the issuance of 122,914,708 new shares and 24,582,948 free attaching shares.

This funding, along with the company’s existing cash reserves, is expected to strengthen its balance sheet, support ongoing drilling activities across its current projects and provide flexibility to pursue potential acquisition opportunities.

The offer involved the issuance of one (1) new share for every two (2) shares held by eligible shareholders on the record date at an issue price of AUD 0.003 per share. Additionally, shareholders were entitled to one (1) attaching new share for every five (5) new shares subscribed for, bringing the cost per new share to approximately AUD 0.0025.

Entitlement and Shortfall Offers Aim for AUD 2.27Mn

Entitlement and Shortfall Offers Aim for AUD 2.27Mn

Pareto Capital will commence the placement of new shares available under the shortfall offer following the completion of the entitlement offer. Upon completion, the combined entitlement offer and shortfall offer are expected to raise up to a total of AUD 2,277,000. The shortfall securities will be issued once all application funds have been received by the company as cleared funds.

CTN shares last traded at AUD 0.002 on 14 April 2025.