Highlights:

- Black Canyon, focused on its Flanagan Bore Manganese Project, has continued its recent successes with its exploration works.

- In the latest update, the Mineral Resource Estimate (MRE) at Flanagan Bore soared by 64% to stand at a total of 171 Mt @ 10.3% Mn containing 18Mt of manganese.

- High confidence Measured Mineral Resources now stand at 100 Mt @ 10.4% Mn.

- With the updated MRE, the large deposit scale, well-defined grade domains and considerable contained manganese have been highlighted.

- The company expects to deliver a robust manganese feasibility study, continue exploration activities and scope the development of high purity manganese sulphate over the next 12 months.

- BCA recently submitted a mining lease application for Flanagan Bore’s FB3 and LR1 manganese deposits.

The shares of Western Australia-focused Black Canyon Ltd (ASX:BCA) soared by almost a whopping 15% at the time of writing this article.

The manganese explorer has made an announcement regarding its June 2022 infill and resource expansion drill program. Thanks to the results, there have been considerable increases to the Mineral Resource Estimate (MRE) tonnage, contained manganese and JORC classification confidence at the Company’s flagship Flanagan Bore Manganese Project.

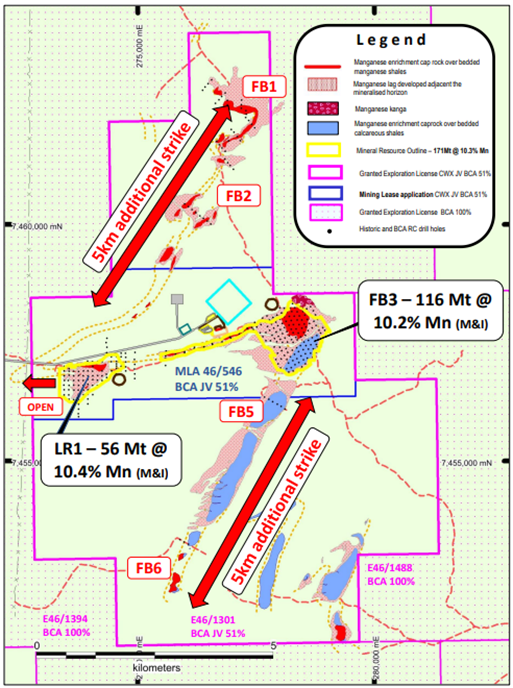

This project is situated in the eastern Pilbara region, WA. Flanagan Bore is part of BCA’s Joint Venture agreement (having earnt 51% and earning up to 75%) with Carawine Resources Ltd (ASX:CWX).

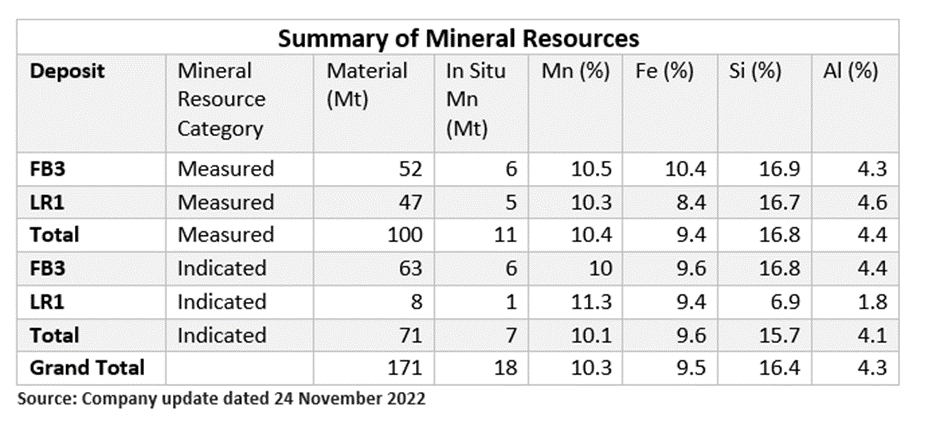

The MRE for the Flanagan Bore has soared by 64% to stand at a total of 171 Mt @ 10.3% Mn containing 18Mt of manganese comprising:

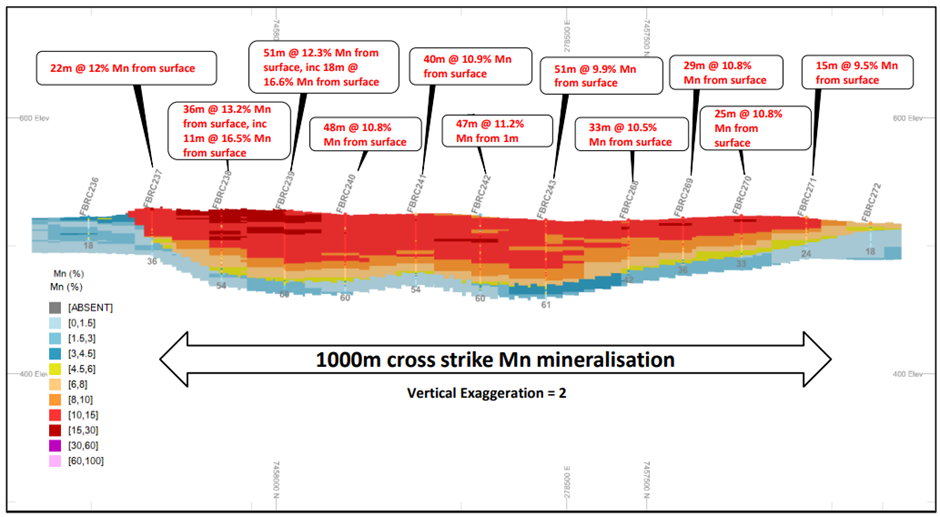

- FB3 Deposit: 116 Mt @ 10.2% Mn (45% Measured and 55% Indicated), and

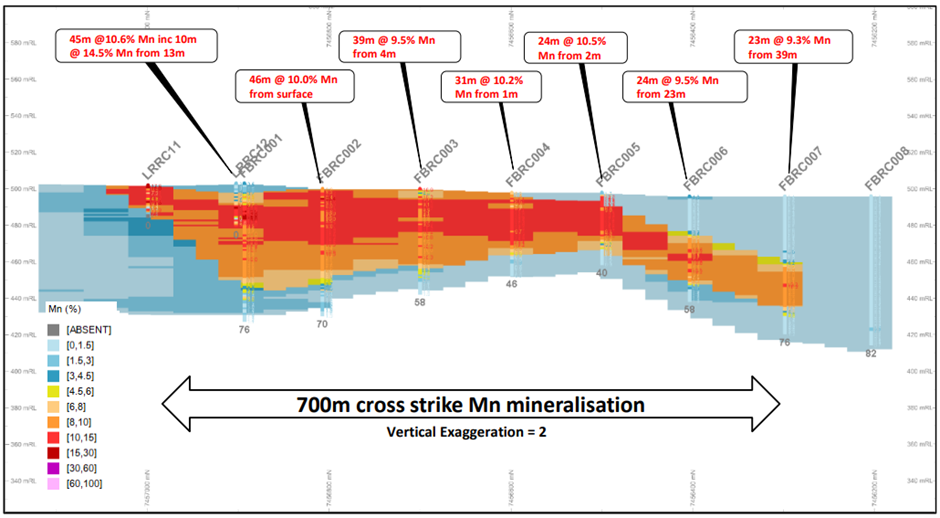

- LR1 Deposit: 56 Mt @ 10.4% Mn (90% Measured and 10% Indicated)

With this, the high confidence Measured Mineral Resources now totals 100 Mt @ 10.4% Mn.

Black Canyon Executive Director, Brendan Cummins, said among other things:

© 2022 Kalkine Media®, data: Company update dated 24 November 2022

Flanagan Bore’s FB3 and LR1 deposits: updates and prospects

Source: Company update dated 24 November 2022

The Mineral Resources at LR1 and FB3 are outcropping in nature, and have been estimated based on

- 516m historical RC drilling in 2012

- 4,312m RC drilling program completed in December 2021, and

- 7436m RC drill program completed in June 2022.

Note that the Mineral Resources stated have been estimated by a cut-off grade of 7% Mn:

The Flanagan Bore MRE has soared 64% to 171Mt @ 10.3% Mn containing 18Mt of manganese. This represents a substantial increase of 67Mt of total tonnage and 7Mt of contained manganese from the previous Mineral Resource.

Further, referring to the drill data, the company says that the manganese grades are strongly continuous downhole and across strike. This in turn has significantly improved the confidence in the estimates while underpinning the ‘Measured’ and ‘Indicated’ Mineral Resource classification.

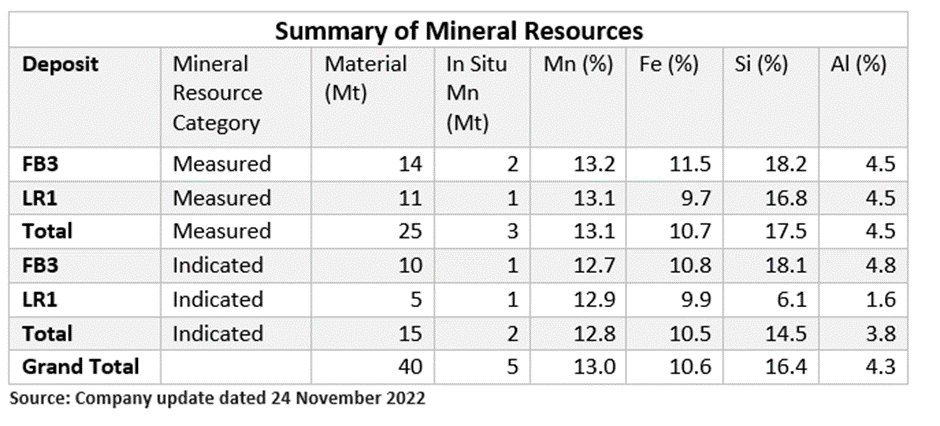

High-grade manganese mineralisation (estimated for the deposits by applying an 11% Mn cut-off grade) has been encountered from surface at the FB3 and LR1 deposits, with continuous mineralisation zones typically having thickness between 20 and 40m.

A shallow, high-grade subset of the mineralisation has been delineated across the LR1 and FB3 Mineral Resources.

As presented in the table, significant higher-grade component totals 40 Mt @ 13.0% Mn (63% Measured and 37% Indicated) across the deposits.

As the Company makes progress on the development and feasibility studies, access to high-grade manganese Mineral Resources from surface could add significant value.

FB3 Mineral Resource model cells and drill holes coloured by Mn grade (%) (Source: Company update dated 24 November 2022)

LR1 Mineral Resource model cells and drill holes coloured by Mn grade (%) (Source: Company update dated 24 November 2022)

The way ahead

Thanks to the enhanced scale of and confidence in the Mineral Resource, the Company will focus on development and feasibility studies while progressing on the pathway to approval of the recent Mining Lease application for Flanagan Bore’s FB3 and LR1 manganese deposits.

Over the next 12 months, the Company plans to focus on multiple activities across a number of work fronts to:

- deliver a robust manganese mine Feasibility Study

- continue exploration activities

- scope the development of high purity manganese sulphate suitable for the electric vehicle industry

BCA shares traded at AU$0.25 on 24 November 2022.