Resources sector makes contributions like economic wealth, employment, investment, tax revenues and high wages. Australia ranks amongst the top producers of mineral commodities such as bauxite, alumina, rutile, and tantalum in the world. It is the 2nd largest producer of ilmenite, lead, lithium and zircon, globally. The country also ranks amongst the top three producers of iron ore and uranium, and is known as the main exporter of alumina, black coal, iron ore, lead as well as zinc.

In this article, we will discuss three stocks engaged in serving the resources sector.

AngloGold Ashanti Limited

Company Overview:

AngloGold Ashanti Limited (ASX: AGG) is a global gold mining company with mines and exploration projects in various regions like Continental Africa, Americas, Australasia and South Africa.

AngloGold Ashanti Limited is scheduled to release results for the six-month period ended 30 June 2019 on 8 August 2019 on the Johannesburg Stock Exchange (JSE) News Service. As per the Listings Requirements of the JSE Limited, stocks are required to publish their trading statements when they are sure that the financial results for the period to be reported on next will differ by a minimum of 20% as compared to their previous corresponding period (pcp).

Expected Headline Earnings and Basic Earnings:

The company expects headline earnings for the period ended 30 June 2019 to be in the range of $ 111 million and $ 129 million. Headline earnings stood at $ 99 million during the same period a year ago. Meanwhile, AGGâs headline earnings per share would lie in the range of US$ 27 cents and US$ 31cents for the six months to June 2019, up from US$ 24 cents a year-ago.

Basic earnings of the company are expected to be in the range of $ 106 million and $ 122 million, compared with $ 33 million on pcp. Its basic earnings per share are expected to in the range of US$ 25 cents and US$ 29 cents, which was US$ 8 cents in 1H 2018.

Anticipated growth in headline earnings, as well as basic earnings for the six months to June 2019 can be attributed to increased earnings of $ 22 million after tax, as retrenchment costs associated with the restructuring of operations in South Africa did not recur in 2019. Moreover, in April 2019, a Brazilian power utility legal settlement worth $ 11 million (post-tax) was received by the company. Another factor driving the expected growth in the headline earnings and basic earnings is income from joint ventures. However, these earnings were partially offset by a reduction in net by-product revenue worth $ 25 million after tax and a rise in environmental rehabilitation costs of $ 27 million (post-tax).

Operational Performance:

AGG expects production for the six months ended 30 June 2019 to be slightly lower than that of the six months ended 30 June 2018. Expected production for the reported period would be 1.554 Moz, which was 1.578 Moz on pcp.

Stock Information:

The price of the shares of AGG was A$ 5.450 on 2 August 2019 (AEST 12:33 PM), up 10.324% as compared to its previous closing price. AGG has a market cap of A$ 2.48 billion with approximately 502.99 million outstanding shares, PE ratio of 1,300.000x and an annual dividend yield of 0.3%.

Mastermyne Group Limited

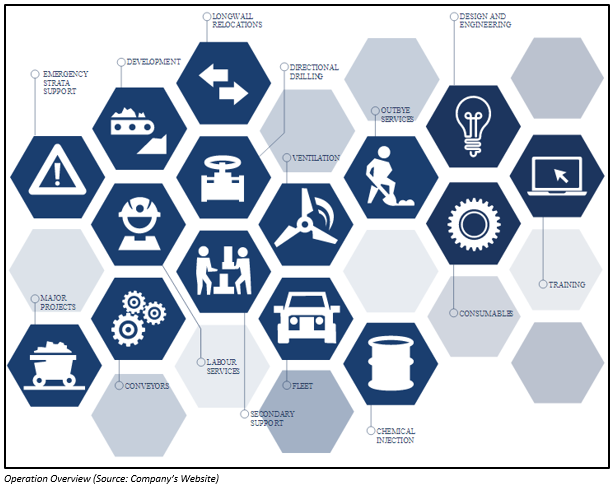

Company Overview:

Mastermyne Group Limited (ASX: MYE), operating in the metals & mining sector, is engaged in the development of underground roadways and installation of conveyors, as well as designing and engineering of dedicated equipment and consumables. The company serves the coal mining industry in Australia.

Anglo American Development and Outbye Services Contract

On 1 August 2019, Mastermyne Group Limited announced that it has secured a development and outbye services contract for the Aquila Project of Anglo American Corporation. Under this contract, the company would be responsible for roadway development in the mains and gate roads as well as outbye related services to develop new longwall operation at Aquila Mine.

The pre-mobilisation work at the site has started, and on being fully resourced, the contract would hire 160 full-time personnel with a project duration of two years. Also, the company would be supplying development equipment for the project, as earlier unveiled. The total revenue generated in these 2 years from the mining contract and equipment supply would be ~ $ 95 million. The initial phase of mobilisation would start in early September 2019, and full mobilisation is planned for November 2019 end.

Stock Information:

The price of the shares of MYE was A$ 1.100 on 2 August 2019 (AEST 12:58 PM), up by 3.286% as compared to the previous closing price. MYE has a market cap of A$ 108.27 million with approximately 101.67 million outstanding shares and a PE ratio of 16.380x.

Strike Energy Limited

Company Overview:

Strike Energy Limited (ASX:STX), founded in 1997, is an oil & gas exploration company with assets in the Cooper Basin in South Australia and the Perth Basin in Western Australia. Its registered corporate office is in Thebarton, South Australia.

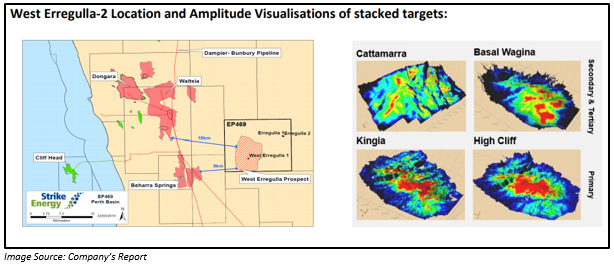

Wagina Gas Discovery

Strike Energy Limited, on 1 August 2019, announced that it had discovered a substantial gas discovery in the Wagina sandstone. The activities were part of the West Erregulla-2 drilling program. According to the market update, the company found the Wagina sandstone to be more than 74 metres in thickness. Moreover, the sandstone was comprised of sections that had clean sand. Additionally, it interpreted blocky porosity development, which upon drilling unveiled to contain hydrocarbons throughout. The company observed and interpreted the section from 4,106 metres to 4,180 metres.

The company is drilling West Erregulla-2 in EP 469, in which it holds a 50% stake. West Erregulla-2, which is yet to encounter water wet sands, is to be drilled to a 5,200-metre depth. It would work on a conventional gas target in the sandstone of Basal Wagina. Moreover, the company would target primary gas sand arrangement in the Kingia High Cliff. According to Strike Managing Director Stuart Nicholls, the significant discovery gives a boost to the companyâs predictions regarding good porosity development within Permian reservoirs.

Stock Information:

The price of the shares of STX was A$ 0.120 on 2 August 2019 (AEST 01:14 PM). STX has a market cap of A$ 186.04 million and approximately 1.55 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)