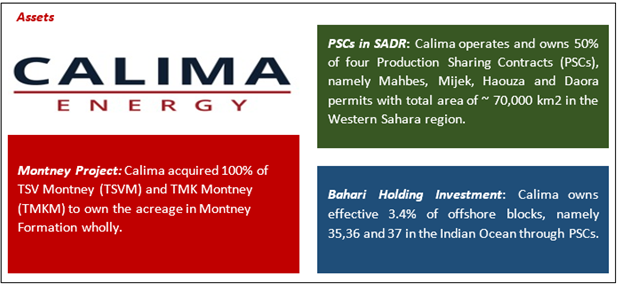

Calima Energy Limited (ASX: CE1) is an ASX-listed international oil & gas (O&G) company, based in Subiaco, Western Australia. The activities of the company involve investments in O&G exploration and production projects, globally. CE1’s key resources sit in super liquids-rich window of the Montney Formation with ~64,458 acres of drilling rights in British Columbia.

To know more about Calima Energy assets, please read Calima Energy's Asset Performance and Future Outlook

Recently, the Company announced its quarterly activities report for the three months to December 2019.

December Quarter Highlights:

- Sale of Namibia PEL 90 (Block 2813B) to Tullow Namibia Limited in exchange of A$2.9 million.

- Positive drilling program on Calima Lands resulting in a continuation lease award for ten years over 49 sections, i.e. 33,463 acres of land.

- O&G industry veteran joining CE1 Board.

- Approval to operate and construct a multi-well production facility by the BC Oil and Gas Commission (OGC).

- Permit to build a pipeline to link regional pipeline and processing infrastructure to the Calima well-pad.

- And lastly, the company well-funded with working capital of A$4.9 million.

Please Read Calima Energy Releases December Quarter Update; Initiatives In Line With Montney Formation Project to know more about the quarterly activities.

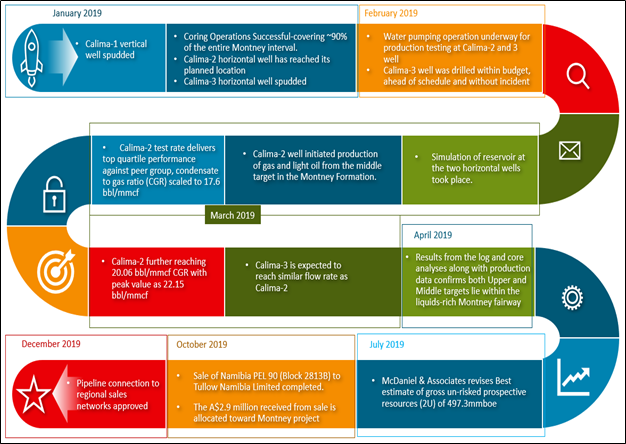

Not just the last quarter, the entire year 2019 was fruitful for the Company with promising results for its core asset in Montney Formation. It all started with Calima-1 vertical well confirming the existence of natural gas condensate after drilling to a depth of 1,872.5m.

Moreover, Calima-2 well-flowing rate delivered top quartile performance against its peer group and right after that Calima-3 well too expected to achieve the same test result, as Calima-2 had garnered positive prospect for CE1.

Also, interestingly, oil saturation values assessed in the Upper and Middle Montney target from the core were up to 59% and 64%, respectively, more than the recorded adjacent value, and superb reservoir properties in comparison to nearby wells have been noticed in Calima's core & logging analyses.

During the year, growth of Calima's asset was backed by increased resources for Calima Lands and grant of pipeline approval. The gross resources value rose to 196.1 million barrels of oil equivalent (mmboe) (2C- Contingent Resource) and 497.3 mmboe (2U- Prospective Resources). The permit was granted for the pipeline with a capacity of up to 50 Mmcf/d wet gas and 1,500 bbls/d of well-head condensate to link the Calima well-pad with regional pipeline and processing infrastructure.

Some of the major updates of Calima during 2019 (Source: CE1 Reports)

The company to support the Montney project sold its Namibia PEL 90 (Block 2813B) to Tullow Namibia Limited in exchange of US$2 million. Moreover, CE1 has access to US$10 million in bonus, subject to the success of PEL 90. The bonus is divided in two equal tranches of US$5 million, following the award of a production licence and then upon the commencement of commercial production.

Also, it is pertinent to mention that CE1 is planning to sell its existing PSCs in Saharawi Arab Democratic Republic and Bahari Shares entirely or partly. The step reflects a continuous focus of the Company towards its premier asset in Montney Formation, which is predicted to become one of the top plays in Western Canada and North America.

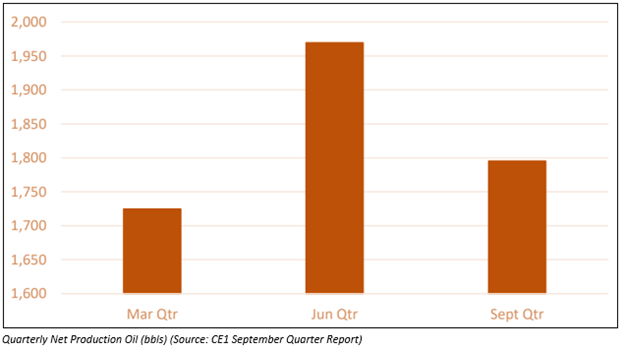

The prospect of Calima Lands can be easily gauged with the production of oil from one of its wells at the time of drilling and assays.

Interesting in knowing Calima’s Strategy: Mapping O&G Company, Calima Energy’s Strategy and Initiatives

Calima’s past year was very crucial in moulding the project toward commercialisation. And, it would be quintessential to see the upcoming decisions and steps taken in line with high prospect Montney Formation asset in 2020.

Stock Price Information – The stock of Calima Energy last traded at $ 0.006 on 6 February 2020, up 20% from its previous closing price with a market cap of $ 10.78 million.