Summary

- The S&P Financial Index beat overall market gains on Monday and rose by 0.16% by the end of trade.

- Crown Castle Inc., cell tower owner and operator, reported a net income of US$455 million for Q2 2023.

- Citizens Financial Group Inc., a banking sector firm, reported an underlying net income of US$531 million and an EPS of US$1.04 for Q2 2023.

The S&P 500 index closed 0.4% higher on Monday, September 25, 2023, in tandem with the overall market which also rose on a broad basis. At the same time, the financial sector’s gains through the day exceeded S&P 500’s gains as the S&P 500 Financials Index rose 0.16% on Monday.

The S&P Financial Index’s 6-month performance shows an increase of 7.46% as at the close of trade on Monday.

ALSO READ: Should you watch these dividend stocks

The financial sector’s performance over a given period is often suggestive of the overall economic condition. Financial stocks can be a great add-on to a portfolio, as many of these corporations are large-cap firms that may issue dividends.

With that, let us look at two financial sector stocks that investors can examine:

Crown Castle Inc. (NYSE: CCI)

Crown Castle owns around 40,000 cell towers in the US and over 80,000 route miles of fiber. The company’s market cap stands at over US$40 billion.

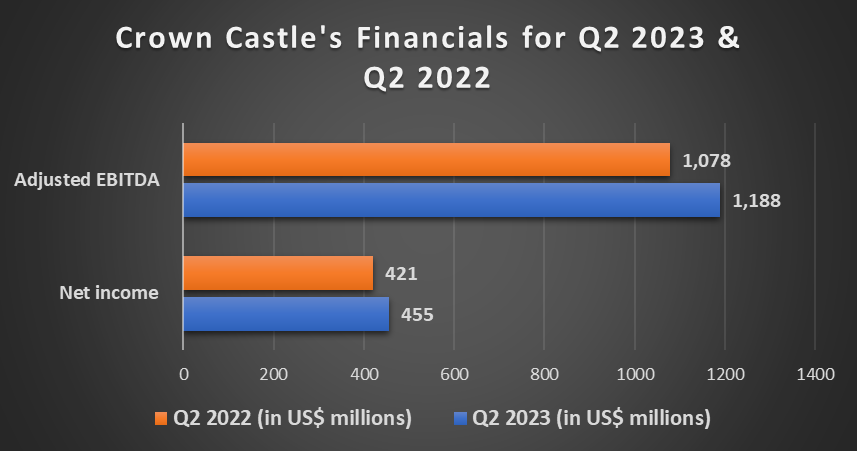

For Q2 2023, Crown Castle reported a net income of US$455 million, an increase of 8% year-on-year. Meanwhile, the net income per diluted share was US$1.05, an 8% increase compared to the same period in the previous year. The adjusted EBITDA was US$1.188 billion for the period, a 10% increase year-on-year.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

The company declared a dividend of US$1.565 per common share to be paid to common stockholders on September 29, 2023.

Based on Monday’s closing price, CCI has a P/E ratio of 23.41x and has a dividend yield of 6.81%. The stock closed 0.36% higher on Monday at US$92.31.

ALSO READ: Tech stocks to examine as the S&P 500 IT index rises

Citizens Financial Group Inc. (NYSE:CFG)

Citizens Financial Group has two operating segments – consumer banking and commercial banking. The bank derives most of its revenue from net interest income, for which the primary sources include commercial loans, securities, home equity lines of credit, etc.

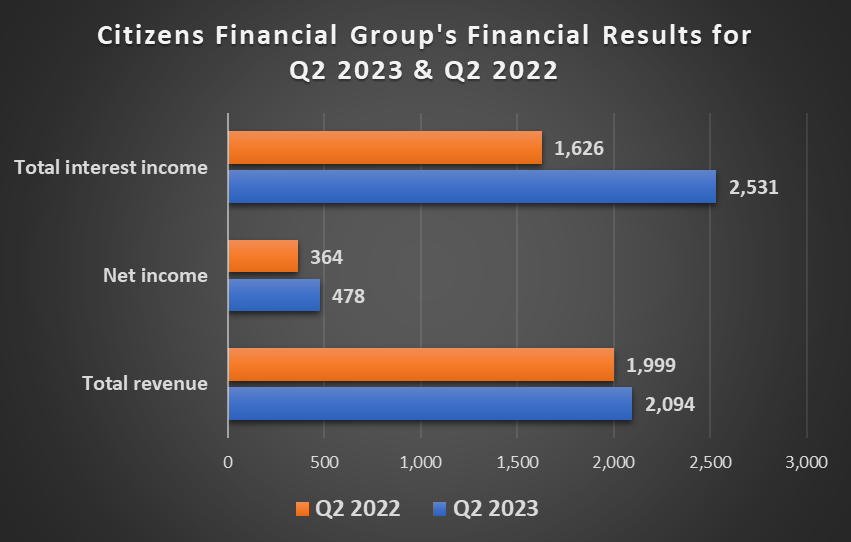

The company reported an underlying net income of US$531 million and an EPS of US$1.04 for the second quarter of 2023. The company grew its deposits by US$5.5 billion and reduced its Federal Home Loan Bank (FHLB) borrowings by around US$7 billion to US$5 billion.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

The company’s board declared a quarterly dividend of US$0.42 to be paid to common stock holders. The dividend was paid in mid-August.

After Monday’s close, CFG stock price rose 0.26% intraday. Based on Monday’s closing price of US$26.63, CFG had a P/E ratio of 6.03x and a dividend yield of 6.33%.