Highlights:

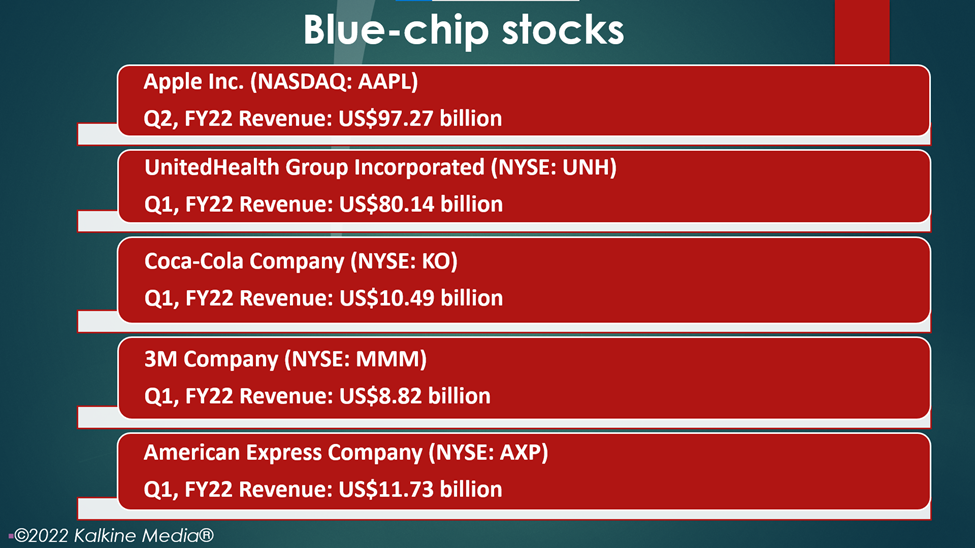

- Apple Inc's (NASDAQ:AAPL) net sales rose 9% YoY in Q2, FY22.

- UnitedHealth Group (NYSE:UNH) will report its second-quarter results on July 15.

- American Express Company (NYSE:AXP) revenue soared 29% YoY in Q1, FY22.

Blue-chip stocks are generally the leaders in their respective sectors. They wield significant brand recognition among the public through their long experience in the market.

These companies also see steady growth and remain resilient during occasional market upheavals. Only a major economic crisis in the country could jolt these stocks. Also, they usually have strong business models and make regular dividend payments to investors.

Hence, they are a favorite for some long-term investors. Here we discuss five blue-chip companies and their performance in the face of volatile market conditions.

Also Read: TSLA to LCID: 5 EV stocks to explore in Q3 after Fed’s rate hike

Apple Inc. (NASDAQ:AAPL)

Apple is one of the leading technology companies specializing in consumer electronics, software, and related services. It is based in Cupertino, California.

Its shares closed at US$131.56 on June 17, up 1.15% from their previous close. The stock declined around 28% YTD (as of June 17).

Apple has a market cap of around US$2.28 trillion, a P/E ratio of 21.36, and a forward one-year P/E ratio of 21.29. Its current yield is 0.68%, and its annualized dividend is US$0.92.

The 52-week highest and lowest stock prices were US$182.94 and US$129.04, respectively. Its trading volume was 134,520,300 on June 17.

The company's total net sales rose 9% YoY to US$97.27 billion in Q2, FY22. Its net income came in at US$25.01 billion, or US$1.52 per diluted share, against an income of US$23.63 billion, or US$1.40 per diluted share, in Q2, FY21.

Also Read: Seagen (SGEN) stock roared 17% higher on Merck’s (MRK) buyout plan

Source: ©2022 Kalkine Media®

Source: ©2022 Kalkine Media®

UnitedHealth Group Incorporated (NYSE:UNH)

UnitedHealth is a diversified healthcare firm offering customers a range of healthcare and insurance services. The company is based in Minnetonka, Minnesota.

The stock closed at US$452.06 on June 17, down 0.88% from its previous closing price. The UNH stock fell 9.2% YTD (as of June 17).

Its market cap is US$424.10 billion, the P/E ratio is 24.74, and the forward one-year P/E ratio is 20.97. Its current yield is 1.25%, and its annualized dividend is US$6.60.

The stock touched a peak price of US$553.29 and the lowest price of US$383.12 in the last 52 weeks. Its share volume on June 17 was 5,277,373.

The company will report its second-quarter fiscal 2022 results on July 15.

Meanwhile, in the first quarter of fiscal 2022, the company's revenue surged 14% YoY to US$80.14 billion. Its net earnings attributable to common shareholders came in at US$5.02 billion, or US$5.27 per diluted share, against an income of US$4.86 billion, or US$5.08 per diluted share, in Q1, FY21.

Also Read: US mid-term polls in a year marred by inflation, fear of recession

Coca-Cola Company (NYSE:KO)

Coca-Cola is a multinational beverage firm based in Atlanta, Georgia. It operates in more than 200 countries.

Its shares closed at US$59.43 on June 17, up 0.61% from their closing price of June 16. Its stock value increased by 0.22% YTD (as of June 17).

Coca-Cola has a market cap of US$257.63 billion, a P/E ratio of 24.97, and a forward one-year P/E ratio of 23.91. Its current yield is 2.95%, and its annualized dividend is US$1.76.

The 52-week highest and lowest stock prices were US$67.20 and US$52.28, respectively. Its trading volume was 34,781,920 on June 17.

The company reported revenue of US$10.49 billion in Q1, FY22, an increase of 16% YoY. Its net income attributable to common shareholders came in at US$2.78 billion, or US$0.64 per diluted share, compared to US$2.24 billion, or US$0.52 per diluted share, in Q1, FY21.

Also Read: Five financial stocks to watch in Q3: FHN, Y, WRB, LPLA & PGR

3M Company (NYSE:MMM)

3M is a multinational conglomerate firm engaged in worker safety, healthcare, consumer goods, etc. It is based in Saint Paul, Minnesota.

The stock closed at US$129.84 on June 17, down 0.84% from its previous closing price. The MMM stock declined 26.33% YTD (as of June 17).

Its market cap is US$73.88 billion, the P/E ratio is 13.51, and the forward one-year P/E ratio is 12.08. Its current yield is 4.44%, and its annualized dividend is US$5.96.

The stock touched a peak price of US$203.21 and the lowest price of US$130.33 in the last 52 weeks. Its share volume on June 17 was 7,181,134.

The company reported net sales of US$8.82 billion in Q1, FY22, compared to US$8.85 billion in the year-ago quarter. Its attributable net income was US$1.29 billion, or US$2.26 per diluted share, against an income of US$1.62 billion, or US$2.77 per diluted share, in Q1, FY21.

Also Read: Top agri stocks to watch amid rising prices: ADM, CTVA, MOS, BG & CF

American Express Company (NYSE:AXP)

American Express is a payment services firm based in New York. Its products help customers build their businesses.

Its shares closed at US$144.18 on June 17, up 4.86% from their previous closing price. The stock value tumbled 18.26% YTD (as of June 17).

American Express has a market cap of US$108.57 billion, a P/E ratio of 14.45, and a forward one-year P/E ratio of 14.09. Its current yield is 1.42%, and its annualized dividend is US$2.08.

The 52-week highest and lowest stock prices were US$199.55 and US$136.49, respectively. Its trading volume was 10,033,580 on June 17.

The company's total revenue soared 29% YoY to US$11.73 billion in Q1, FY22. Its net income was US$2.09 billion, or US$2.73 per diluted share, against an income of US$2.23 billion, or US$2.74 per diluted share, in Q1, FY21.

Also Read: VALE to KR: Can these 5 stocks protect against stagflation?

Bottom line:

Although blue-chip companies have a robust presence in the market, investors should carefully evaluate them and the broader market before investing in stocks. The S&P 500 index fell 22.90% YTD and 12.96% over the past 12 months.