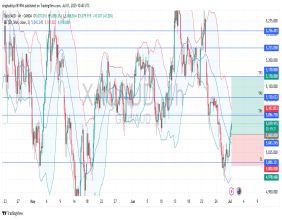

The copper market is flashing warning signs of scarcity with spot prices on the London Metal Exchange trading well above the futures.

The cost of purchasing copper on Tuesday is higher than the futures contracts of the commodity. The premium on the most active 3-month contract has reached its widest point since 2021.

“The reason for this continues to be strong import demand from the US, which threatens to deplete the LME and SHFE warehouses,” Thu Lan Nguyen, head of FX and commodity research at Commerzbank AG, said in a report.

Investors active on these exchanges face a problem, having hedged against copper price declines.

“They lack the physical material to close their positions, which is why they have to resort to purchases on the spot market,” Nguyen said.

Abrupt end on the horizon

It is difficult to say how long the trend will continue.

However, it is evident that this trend is likely to cease abruptly once US import demand declines.

Nguyen expects the trend is likely to end abruptly, which could happen sooner rather than later.

“After all, the increase in imports is not a reflection of a sustained rise in demand, but is primarily due to fears of the introduction of US import tariffs on copper,” she added.

The introduction timeline of the tariffs remains uncertain. However, it’s reasonable to assume that their implementation will be closely tied to the ongoing trade talks.

This is because some countries have indicated a desire to avoid being caught off guard by new sectoral US tariffs once negotiations are complete and tariffs are established.

Nguyen said:

The more successful the trade talks are, the less likely it is that copper tariffs will be introduced.

Inventory decline

A general copper shortage is not indicated by the inventory declines on the LME and SHFE.

Instead, these declines are primarily a result of regional market distortions, likely caused by potential US tariffs.

This is evident in the sharp rise in COMEX inventories.

Since mid-June, copper stocks available on the LME (on-warrant stocks) have seen a slight increase.

The slight increase in stocks is primarily due to a significant decline in cancelled warrants, indicating that less copper is designated for immediate delivery. This trend suggests an impending correction in the market.

This may signal the nearing completion of inventory reduction.

Global situation

As reported by the International Copper Study Group, there was a supply deficit in April, but a surplus is anticipated for the entire year.

This comes amid a significant decline in treatment and refining charges (TC/RC) for copper smelters.

In February, China’s metal production, which constituted 44% of the global output last year as per USGS data, experienced a decline into negative territory, according to a Bloomberg series.

A significant development in the mining sector is the agreement between a major Chilean mining producer and a Chinese smelter to eliminate all TC/RC charges, as recently reported.

“The effective processing fees of zero apply to copper ore mined in the coming year, representing a record low for deliveries so far in the future,” Nguyen said.

However, refined copper production in China continues to be high, reaching a record in April and May.

No visible impact on demand from smelters

Strong copper ore imports by China suggest that low TC/RCs have not yet visibly affected smelter demand.

“It can therefore be assumed that Chinese metal production will remain at least at a high level.,” Nguyen said.

Chinese smelters are reportedly looking to increase copper exports to replenish LME stocks.

“All in all, although there are signs of a tightening in the copper market, there is no evidence (yet) of an acute copper shortage,” Nguyen added.

As long as metal production in China, the most important manufacturing country, proves resilient, we continue to see downside potential for the copper price. Our year-end forecast is USD 9,500 per ton.

The post Copper price surge signals strain, but no acute shortage yet appeared first on Invezz