Summary

- Frasers Group announced a staff bonus scheme that could be worth in excess of £100 million

- In 2017, the company had last made a bonus payout to 2,000 of its employees of £43 million

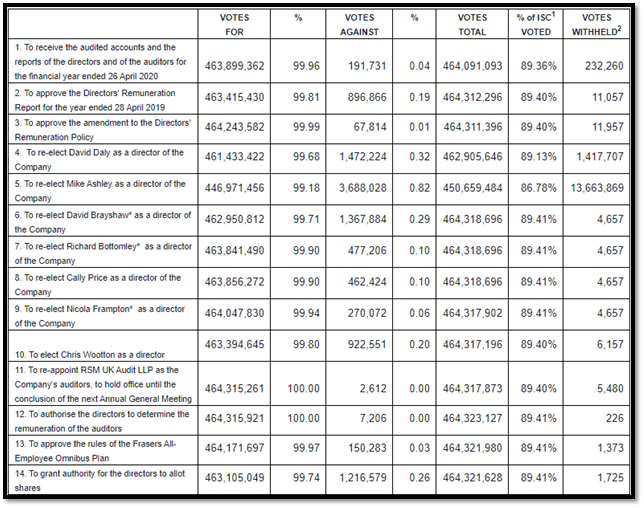

- Investors voted in favour of the staff bonus scheme and the re-election of Mike Ashley as the Director and David Daly as the Chairman

The Board of Frasers Group PLC (LON: FRAS), had asked its shareholders to vote for the new bonus scheme in its Annual General Meeting (AGM) on 7 October 2020. The scheme includes cash bonuses for eligible employees for their work and devotion. A vast majority of its workforce, i.e., 30,000 workers, will be eligible for this scheme and will be receiving either cash or share awards.

Prior to the AGM, Frasers Group workers’ representative to the Board, Cally Price said that the workforce of the organization is its lifeblood. Adding to this, she also called that she was expecting the shareholders to recognise the company’s efforts and give them an opportunity to share in the future success of the company.

Sub-Plans of the Scheme:

- The employee’s length of service will be the determining factor for the scheme. Staffs who have been serving the Group for more than four years are expected to receive a cash bonus worth up to four weeks of salary.

- Fearless 1,000 (1,000 eligible and qualifying workerswho have been giving incredible performance) would be entitled to receive share awards. The top 10 performers out of the Fearless 1,000 would be receiving share awards worth approximately £1 million. At the same time, the remaining workers would receive shares worth between £50,000 and £500,000.

Criteria:

- The criteria on which the bonus scheme is based is that the payout will only be triggered if company’s shares would hit at least £10, more than double the value within the next four years and stays above the £10 mark for 30 consecutive days.

- The group’s directors and consultants will not be considered for the scheme.

In the Annual General Meeting held on 7 October 2020, the shareholders/investors voted in favour of the staff bonus scheme, showing overwhelming response, along with the re-election of Mike Ashley as the Director, with 99.2 per cent votes and David Daly as the Chairman, with and 99.7 per cent votes.

Despite facing opposition from Pirc, a major shareholder advisory firm, there was a positive response for both Mr. Ashley and Mr. Daly. Earlier this year, the company was in the news for asking its staffs to work during the furlough. Hence, Pirc had advised the shareholders to vote against their re-election after allegations were made public. Pirc had also made a remark saying that the representative of a corporate control does not meet the best practice standards regarding the treatment of its employees.

Source: Company’s AGM Report, RNS

Chris Wootton, the chief finance officer of Fraser Group told the shareholders that to achieve the target of £10 would be challenging, but it is achievable, keeping in my mind the company’s ‘elevation strategy’. The stock price of the Group last traded at 360.8 pence on 6 October 2020.

Fraser Group and Its Controversies

Established in 2006 and based in the United Kingdom, Frasers Group PLC is a retailer of sporting goods. The company was earlier known as Sports Direct International PLC, operating in various segments such as sports, fitness, lifestyle fascias and brands and fashion.

In late March, when the lockdown restrictions forced all the non-essential shops to close down, the Sports Direct remained open. However, it soon made a u-turn and shut down the shops.

Also Read: Fraser Group May Shut Down Stores Amid Covid-19 Crisis

The company was under the surveillance of the public for employing workers on zero-hours contracts three years ago. The contract covered most of its staff working in stores and those employed in Derbyshire.

According to a parliamentary report, Fraser Group was also criticised four years ago, for its working conditions by a parliamentary report, such as non-payment of the minimum wage to its workers.

Financial Highlights

On 20 August 2020, Frasers Group PLC come up with its annual result for the FY 20. With Brexit uncertainty and the Covid-19 crisis, FY 2020 was a challenging year for the company. However, it was successful in achieving an increase in the revenue of 6.9 per cent to £3,957.4 million (FY 2019: £3,701.9 million), with UK Sports Retail, Premium Lifestyle and European Retail contributing to the same. An increase in the EBITDA of 98.7 per cent to £551.0 million (FY 2019: £277.3 million) was recorded by the Group, primarily due to the change in reporting because of the implementation of IFRS 16.

To Know More, Do Read: Business Updates Unveiled by Two Consumer Stocks - Frasers Group & AO World

Stock Price Performance of Frasers Group

The stock of FRAS was trading at GBX 370.20 on 8 October at 11:51 AM, up by 2.38 per cent from its previous close of 361.60. The stock’s 52-week low/high price range recorded as GBX 182.60/518.00. The retailer’s total outstanding market capitalisation stood at £1,877.94 million. FRAS’ shares delivered a price return of -21.29 per cent, from the beginning of 2020 till date.