Summary

- Frasers Group's revenue increased by 6.9 percent year on year in FY2020.

- Frasers Group's UK Sports Retail segment reported revenue of £2,203.3 million in FY2020.

- Frasers Group expects the underlying EBITDA to improve in FY2021.

- AO World's adjusted EBITDA increased by 53.6 percent year on year in FY2020.

- AO World reported resilient business performance for four months period ended 31 July 2020.

- AO World closed the business operations in the Netherlands.

Frasers Group PLC (LON:FRAS) & AO World PLC (LON:AO) are two consumer stocks included in the FTSE-250 index. The shares of FRAS were up by around 0.46 percent, whereas shares of AO were down by about 0.10 percent, respectively from the previous day closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1).

Frasers Group PLC (LON:FRAS) - Net debt stood at £366.0 million

Frasers Group PLC is a UK based group that is engaged in the retail of clothes, accessories and sports good. Frasers Group was erstwhile Sports Direct International PLC, and the name was changed in FY2020. The Group operates close to 1,534 stores and has close to 30,000 employees. Frasers Group was formed in 1849, and it is included in the FTSE 250 index.

FY20 results (ended 26 April 2020) as reported on 20 August 2020

(Source: Group website)

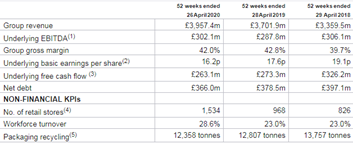

In FY20, the Group revenue was £3,957.4 million, which increased by 6.9 percent year on year from £3,701.9 million a year ago. The gross margin was 42.0 percent in FY20 somewhat close to 42.8 percent reported last year. The Group underlying EBITDA improved by 5.0 percent from £287.8 million in FY19 to £302.1 million in FY20. The reported profit after tax declined by 12.9 percent year on year to £101.0 million in FY20. As on 26 April 2020, Frasers Group net debt stood at £366.0 million. The Group did not announce any dividend in FY20. On 29 June 2020, the Company made a strategic investment in Hugo Boss AG through stocks and options. The Group has a total investment of approximately £186 million in Hugo Boss. The Group acquired Game Digital PLC, Jack Wills, Sofa.com and Brookfield Unit Trust in FY20.

Performance by business segment in FY20

In FY20, the UK Sports Retail reported revenue of £2,203.3 million that increased by 0.7 percent year on year from £2,187.3 million a year ago. UK Sports Retail constituted 55.8 percent of the Group revenue. Premium Lifestyle segment grew by 34.9 percent year on year to £722.0 million. The European Retail division revenue increased by 16.3 percent year on year to £697.7 million, whereas Rest of World segment revenue fell by 19.3 percent to £174.2 million. Wholesale & Licensing revenue declined by 2.0 percent year on year to £160.2 million in FY20 from £163.5 million in FY19.

One Year Share Price Performance Analysis

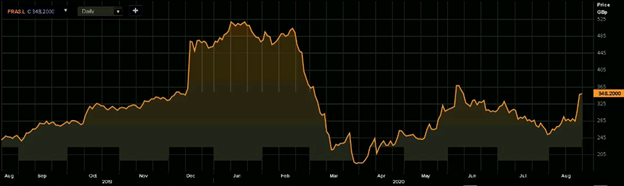

1-Year Chart as on August-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Frasers Group PLC's shares were trading at GBX 348.20 and were up by close to 0.46 percent against the previous closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1). FRAS's 52-week High and Low were GBX 536.35 and GBX 174.20, respectively. Frasers Group had a market capitalization of around £1.80 billion.

Business Outlook

The Group would invest more than £100.0 million in digital transformation. The focus on online channels would strengthen the position and enhance the customer experience. Frasers Group is optimistic of achieving improvement in underlying EBITDA in between 10 percent to 30 percent in FY21 after the stores reopen and robust performance of online sales channel.

AO World PLC (LON:AO) – Liquidity of £63.6 million available at the end of March 2020

AO World PLC is a UK based online retailer of electrical goods. The Company has business in the UK and Europe and sells home appliances and commercial appliances. It also has significant ownership in AO Recycling. AO World is listed on the FTSE 250 index.

Trading Update for four months (ended 31 July 2020) as reported on 20 August 2020

During the reported period, the Company generated revenue of £401.3 million in the UK and €74.3 million in Germany. The reported revenue in the UK and Germany grew by 58.9 percent and 91.5 percent, respectively, during the reported period. The Company invested in the infrastructure to meet the demand and service customers during the pandemic.

FY2020 results (ended 31 March 2020) as reported on 14 July 2020

(Source: Company website)

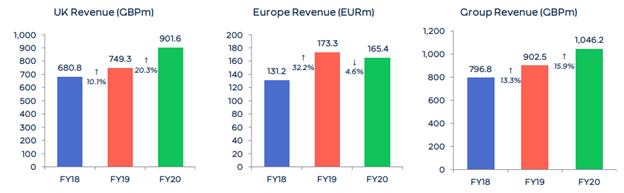

In FY20, the Company reported revenue of £1,046.2 million, which increased by 15.9 percent year on year from £902.5 million in FY19. The UK business added £901.6 million and grew by 20.3 percent year on year from £749.3 million a year ago. The revenue of the Europe division fell by 5.6 percent year on year to £144.5 million in FY20. The revenue of the Europe division was impacted due to the closure of Netherland operations in December 2019. The shutdown was completed at the end of the reported period. The adjusted EBITDA increased by 53.6 percent to £19.6 million in FY20. The profit after tax was £1.4 million in FY20 against loss of £18.1 million in FY19. As on 31 March 2020, AO World had net debt of £23.4 million and had liquidity of close to £63.6 million. As on 31 March 2020, the Company had an inventory of close to £73.0 million. The due payment to creditors was close to £257.0 million.

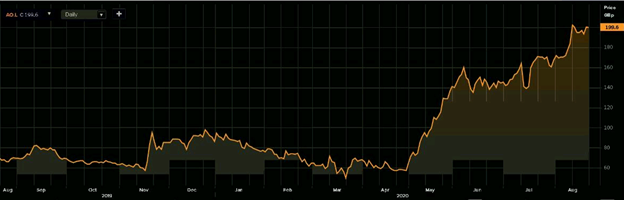

One Year Share Price Performance Analysis

1-Year Chart as on August-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

AO World PLC's shares were trading at GBX 199.6 and were down by close to 0.10 percent against the previous closing price (as on 21 August 2020, before the market close at 12:10 PM GMT+1). AO's 52-week High and Low were GBX 217.57 and GBX 46.67, respectively. AO World had a market capitalization of around £956.13 million.

Business Outlook

The business performance has been steady despite the reopening of the competitor stores in July 2020. There is a shift in how the customers prefer to shop, and the Company is investing in the infrastructure to cater to customer demand. AO World is cautious over the impact on the business in the medium-term due to covid-19 and Brexit in December 2020.